Lending Platform ZeroLend Announces Closure, Cites Unsustainable Operations

The founder of ZeroLend, who goes by "Ryker," has revealed that multiple blockchains hosting the lending platform have become "inactive," resulting in loss-making operational periods.

The decentralized lending platform ZeroLend has announced it will cease all operations following challenges with the blockchains it runs on, which have experienced declining user activity and insufficient liquidity.

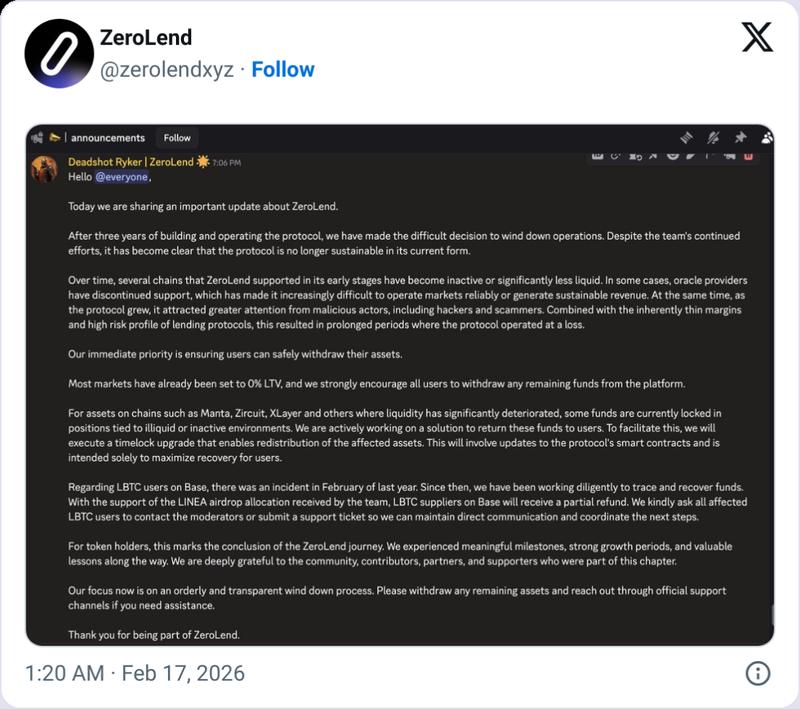

"Following three years dedicated to building and maintaining the protocol, we have arrived at the challenging decision to cease operations," stated the founder of ZeroLend, identified only as "Ryker," in a message the platform published on X this Monday.

"In spite of ongoing efforts from the team, it has become evident that the protocol cannot be sustained in its present configuration," Ryker continued.

The platform ZeroLend concentrated its offerings on layer-2 blockchains built on Ethereum, which Ethereum's co-founder Vitalik Buterin had previously championed as a fundamental component of the network's strategy to achieve scalability and maintain its competitive edge.

Yet Buterin revealed earlier this month that his scaling strategy centered on layer 2s "no longer makes sense," noting that numerous layer-2 solutions have not adequately implemented Ethereum's security mechanisms, and suggesting that scaling efforts should progressively shift toward the mainnet and native rollups.

Ryker attributes operational losses to illiquid blockchain networks at ZeroLend

According to Ryker, the founder of ZeroLend, the platform's closure stems from the fact that multiple blockchains the protocol operated on "have become inactive or significantly less liquid."

Ryker further explained that in certain instances, oracle providers — essential services that retrieve data and are frequently critical for protocol operations — have discontinued their support on particular networks, which has made it "increasingly difficult to operate markets reliably or generate sustainable revenue."

"Simultaneously, as the protocol expanded, it drew increased attention from malicious actors, including hackers and scammers," Ryker explained. "When combined with the naturally thin margins and high risk profile of lending protocols, this resulted in prolonged periods where the protocol operated at a loss."

Ryker confirmed that the protocol will make certain that users are able to withdraw their holdings, stating, "We strongly encourage all users to withdraw any remaining funds from the platform."

According to Ryker, certain user assets may remain locked on blockchains where liquidity has "significantly deteriorated," and ZeroLend plans to upgrade the protocol's smart contracts with the objective of redistributing stuck assets.

Ryker also noted that ZeroLend has been actively working to trace and recover assets connected to an exploit that occurred in February of last year, during which users of a Bitcoin (BTC) product on the Base blockchain were compromised when an attacker drained the lending pools.

According to Ryker, suppliers of the product that was affected by this incident will be given a partial refund that will be financed by an airdrop allocation that the ZeroLend team received.

During its peak in November 2024, ZeroLend reached a total value locked of almost $359 million, but that figure has subsequently declined to $6.6 million, data from DefiLlama shows.

The native ZeroLend (ZERO) token has declined by 34% over the past 24 hours following the announcement of the protocol's closure and has also lost nearly all of its value since reaching a peak of one-tenth of a cent in May 2024, data from CoinGecko indicates.