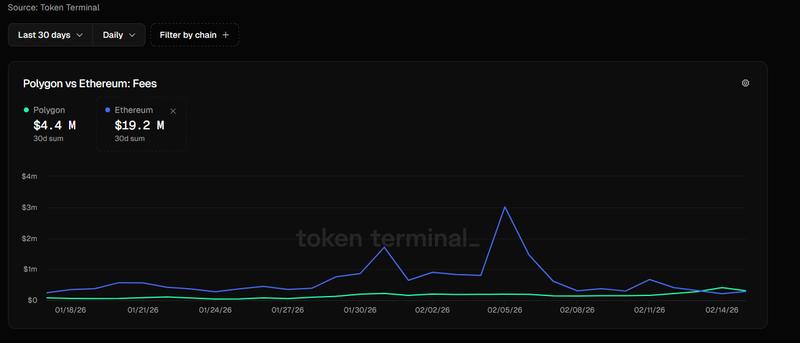

Ethereum overtaken by Polygon in daily fee revenue as prediction markets surge

Friday saw Polygon generate $407,000 in transaction fees for the day, while Ethereum collected $211,000.

Over the past three days, Polygon has generated more in daily transaction fees than Ethereum, a development that one analyst attributes to strong user engagement on the prediction market platform Polymarket.

Token Terminal's most recent data reveals that Polygon collected $407,100 in transaction fees on Friday, while Ethereum brought in $211,700, marking what appears to be the first instance of Polygon surpassing Ethereum in daily fee generation based on the available data.

The difference between the two networks has decreased since then, with Polygon registering approximately $303,000 in daily transaction fees on Saturday, compared to Ethereum's roughly $285,000.

Polymarket, which stands as one of the blockchain industry's most notable prediction market platforms since its 2020 launch, operates on the Polygon network.

Matthias Seidl, who co-founded the Ethereum analytics platform growthepie, drew attention to Polygon's recent surge in activity through an X post on Monday, stating that the growth has been "fully driven by Polymarket."

A chart shared by Seidl demonstrated that Polymarket was responsible for slightly more than $1 million in fees generated on Polygon during the previous seven-day period, while Origin World, the second-highest application on the layer-2 network, contributed approximately $130,000.

The Polygon team has also drawn attention to the escalating activity levels on Polymarket. Through an X post published on Saturday, the team pointed out that a single Oscars market category alone attracted more than $15 million in wagers, emphasizing that "Polygon is the chain underneath it" all.

According to Polygon, there is also a robust ecosystem of trustless agents being launched on the layer-2 network to "tap opportunities" available on the prediction market.

Since the most recent US election, prediction markets have experienced explosive growth in popularity, and this swift adoption has prompted multiple crypto companies to introduce their own prediction market platforms.

Additionally, others have highlighted the increasing use of stablecoins on the layer-2 network, especially Circle's USDC. Polygon data analyst @petertherock noted in an X post on Sunday that the network achieved a new weekly record of 28 million USDC transactions.

Trading on the Polymarket platform utilizes USDC based on Polygon.