Bond Yield Spread Reaches 2021 Peak: What It Means for Bitcoin

Bitcoin confronts mounting challenges as investors prepare for prolonged increases in long-duration bond yields, with Japan's fiscal situation playing a central role.

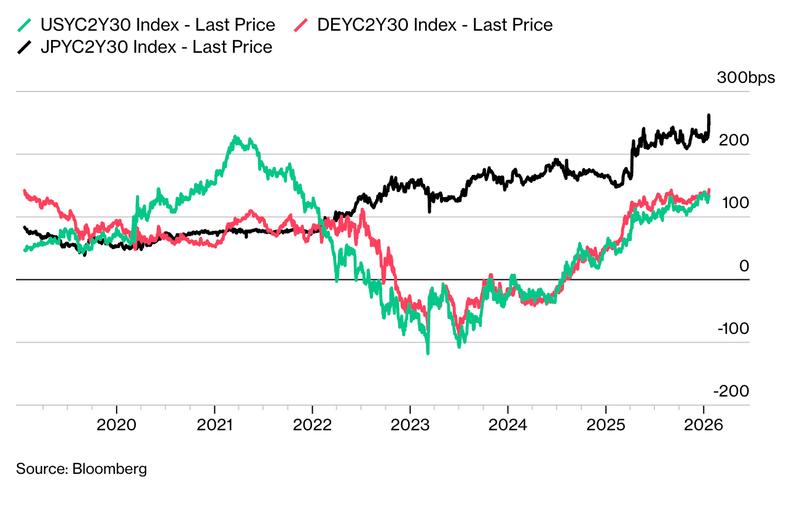

The differential between America's long-duration and short-duration Treasury bonds has expanded to levels not witnessed since 2021, creating possible headwinds for Bitcoin (BTC) as we progress through 2026.

Key takeaways:

- An expanding differential indicates that long-duration yields are climbing, creating downward pressure on Bitcoin.

- The selloff in Japan's long-dated bonds is the primary catalyst, exerting upward force on US yields.

Expanding yield differential poses risks for stocks (and Bitcoin)

The market trajectory for Bitcoin appears increasingly negative, based on an evaluation provided by David Roberts, head of fixed income at Nedgroup Investments, regarding the global stock market environment.

In comments to Bloomberg, Roberts indicated that equity markets would experience difficulties stemming from "a sustained push higher in yield." According to his analysis, the stress is primarily focused on longer-duration yields, with Japan being the epicenter.

During this week's trading sessions, Japan's 30-year bond yield climbed to an unprecedented 3.92%, expanding the spread versus the 2-year bond yields by a range of 220–325 bps.

According to Lauren van Biljon, senior portfolio manager at Allspring Global Investments, there's potential for an additional increase of 75–100 bps, driven by Prime Minister Sanae Takaichi's election vows to increase spending.

The 30-year yield in the United States demonstrates a strong correlation with its Japanese equivalent, suggesting that it will experience similar upward movement in the forthcoming weeks or months.

Elevated yields generally diminish the opportunity cost associated with maintaining non-yielding assets like equities, which raises the likelihood of Bitcoin, a "high-beta" risk asset, experiencing declines in tandem.

This evaluation is consistent with the widely-discussed "four-year cycle," which forecasts BTC's price to reach a trough in the $40,000-50,000 range by the end of 2026.

Can BTC catch up to gold's "historic alpha grab"?

The superior performance of gold is creating an additional obstacle for Bitcoin, based on analysis from Bloomberg Intelligence strategist Mike McGlone.

In a Jan. 23 post, McGlone contended that gold's "historic alpha grab" is channeling capital toward the traditional inflation hedge during a period when elevated long-term Treasury yields are simultaneously vying for investment flows.

Within this configuration, Bitcoin confronts a more challenging obstacle to regain critical psychological thresholds at or beyond $100,000, particularly if investors maintain their preference for lower-volatility stores of value rather than high-beta risk assets.