Wells Fargo Predicts $150B 'YOLO' Trading Surge Targeting Bitcoin and High-Risk Investments

According to a Wells Fargo analyst, increased tax refund amounts in the US could spark renewed retail investment activity by the end of March, channeling new capital into Bitcoin and high-momentum equities.

American taxpayers filing returns in 2026 could receive refunds that exceed those distributed in prior years, a trend that one prominent Wall Street analyst believes may stimulate heightened risk tolerance for cryptocurrency investments and technology equities favored by individual investors.

According to a research note referenced by CNBC, Wells Fargo's analyst Ohsung Kwon indicated that the anticipated tax refund season could catalyze the resurgence of the "YOLO" trading phenomenon, with potentially as much as $150 billion moving into stock markets and Bitcoin (BTC) before the conclusion of March. Kwon noted that this additional capital would likely be most prominent among taxpayers in higher income brackets.

"Speculation picks up with bigger savings…we expect YOLO to return," wrote Wells Fargo analyst Ohsung Kwon in a Sunday note seen by news outlet CNBC. "Additional savings from tax returns, especially for the high-income consumer will flow back into equities, in our view," he added.

According to Kwon, a portion of this increased liquidity may find its way into Bitcoin as well as equities that have gained popularity with individual retail traders, such as Robinhood and Boeing.

Cointelegraph reached out to Wells Fargo seeking clarification on the methodology underlying the $150 billion projection and what portion of that amount the financial institution anticipates might be directed toward cryptocurrency investments, but had not received a response by publication time.

Bitcoin demand depends on sentiment

Although a portion of the tax refund capital may move into Bitcoin and other digital currencies, it's crucial to account for the elevated inflation levels and consumer expenditure patterns relative to the era of the Covid-19 pandemic, Nicolai Sondergaard, research analyst at crypto intelligence platform Nansen, told Cointelegraph:

"If sentiment starts to come around and retail sees positive upwards momentum in crypto assets, I see that as increasing the likelihood of funds flowing in this direction."

On the other hand, individual investors might choose alternative investments displaying "higher momentum and social stickiness," should cryptocurrency market sentiment fail to show improvement in the immediate future, he said.

The increased tax refund amounts stem from the enactment of US President Donald Trump's One Big Beautiful Bill, which incorporated multiple advantageous provisions applicable to 2025 tax year filings.

Trump signed the One Big Beautiful Bill Act into law on July 4, 2025, saying it would cut as much as $1.6 trillion in federal spending.

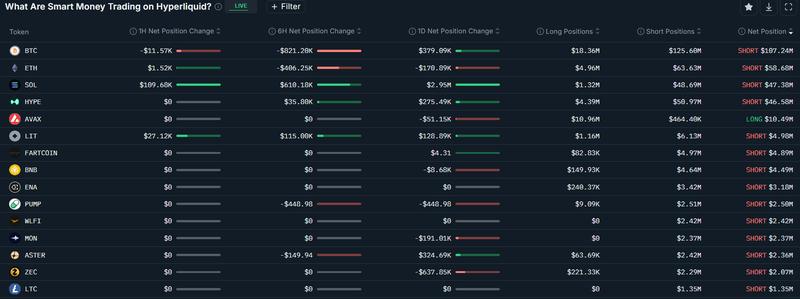

Smart money bets on crypto market downside as whales quietly accumulate

At the same time, cryptocurrency whales, defined as large-scale investors, are continuing their discreet spot market accumulation strategies for the dominant cryptocurrencies, even as the most consistently profitable traders monitored as "smart money" are positioning for additional cryptocurrency market decline.

According to data from crypto intelligence platform Nansen, smart money traders maintained net short positions on Bitcoin totaling a cumulative $107 million, alongside the majority of prominent cryptocurrencies with the exception of Avalanche (AVAX).

In contrast, whale investors have purchased more than $41.9 million in spot Ether (ETH) tokens distributed across 22 separate wallets over the previous seven days, representing a 1.7-fold expansion in spot acquisitions by this investment cohort.