Warren and Kim Urge Treasury Investigation Into $500M UAE Investment in Trump Family Crypto Venture

Two senators request Scott Bessent at Treasury Department examine UAE-backed financial commitment to Trump-affiliated cryptocurrency company WLFI citing potential national security risks.

A pair of United States senators are calling on the Treasury Department to examine a purported foreign capital infusion into a cryptocurrency enterprise connected to the Trump family, citing worries about national security implications, foreign governmental influence and potential access to confidential financial information.

Through a letter delivered on Friday to Treasury Secretary Scott Bessent, Senator Elizabeth Warren of Massachusetts and Senator Andy Kim of New Jersey requested that the government evaluate whether the Committee on Foreign Investment in the United States (CFIUS) ought to examine a transaction whereby a UAE-backed investment entity agreed to acquire a 49% ownership position in World Liberty Financial (WLFI) for approximately $500 million.

The senators indicated in their correspondence that the deal reportedly took place in the days leading up to Donald Trump's inauguration and would establish the foreign fund as the company's primary shareholder and its sole publicly disclosed external investor. They requested that Bessent, who serves as CFIUS chairman, verify whether the committee received notification and, if warranted, initiate a "comprehensive, thorough, and unbiased investigation."

The financial commitment was purportedly supported by Sheikh Tahnoon bin Zayed Al Nahyan, who serves as the UAE's national security adviser. The arrangement supposedly allocated approximately $187 million to organizations associated with the Trump family and provided two positions on the board of directors to executives affiliated with G42, a technology enterprise that has faced previous scrutiny from US intelligence services due to concerns regarding connections to China, according to the letter.

UAE stake could expose Americans' financial and personal data

The senators Warren and Kim contended that the arrangement's structure could enable a foreign government to obtain influence over an American company that manages financial and personal information. They highlighted that the company's privacy disclosures reveal it gathers data such as wallet addresses, IP addresses, device identifiers and approximate location data, in addition to certain identity records obtained through service providers.

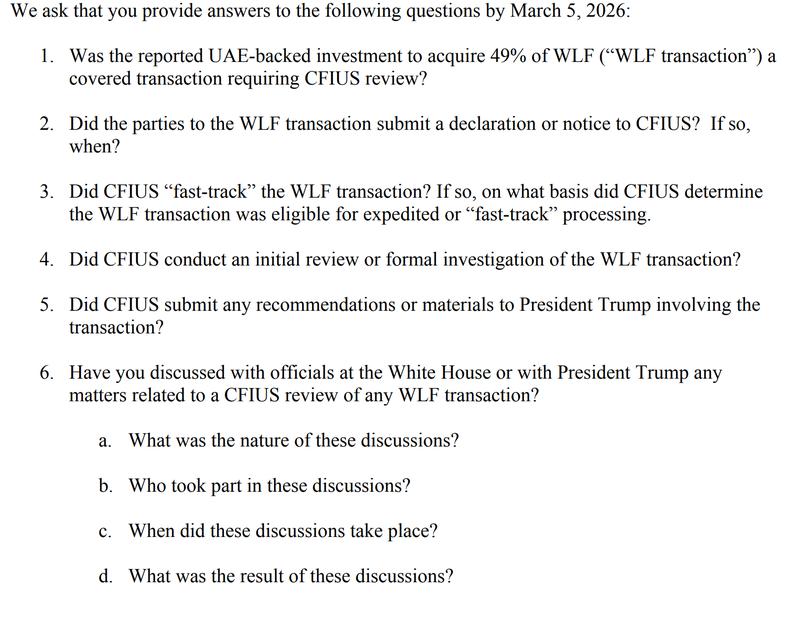

CFIUS holds responsibility for examining foreign investments that might grant access to sensitive technologies or personal data of US citizens. The senators demanded responses no later than March 5.

In the previous year, Senators Warren and Jack Reed similarly urged US authorities to examine purported connections between World Liberty Financial's token offerings and sanctioned foreign entities. In their November correspondence to the Justice Department and Treasury, they referenced allegations that WLFI governance tokens were purchased by blockchain addresses associated with North Korea's Lazarus Group, along with entities linked to Russia and Iran.

Trump says sons handle WLFI investment

During the early part of this month, US President Donald Trump indicated he had no knowledge of the reported multimillion-dollar investment associated with an Abu Dhabi royal and organizations connected to the World Liberty Financial cryptocurrency platform.

In statements made to reporters, Trump declared he had no personal involvement in the transaction and indicated the issue was being overseen by his family.

"My sons are handling that — my family is handling it. I guess they get investments from different people."