Historical Bitcoin Data Points to $122K 'Typical Gains' Within Next 10 Months

Analysis of Bitcoin's historical performance indicates an 88% probability of elevated prices before early 2027, adding to growing optimistic BTC forecasts.

If historical patterns hold true, Bitcoin (BTC) reaching $122,000 within the next ten months could represent typical performance levels.

Key points:

- A Bitcoin price analysis tool described as "informal" projects 88% probability of BTC/USD experiencing gains by the beginning of 2027.

- Historical performance data suggests $122,000 per coin would constitute typical returns.

- Optimistic BTC price forecasts persist even amid currently subdued market sentiment.

Half of previous 24 months showed positive BTC price action

Fresh analysis from Timothy Peterson, a network economist, projects close to 90% probability of BTC prices rising by the start of 2027.

Despite Bitcoin's lackluster performance throughout Q4 2025, not every optimistic BTC price forecast relying on historical data has been abandoned.

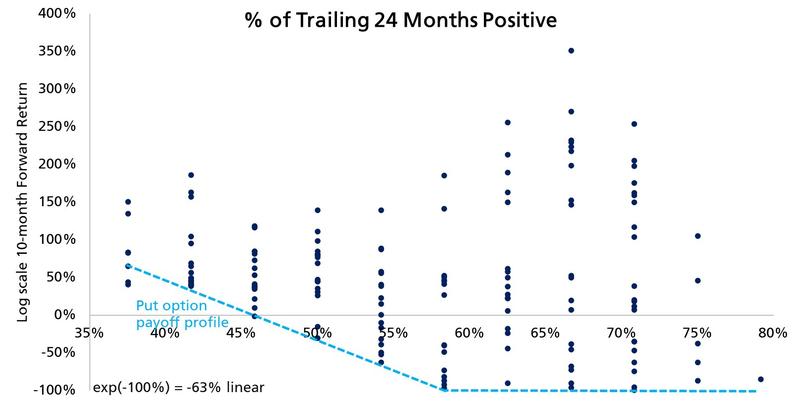

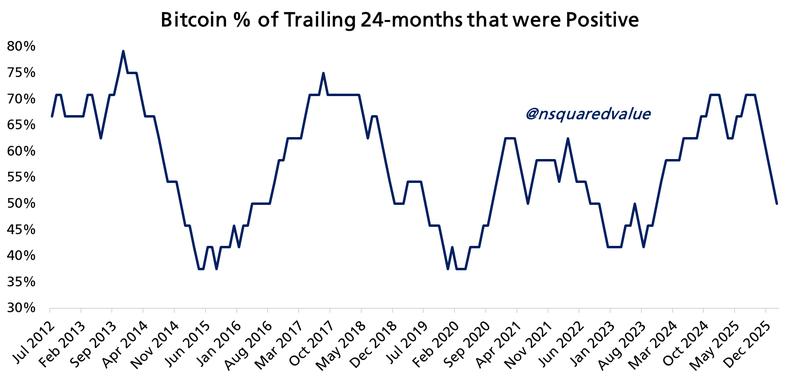

According to Peterson's analysis, monthly price movements across the preceding two years suggest potential recovery throughout the remainder of the year.

"50% of the past 24 months have been positive. This implies a 88% chance that Bitcoin will be higher 10 months from now," he shared on X.

"The average return is exp(60%)-1 = 82% => $122,000. Data goes back to 2011."

In an earlier post, Peterson explained that trailing price performance serves better for spotting trend "inflection points" compared to establishing specific price targets.

"This metric measures frequency, not magnitude. So Bitcoin could trend sideways for months and this metric could still go down. But it is still very useful for identifying inflection points," he explained, describing the analytical tool as "informal."

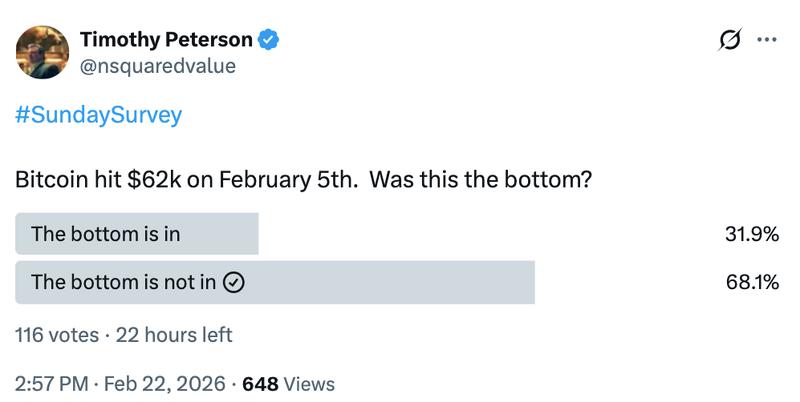

Meanwhile, a survey Peterson conducted on Sunday highlighted the prevailing pessimistic sentiment within crypto markets.

Optimistic Bitcoin forecasters maintain their positions

As previously reported by Cointelegraph, additional market analysts remain committed to forecasting significant BTC price increases throughout 2026.

One such analysis comes from Bernstein, which recently put forward a $150,000 price target this month, characterizing Bitcoin's recent decline as its "weakest bear case" ever recorded.

Major US banking institution Wells Fargo is also projecting $150 billion in capital flowing into Bitcoin and equities before the conclusion of March.

"Speculation picks up with bigger savings…we expect YOLO to return," analyst Ohsung Kwon stated in a note last week.