CFTC chairman intensifies defense of prediction markets against state lawsuits

The US financial regulator's leader, Michael Selig, revealed the agency submitted an amicus brief to counter what he described as a wave of state-initiated legal actions targeting prediction market platforms.

The chairman of the US Commodity Futures Trading Commission, Michael Selig, serving under President Donald Trump's administration, revealed that his agency plans to address what he characterized as a wave of state-initiated legal challenges targeting platforms that operate prediction markets.

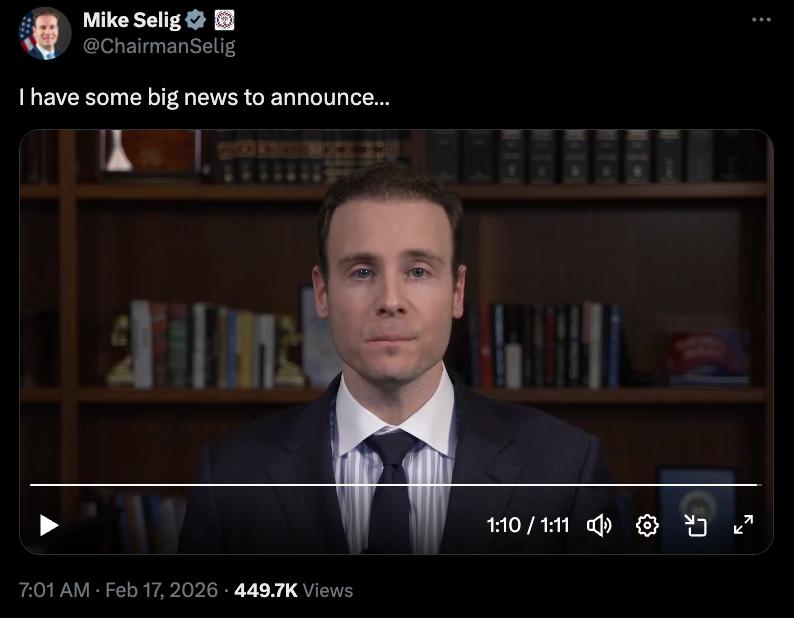

Through a video message shared on X this Tuesday, Selig disclosed that the CFTC had submitted an amicus brief — alternatively referred to as a "friend of the court" filing — intended to "defend its exclusive jurisdiction" over the regulation of prediction markets, which he compared to derivative market operations. The commission's leader issued a warning that state-level organizations attempting to contest the CFTC's regulatory authority over these markets should expect to face the agency in legal proceedings.

"Prediction markets aren't new — the CFTC has regulated these markets for over two decades. They provide useful functions for society by allowing everyday Americans to hedge commercial risks [...] they also serve as an important check on our news media and our information streams."

Michael Selig

The chairman's comments came in response to numerous state-level regulatory bodies and governmental authorities initiating lawsuits against prediction market platforms that provide event-based contracts, with companies such as Coinbase, Crypto.com, Kalshi, and Polymarket among those targeted. In the previous week, Polymarket launched its own legal action against the Commonwealth of Massachusetts, arguing that sole authority to regulate such markets rests with the CFTC as the federal oversight body.

The commission's chairman has been reinforcing his public advocacy for prediction markets in the face of enforcement measures initiated at the state level. This past Monday, the Wall Street Journal published an opinion piece authored by Selig, in which he reiterated his stance that state governments were overstepping boundaries and "encroaching" on the regulatory domain of the CFTC.

Last Friday, a coalition of 23 United States senators delivered correspondence to Selig, calling on the CFTC chairman to "abstain from intervening in pending litigation" related to event-based contracts and to "realign the Commission's actions with the statute and with the testimony" he delivered to congressional representatives during his confirmation proceedings. Selig indicated that he would seek the court's direction during a hearing held in November.

"[Y]our recent comments instead suggest that you view the prohibitions Congress […] as subject to reinterpretation through regulatory posture or litigation strategy. That approach converts a statutory prohibition into case-by-case policy judgments. It also places the Commission in direct conflict with state and tribal governments whose gambling laws Congress expressly chose not to preempt."

23 US Senators

Federal regulators await crypto market structure bill

Throughout recent months, members of the US Senate have been deliberating on legislation concerning digital asset market structure, which the House of Representatives passed under the designation of the CLARITY Act this past July. While the Senate Agriculture Committee moved to advance the proposed legislation in January, it remained uncertain as of Tuesday whether the bill would garner sufficient backing to succeed in a potential full chamber vote.

Selig had a scheduled appearance to discuss the legislative bill's advancement at a gathering hosted by World Liberty Financial, the cryptocurrency platform backed by the Trump family, taking place at the president's Mar-a-Lago resort property in Florida on Tuesday.