Buterin advocates for transformation of prediction markets into consumer hedging tools

Ethereum's co-founder Vitalik Buterin suggests prediction markets need to shift away from short-term speculation toward serving as price protection mechanisms for everyday consumers.

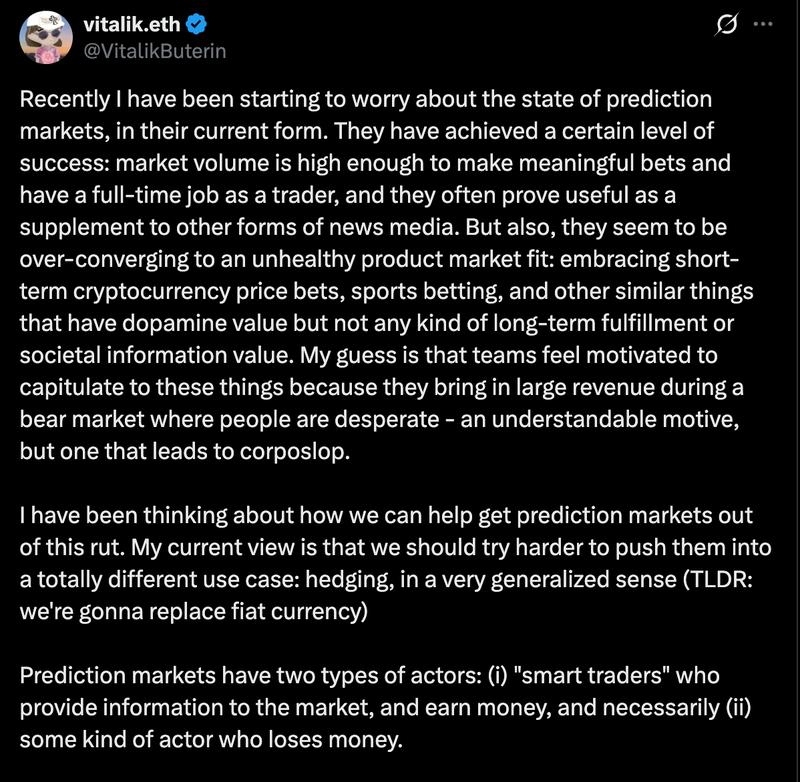

Vitalik Buterin, the co-founder of Ethereum, expressed growing concerns regarding the current trajectory of prediction markets and proposed they should evolve into platforms where consumers can mitigate their exposure to price fluctuation risks.

According to Buterin in a post shared on X, prediction markets are experiencing an "over-convergence" toward products he considers "unhealthy," with excessive emphasis on short-term price speculation and betting activities rather than sustainable, long-term development.

According to Buterin, blockchain-based prediction markets integrated with artificial intelligence large-language models (LLMs) should transform into comprehensive hedging tools that deliver price stability for consumers purchasing goods and services. His explanation of the proposed system includes the following:

"You have price indices on all major categories of goods and services that people buy, treating physical goods and services in different regions as different categories, and prediction markets on each category.

Every user, whether an individual consumer or a corporate entity, would utilize a local LLM with the capability to analyze that specific user's spending patterns and provide them with a customized portfolio of prediction market shares, which would represent 'N' days of that user's projected future expenditures," Buterin added.

According to Buterin's vision, both individuals and commercial enterprises could maintain a portfolio combining wealth-building assets alongside "personalized prediction market shares" designed to counterbalance the increasing cost of living driven by inflationary pressures in fiat currencies.

Prediction markets are useful market intelligence tools, supporters say

According to advocates of prediction markets, these crowdsourced intelligence platforms can deliver valuable perspectives on worldwide events and financial market movements, simultaneously enabling both individuals and enterprises to protect themselves against various forms of risk.

Harry Crane, a professor specializing in statistics at Rutgers University, argues that prediction markets demonstrate superior accuracy compared to traditional polling methods and merit recognition as a public good.

In his conversation with Cointelegraph, Crane suggested that critics of prediction markets within the United States government seek to impose restrictions on these platforms precisely because they generate insights that cannot be readily dismissed or controlled by centralized authorities.

According to Crane, prediction market platforms such as Polymarket or Kalshi serve as alternatives to information disseminated through official channels or mainstream media outlets, which can be subject to control or manipulation in order to support specific narratives through the distortion of public sentiment.