Bitdeer sells off complete Bitcoin treasury, zero BTC remaining in reserves

Mining company Bitdeer sold 943 BTC from its treasury along with freshly mined coins, completely eliminating its corporate Bitcoin position.

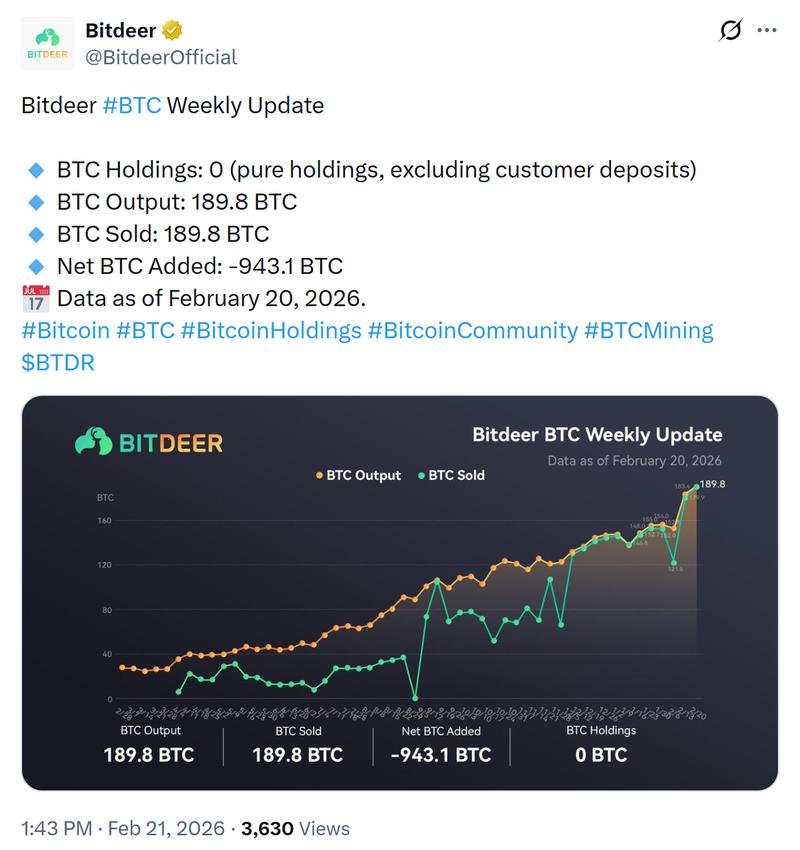

According to its most recent operational update, Bitcoin mining company Bitdeer has completely liquidated its corporate BTC holdings, bringing its treasury balance down to zero.

The latest weekly operational report from Bitdeer revealed that the firm's "pure holdings," which exclude customer deposits, have dropped to 0 Bitcoin (BTC). According to the data, the mining operation generated 189.8 BTC throughout the reporting period and proceeded to sell the entire amount. Additionally, the company liquidated 943.1 BTC from its treasury reserves that had been held previously.

The previous update published on Feb. 13 showed the mining company maintaining a treasury of 943.1 BTC. During that week, the firm mined 183.4 BTC and sold 179.9 BTC, keeping its reserve balance unchanged despite the regular sale of freshly produced coins.

While it's standard practice for mining companies to liquidate portions of their production to cover operational expenses such as electricity, hosting services and equipment maintenance, most firms retain a treasury balance to benefit from potential Bitcoin price increases. Complete liquidation of reserve holdings represents an uncommon move in the industry.

Cointelegraph contacted Bitdeer requesting comment on the matter, but no response had been received at the time of publication.

Bitdeer announces $300 million convertible debt raise

Bitdeer's stock price experienced a significant decline on Thursday following the company's announcement of a plan to secure $300 million via a convertible senior note offering. The offering includes provisions for an additional $45 million expansion if needed. These notes, which mature in 2032, provide holders the option to convert them into company shares, cash or a combination of the two.

Founded by Jihan Wu, a former co-founder of Bitmain, the company stated that the capital raised will be allocated toward expanding data center infrastructure, advancing AI cloud capabilities, developing mining hardware technology and addressing general corporate requirements.

As customer demand for its mining equipment continues to decline, Bitdeer has been scaling up its proprietary mining operations, choosing to deploy its own mining rigs for Bitcoin production instead of selling equipment to external buyers.

Bitcoin miners pivot to AI

MARA Holdings acquired a controlling stake in Exaion, a French computing infrastructure company, on Friday, representing a significant expansion into the artificial intelligence and cloud services sectors. Through this deal, MARA France secured a 64% controlling interest in the company, with energy giant EDF maintaining its position as both a minority shareholder and a client.

This acquisition reflects a broader transformation taking place throughout the mining sector. In the wake of the 2024 halving event and increasingly compressed profit margins, numerous mining operators have embraced a diversified business model that blends traditional Bitcoin mining with revenue streams from AI and high-performance computing operations.

Mining firms including HIVE, Hut 8, TeraWulf and IREN are converting their existing facilities and energy infrastructure to accommodate data center operations, while other companies such as CoreWeave have completely pivoted their business model to focus exclusively on AI infrastructure provision.