Bitcoin Struggles Below $70K as Economic Uncertainties and US Market Turbulence Intensify

The push by Bitcoin buyers to cross the $70,000 threshold faltered following a spike in a crucial US economic anxiety indicator past a pivotal level. Could Bitcoin be heading back toward its annual low points?

The price of Bitcoin (BTC) remains confined beneath the $70,000 mark this Tuesday, with market information indicating that the possibility of revisiting year-to-date lows continues to loom if purchasing momentum fails to establish this price point as a stable support level.

Bitcoin's price action has demonstrated increasingly erratic behavior as volatility within US markets climbed beyond an important threshold, coinciding with Treasury yields experiencing their most dramatic weekly decline in several months.

Market observers indicate that this broader economic environment could point toward a prolonged period of sluggish performance for BTC valuation, even as blockchain-based data reveals that market participants continue to await more convincing bullish triggers.

Key takeaways:

- The CBOE Volatility Index at 22.50 signals a rising market volatility and risk-off positioning for investors.

- The US 10-year yield is at 4.02%, down 3.75% last week, nearing its 200-day moving average trend for the first time since March 2022.

The case for Bitcoin remaining in "risk-off" territory

The CBOE Volatility Index (VIX), a gauge measuring anticipated 30-day volatility within US stock markets, has risen to 22.50 in 2026 and is edging closer to its peak level last observed on November 21, 2025.

An ascending VIX generally indicates heightened market uncertainty and diminishing investor willingness to engage with risk-oriented assets, creating a "risk-off" environment that has traditionally weighed down Bitcoin's performance.

To provide historical perspective, the chart illustrates a recurring inverse relationship between Bitcoin price movements and the VIX indicator around the 20 threshold. During December 2024, when the VIX jumped past 20, BTC established a peak at $104,000. A more pronounced surge exceeding 25 between March and April 2025 corresponded with a steep BTC pullback to $80,000.

Yet another breach above 20 during Q4 coincided with Bitcoin reaching its cycle peak near $126,000, while BTC's subsequent decline below $100,000 occurred alongside the VIX climbing past this same threshold.

Simultaneously, the US 10-year Treasury yield experienced a 3.75% weekly drop, marking its most significant weekly percentage decrease since September 2025. Currently positioned at 4.02%, the yield appears poised to test its 200-period simple moving average (SMA) for the initial time since March 2022.

Declining yields signal defensive investor behavior throughout conventional financial markets, further emphasizing the prevailing cautious market sentiment.

Deceleration in stablecoin liquidity expansion

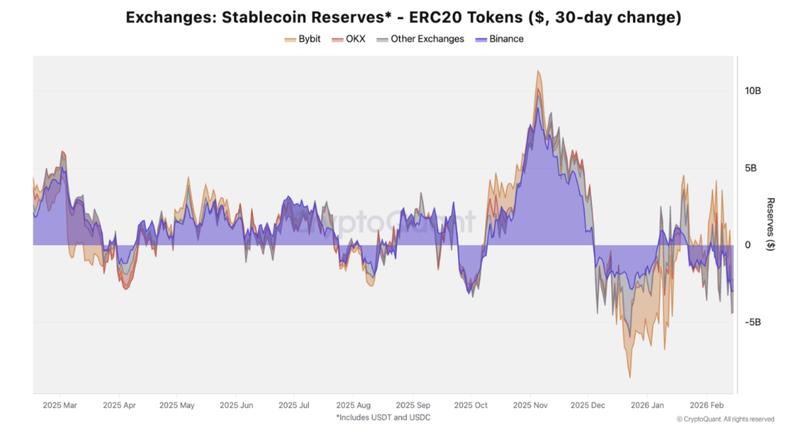

Information from CryptoQuant reveals that stablecoin reserves experienced an increase of $11.4 billion during the 30-day period concluding on November 5, 2025, demonstrating substantial purchasing capacity flowing into the cryptocurrency market.

Nevertheless, as bearish market conditions intensified, stablecoin reserves contracted by $8.4 billion by December 23, 2025, indicating that investment capital was exiting the ecosystem.

Throughout the most recent month, reserves distributed across multiple exchanges have diminished by a relatively modest $2 billion. This represented a deceleration when compared to the pronounced outflows witnessed during Q4, though the absence of substantial inflows suggested that liquidity conditions remain constrained.

Binance maintained dominance in exchange liquidity levels, controlling $47.5 billion in combined USDT and USDC reserves, representing approximately 65% of aggregate centralized exchange balances, which includes $42.3 billion in USDT, reflecting a 36% year-over-year increase.

Concerning stablecoin inflows and overall reserves, cryptocurrency analyst Maartunn noted that USDC inflows to exchanges are exhibiting a downward trend once more, suggesting that fresh liquidity has not yet returned in meaningful quantities.