Bearish chart formation and major whale movements signal potential 20% Bitcoin decline

A textbook bearish technical pattern has emerged on Bitcoin's daily timeframe, suggesting the cryptocurrency could potentially decline to $56,000 if the pattern plays out as expected.

Main highlights:

- An emerging bear pennant pattern suggests BTC could potentially fall toward the $56,000 level.

- Increased whale deposit activity on Binance reinforces the bearish outlook.

Bitcoin (BTC) faces the prospect of additional downside pressure throughout February as technical chart patterns align with heightened whale transaction activity on Binance.

Bear pennant formation suggests potential 20% decline in BTC value

Bitcoin appears to be developing what technical analysts recognize as a bear pennant formation on its daily timeframe.

This bear pennant configuration develops when price action consolidates within converging trend boundaries following a significant downward move, known as the "flagpole." The pattern typically concludes with an additional downward movement, approximately equivalent to the magnitude of the original decline.

Examining BTC's price chart reveals this formation appeared following the pronounced sell-off that pushed prices toward the $60,000 level. Subsequently, the price action has become compressed within a narrowing triangular formation while trading beneath important moving average indicators, demonstrating diminished upward momentum.

Should a convincing breakdown occur below the pennant's support boundary, it could pave the way for a decline beneath the $56,000 threshold, representing approximately 20% downside from present price levels, potentially materializing during February.

On the other hand, a breakout above the pennant's upper boundary, which coincides with the 20-day exponential moving average (20-day EMA; the green wave) positioned near $72,700, would potentially negate the bearish pattern entirely.

Binance whale deposit activity compounds bearish BTC outlook

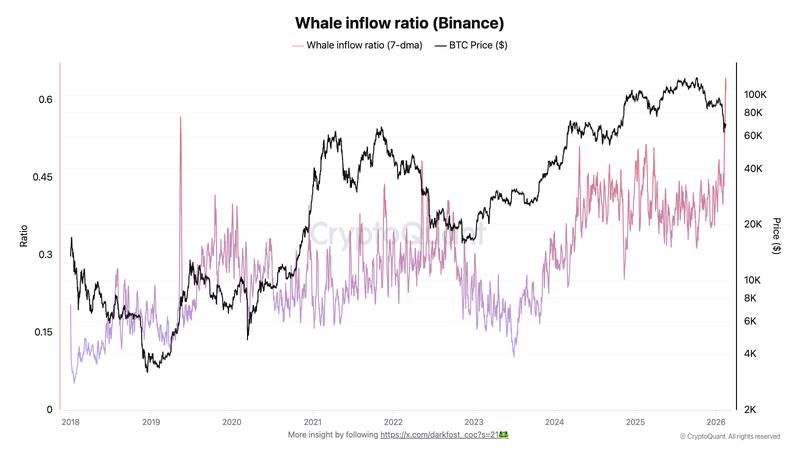

By Feb. 17, Bitcoin's whale inflow ratio (7-day average) had surged to an unprecedented peak of 0.619 when compared to 0.40 recorded at the start of the month, based on information from data analytics platform CryptoQuant.

This ratio measures exchange deposits from the 10 largest BTC transactions relative to aggregate inflows. The increase in this metric, as explained by Darkfost, an analyst affiliated with CryptoQuant, suggests heightened selling pressure originating from whale-sized holders.

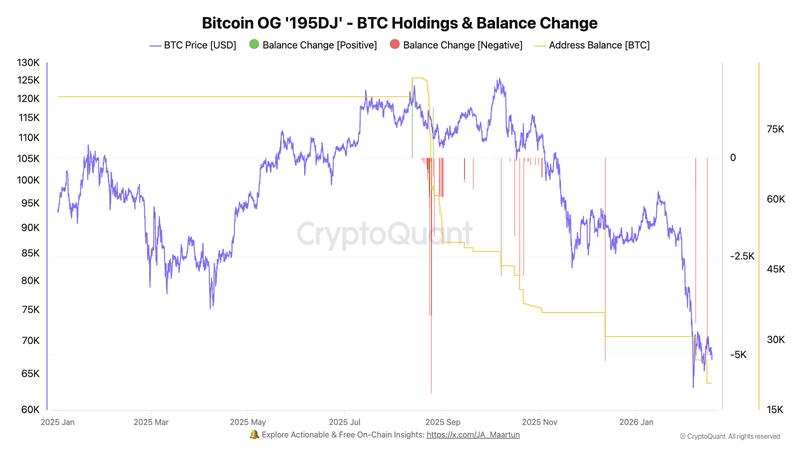

Some portion of this recent surge appears connected to a prominent whale widely suspected to be Garrett Jin.

Known by the moniker 195DJ, or the "Hyperunit whale," this entity has demonstrated particularly notable activity on Binance, transferring approximately 10,000 BTC to the exchange through recent transactions, according to data monitoring by CryptoQuant.

Bitcoin's sustainable bottom may be approaching

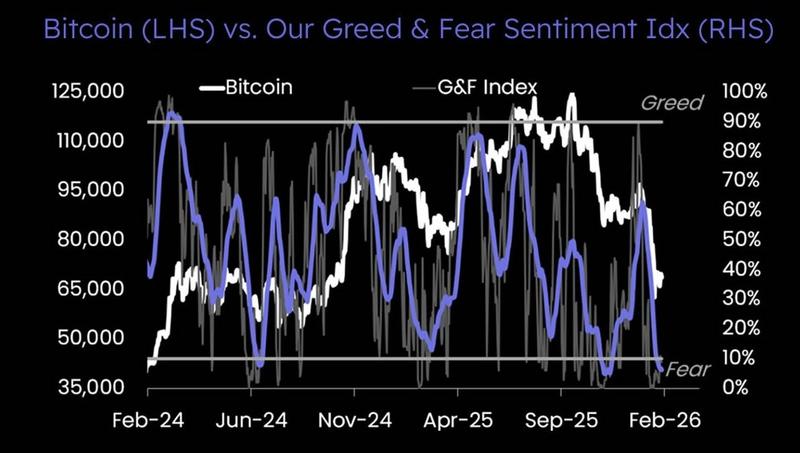

An indicator from Matrixport provides a near-term offsetting perspective to the prevailing bearish pattern.

During the current week, Bitcoin's "fear and greed index" generated a possible bottom formation signal: the 21-day moving average has fallen beneath zero and is currently reversing upward.

Looking at historical precedent, this particular combination has coincided with "durable bottoms," suggesting that selling pressure may be approaching exhaustion.

While this doesn't eliminate the possibility of another sharp decline, it does increase the probability of a relief rally occurring prior to any prolonged downward movement establishing itself.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.