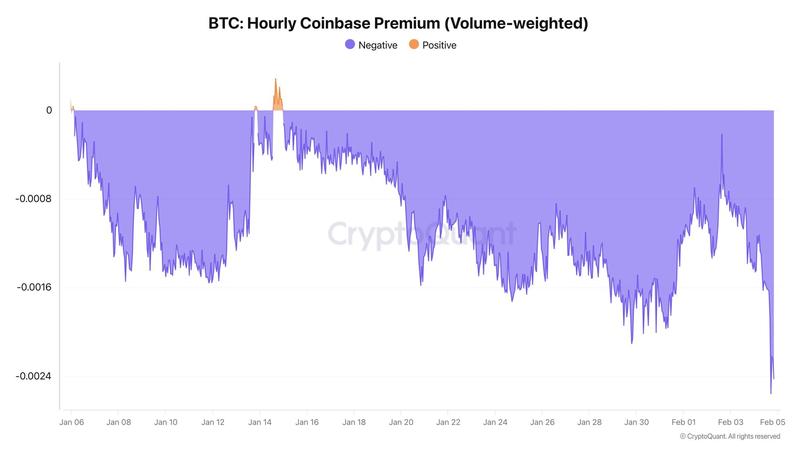

Institutional investors signal retreat as Coinbase premium reaches 12-month bottom

Bitcoin's price differential between Coinbase and Binance exchanges has plummeted to December 2024 levels, marking a concerning trend.

A key indicator tracking institutional investor appetite for Bitcoin versus retail demand has plunged to its weakest point in more than twelve months — suggesting professional investors may be actively liquidating positions, according to market analysis.

This metric, known as the Coinbase Premium, measures the variance in pricing between Coinbase's BTC/USD trading pair and Binance's BTC/USDT trading pair.

A substantially negative reading indicates that Bitcoin (BTC) trades at lower values on Coinbase Pro — a trading venue predominantly utilized by institutional players, professional traders, and accounts representing high-net-worth individuals — compared to Binance, which caters to a broader audience with significant retail investor participation, noted CryptoQuant analyst Darkfost on Thursday.

"The selling pressure is intensifying on the institutional side," added Darkfost.

"In other words, selling pressure coming from institutional players has intensified, pushing the price lower and creating a negative gap."

Coinbase premium downtrending since October

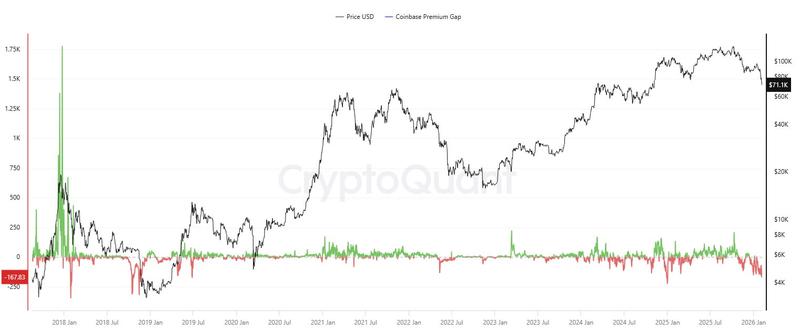

According to data from CryptoQuant, the Coinbase Premium Gap currently stands at -167.8, representing its most negative reading since December 2024.

When this metric exhibits a downward trajectory, it suggests that "whales are continuously selling at a lower premium. In addition, it shows decreasing interest and activeness of investors in Coinbase," it explained.

Following the market correction that began in mid-October, the Coinbase Premium Gap has maintained a consistent downward path, with the decline becoming more pronounced throughout the previous seven days.

"The current period is extremely challenging and highly uncertain, a climate that is not conducive to risk-taking and therefore to significant investments in BTC, which remains a volatile and risky asset," said the analyst.

Spot ETFs offloading billions in BTC

In a market intelligence report released on Wednesday, CryptoQuant indicated that "institutional demand has reversed materially."

The blockchain analytics firm noted that United States spot exchange-traded funds, which had accumulated over 46,000 BTC during the corresponding period in the previous year, have shifted to net selling positions in 2026, disposing of 10,600 BTC.

This shift establishes a "56,000 BTC demand gap versus 2025 and contributes to persistent selling pressure," it added.

Throughout the last seven-day period, spot Bitcoin ETFs have experienced $1.2 billion in capital withdrawals, coinciding with the cryptocurrency's decline to a fifteen-month low beneath $71,000 on Thursday.