Canton Network Gains Fireblocks Support for Institutional Onchain Asset Settlement

Financial institutions can now leverage the integration to manage and settle digital assets on a blockchain infrastructure designed specifically for privacy-focused regulated markets.

Digital asset infrastructure provider Fireblocks has integrated the Canton Network into its platform, providing financial institutions with the capability to manage custody and conduct settlements of digital assets on a blockchain network specifically engineered for privacy-enabled regulated market operations.

The announcement made on Tuesday reveals that the integration facilitates controlled settlement of Canton Coin (CC) via Fireblocks' infrastructure platform and its trust entity that holds a charter from the New York Department of Financial Services. The service targets banks, custody providers and asset management firms that are investigating tokenized securities, deposits and other regulated financial instruments requiring private settlement capabilities and rigorous oversight mechanisms.

Through Fireblocks, financial institutions gain the ability to maintain custody of Canton Coin while utilizing the platform's established enterprise-level policy controls and automated workflow systems for settling assets on the Canton Network. Additionally, Fireblocks functions as a Super Validator on the network, providing the company with a direct participatory role in both transaction validation processes and network governance activities.

According to Fireblocks, the company anticipates expanding support to include additional tokens and applications operating on the Canton Network in the future.

The company reports that Fireblocks provides security for digital asset transfers exceeding $5 trillion on an annual basis and has facilitated more than $10 trillion in cumulative transfers since inception, with its platform currently serving more than 2,400 organizational clients, based on company data.

Institutional adoption builds on the Canton Network

The Canton Network, which operates as a permissioned blockchain created by Digital Asset and overseen by the Canton Foundation, has experienced consistent growth in institutional integrations throughout the latter part of 2025 and into early 2026.

During October, BitGo, a provider of digital asset infrastructure solutions, introduced support for Canton Coin, which enables banks and asset managers operating in the United States to hold the token under the custody of a qualified custodian.

Approximately one month following that development, Franklin Templeton established a connection between its Benji tokenization platform and the Canton Network. This integration enables tokenized assets that are issued through Benji, which includes Franklin Templeton's blockchain-based US government money market fund, to serve as collateral and provide liquidity within Canton's Global Collateral Network ecosystem.

During December, the Depository Trust & Clearing Corporation (DTCC) announced its intention to create a subset of US Treasury securities on the Canton Network, indicating the possibility of expanding to additional asset classes in the future.

In a more recent development, Temple Digital Group introduced a private institutional trading platform constructed on Canton, which provides continuous trading capabilities operating 24 hours a day, seven days a week, utilizing a central limit order book mechanism combined with a non-custodial infrastructure design.

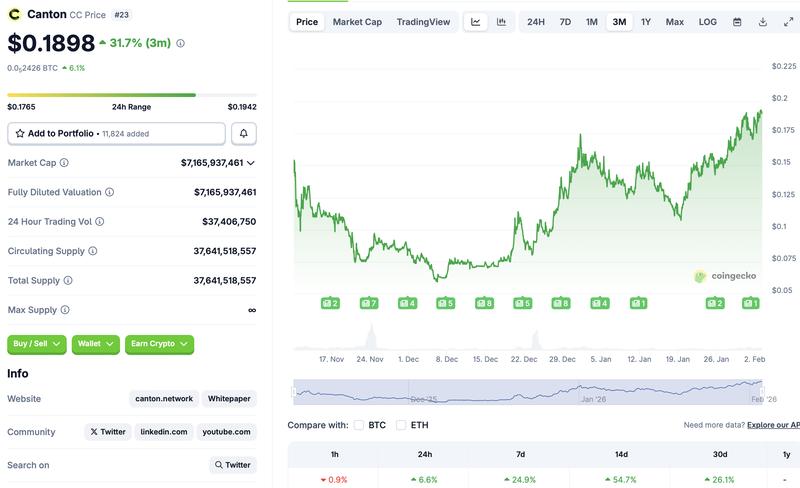

Canton Coin, the native digital asset of the Canton Network, has demonstrated positive price movement in correlation with heightened network activity. The token has gained approximately 31% in value during the past three months, as reported by data from CoinGecko.