Binance finalizes Bitcoin conversion worth $1B for SAFU emergency reserve

The cryptocurrency exchange Binance has finalized its conversion of $1 billion into Bitcoin for its user emergency protection fund amid unprecedented bearish market sentiment and rising short positions from sophisticated traders.

The cryptocurrency exchange Binance has finalized the conversion of $1 billion into Bitcoin for its emergency protection fund, making a commitment to maintain Bitcoin as the principal reserve asset for this critical safety net.

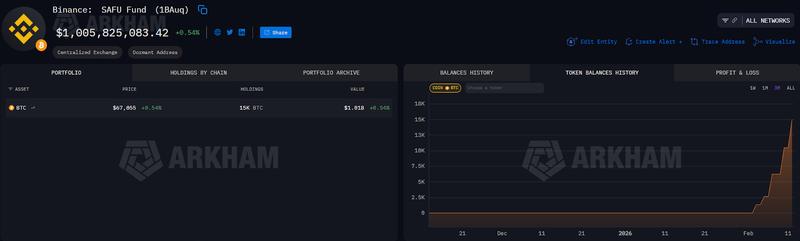

On Thursday, Binance acquired an additional $304 million in Bitcoin (BTC), thereby finalizing the $1 billion conversion into Bitcoin for its Secure Asset Fund for Users (SAFU) wallet, as indicated by information from Arkham data.

The emergency protection fund currently maintains 15,000 Bitcoin, valued at more than $1 billion, purchased at an average aggregate acquisition price of $67,000 per Bitcoin, the exchange disclosed in a Thursday post on X.

"With SAFU Fund now fully in Bitcoin, we reinforce our belief in BTC as the premier long-term reserve asset."

This final acquisition of BTC occurred three days following Binance's preceding $300 million purchase executed on Monday.

The cryptocurrency trading platform initially revealed its plans to convert its $1 billion user safety fund into Bitcoin on Jan. 30, originally committing to a 30-day timeframe for completing the purchases, though the entire conversion was accomplished in under two weeks.

According to the exchange's statement, it will implement rebalancing measures for the fund should market volatility cause its valuation to drop beneath $800 million.

Cryptocurrency investor sentiment drops to historically low levels

This conversion activity occurs as overall market sentiment throughout the cryptocurrency sector continues to exhibit profoundly pessimistic characteristics.

Market sentiment experienced an additional decline in the aftermath of Bitcoin's temporary correction that pushed prices beneath $60,000 on Feb. 5, with the fear and greed index tumbling to five on Thursday — representing the lowest measurement ever recorded — indicating extreme levels of fear pervading investor psychology, based on metrics from alternative.me.

This particular index represents a multifactorial measurement system designed to gauge overall cryptocurrency market sentiment.

The cryptocurrency industry's most successful traders measured by profitability, monitored under the designation "smart money," are similarly positioning themselves defensively in anticipation of additional cryptocurrency market deterioration.

These smart money traders maintained net short positions on Bitcoin totaling a cumulative $105 million, while also holding net short positions across the majority of prominent cryptocurrencies with the notable exception of the Avalanche (AVAX) token, which experienced $10.5 million in net cumulative long position establishment, as reported by cryptocurrency intelligence platform Nansen.

The correction experienced by Bitcoin additionally resulted in a substantial quantity of tokens falling into unrealized loss territory equivalent to 16% of Bitcoin's total market capitalization, representing the most severe pain threshold observed in cryptocurrency markets since the collapse of algorithmic stablecoin provider Terra during May 2022, according to a Monday post on X from Glassnode.

However, providing a potentially optimistic perspective amid the market correction, the underlying market structure is beginning to exhibit preliminary indicators of stabilization, as assessed by Dessislava Ianeva, dispatch analyst at the digital asset platform Nexo.

"Derivative positioning remains cautious. Funding rates are neutral to slightly negative, reflecting subdued leverage demand, while open interest in native BTC terms has returned to early-February levels, suggesting stabilization rather than a renewed expansion phase," the analyst told Cointelegraph.