Strive Targets $150M Capital Raise for Debt Reduction and Bitcoin Acquisition

Investment firm Strive is preparing to secure up to $150 million via a preferred stock sale, allocating funds to reduce Semler Scientific debt obligations and grow its Bitcoin holdings.

The asset management firm Strive, which was co-founded by former presidential candidate Vivek Ramaswamy during 2022, has outlined intentions to secure up to $150 million in capital via a preferred stock issuance, with the funds designated for reducing outstanding debt and purchasing additional Bitcoin.

According to a statement released on Wednesday, Strive intends to issue shares of its Variable Rate Series A Perpetual Preferred Stock, which will be listed under the trading symbol SATA.

The asset manager indicated that funds generated from this initiative, combined with available cash reserves and possible revenue from terminating hedging arrangements, will be directed toward settling financial obligations at Semler Scientific, its fully owned subsidiary. The company plans to buy back a segment of Semler's convertible senior notes carrying a 4.25% interest rate and maturing in 2030, along with settling existing loans under a master financing arrangement with Coinbase Credit.

According to Strive, the strategic initiative aims to streamline its financial structure and transition back to what it describes as a "perpetual-preferred only amplification model." Surplus funds from the offering may be directed toward purchasing Bitcoin (BTC) and investment products related to Bitcoin.

Strive plans debt swaps

The company, which operates as a Bitcoin treasury entity, has additionally disclosed intentions to pursue private negotiated exchanges with select holders of the convertible notes issued by Semler, providing them the opportunity to convert their debt holdings into SATA preferred stock. While such exchanges would decrease the overall size of the public stock offering, they would not produce additional cash resources for the firm.

The SATA preferred shares feature an initial annual dividend yield of 12.25%, distributed to shareholders monthly in cash form, with the rate subject to periodic adjustments based on prevailing market dynamics and fluctuations in short-term interest benchmarks. While the preferred securities have no maturity date, Strive retains the right to redeem them, typically at a price of $110 per share in addition to any accumulated unpaid dividends.

The offering has enlisted Barclays and Cantor Fitzgerald to serve as joint book-running managers, while Clear Street has been designated as co-manager for the transaction.

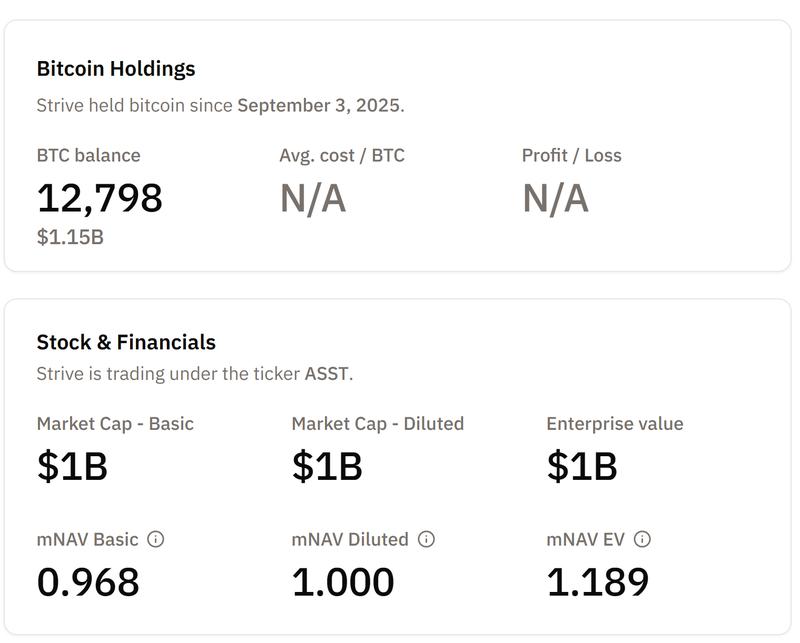

In January, Strive made public an all-equity transaction to take over Semler Scientific. The firm confirmed receiving shareholder authorization for the proposed acquisition, which is expected to incorporate Semler Scientific's holdings of 5,048.1 Bitcoin into Strive's current reserves. Upon completion of this deal, Strive's aggregate Bitcoin portfolio will expand to 12,797.9 BTC.

During May 2025, Strive unveiled a capital raise of $750 million intended to develop "alpha-generating" investment strategies focused on Bitcoin-related asset acquisitions. Subsequently, in December, the company introduced an additional $500 million equity sales initiative designed to generate capital for further BTC acquisitions.

Crypto treasury firms face challenges in 2026

The fundraising strategy from Strive emerges at a time when cryptocurrency treasury companies are entering what appears to be a challenging phase, with industry leaders cautioning that numerous firms established during Bitcoin's previous upward momentum may struggle to remain operational. According to MoreMarkets CEO Altan Tutar, the year 2026 could witness extensive business closures as cryptocurrency price declines and deteriorating equity valuations apply significant pressure to operational models that depend primarily on maintaining digital asset reserves.

Tutar anticipates that treasury companies focused on alternative cryptocurrencies will be the first to experience failure, with large-capitalization strategies centered on digital assets including Ethereum (ETH), Solana (SOL) and XRP (XRP) likely to follow. His assessment suggests the industry has become excessively saturated and lacks the capacity to maintain market valuations exceeding net asset value without developing supplementary revenue streams and return mechanisms.