Regulatory Pressure and Treasury Returns Halt Stablecoin Market Expansion

The stablecoin sector faces a slowdown as institutional compliance requirements and attractive Treasury returns drive a shift from aggressive growth to conservative balance-sheet management.

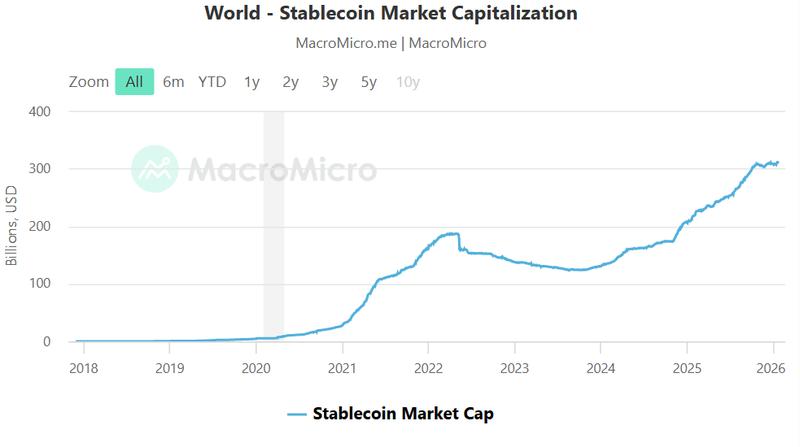

Following an era of explosive growth, stablecoin markets worldwide have essentially plateaued, marking a period of consolidation driven by emerging regulatory frameworks, tightening liquidity conditions and competitive returns in traditional finance, according to Jimmy Xue, co-founder of quantitative yield protocol Axis.

In analysis provided to Cointelegraph, Xue explained that despite progress in stablecoin regulation, more stringent requirements emerging from the United States and Europe have compelled institutional token issuers to maintain superior reserve quality and shoulder increased compliance expenses, thereby moderating the velocity of net token creation.

Concurrently, higher real interest rates available through US Treasury securities have raised the opportunity cost associated with maintaining stablecoin positions that provide no inherent yield. This market condition has reduced speculative token minting activity and strengthened stablecoins' fundamental position as infrastructure supporting payments, settlement operations and short-term liquidity management, as opposed to high-growth investment vehicles.

The recent plateau in stablecoin market cap is primarily a consolidation phase following the explosive growth of 2025

Jimmy Xue, co-founder of Axis

Xue stated, referencing institutional market participants adapting to more demanding liquidity standards mandated by the US GENIUS Act and the European Union's Markets in Crypto-Assets framework.

Xue continued that a generally risk-averse macroeconomic climate, when combined with attractive Treasury security yields, has additionally diminished enthusiasm for accelerated stablecoin market growth.

Although projections differ, sector statistics indicate the aggregate stablecoin market has stayed relatively unchanged since October, with fiat-backed tokens in active circulation maintaining levels near $310 billion. The circulating token volume had increased by more than 100% between January 2024 and the beginning of 2025.

Stablecoin supply and market stress

The timing may be more than coincidental that stablecoin supply expansion plateaued following the severe cryptocurrency market downturn that occurred after the Oct. 10 liquidity shock, an event that precipitated approximately $19 billion in forced position liquidations across both centralized and decentralized trading platforms. This event represented the most substantial leverage reduction episode in the industry's recorded history.

Following that milestone, a confluence of synchronized selling pressure, heightened funding market stress and continuously cautious investor sentiment has produced recurring selloff waves throughout digital asset markets, with valuations still unable to achieve a durable recovery trajectory.

Stablecoin circulation generally increases during intervals of heightened investor engagement, as market participants transfer capital onto blockchain networks to establish leveraged positions, rebalance asset allocations or temporarily hold funds in dollar-denominated tokens while evaluating upcoming opportunities. When risk tolerance diminishes and leveraged positions are closed, this demand characteristically weakens, decelerating fresh issuance and, under certain circumstances, producing net token burns.

Simultaneously, the topic of yield-generating stablecoins has attracted increasing attention in the United States as traditional banking institutions escalate lobbying campaigns to limit or prohibit interest-bearing stablecoins throughout discussions surrounding the CLARITY Act, draft legislation designed to establish regulatory supervision and authorized functions for digital asset token issuers.

Banking sector representatives have contended that stablecoins offering yield could directly compete with conventional deposit accounts and money market instruments, generating apprehensions regarding financial system stability and equitable regulatory treatment.

Jeremy Allaire, chief executive of USDC issuer Circle, dismissed those assertions, informing participants at the World Economic Forum in Davos, Switzerland that the banking industry's concerns over stablecoin yields are unfounded and "totally absurd."