Prediction Markets Signal $100K Bitcoin Price Remains Distant Goal

Confidence in Bitcoin's bull run has weakened following the October market downturn, with expectations for a near-term BTC rally beyond $100,000 continuing to diminish.

Bitcoin (BTC) could struggle to reclaim the $100,000 threshold throughout the initial six months of 2026 as bullish momentum drivers remain scarce against a backdrop of macroeconomic uncertainty.

Key takeaways:

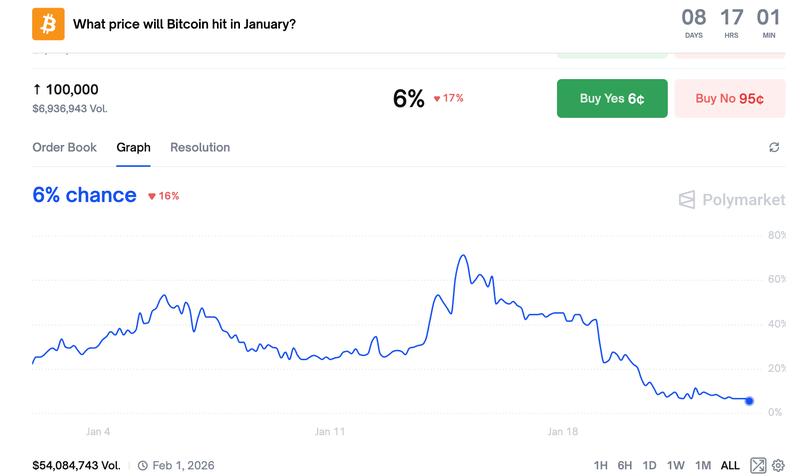

- Prediction markets indicate BTC price has less than a 10% probability of surpassing $100,000 prior to Feb. 1.

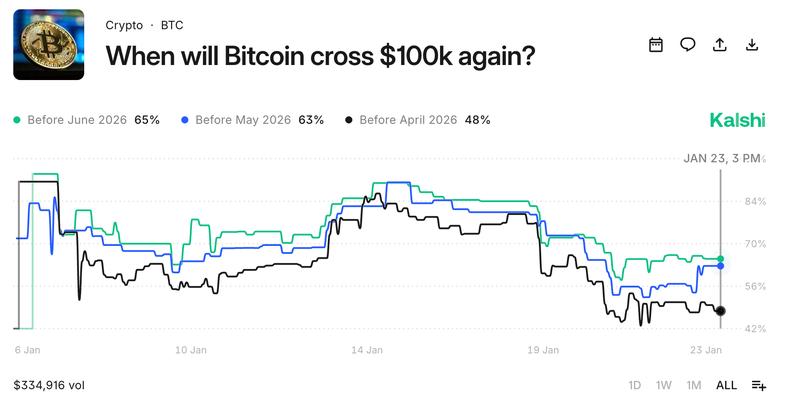

- Market participants anticipate that Bitcoin will remain under $100,000 until at least June.

- Bitcoin's valuation will probably fall beneath Strategy's average purchase price.

BTC faces sub-10% probability of reaching $100,000 before February

The vast majority of market participants on Polymarket and Kalshi are not anticipating Bitcoin's return to six-figure territory within the coming seven-day period.

Data from Jan. 22 shows Polymarket participants estimate approximately 6% probability of BTC surpassing $100,000 prior to Jan. 31. Meanwhile, Kalshi participants calculate 7% odds of BTC reclaiming the $100,000 psychological threshold before January concludes.

The 2026 peak for Bitcoin stands at $97,900, a level achieved on Jan. 14, while the most recent instance of the BTC/USD trading pair exceeding $100,000 occurred on Nov. 13.

When BTC/USD previously fell beneath $100,000, it required 93 days to recover that level after experiencing a 25.5% drawdown.

Should a comparable pattern unfold, BTC price might recover the $100,000 mark around mid-February, according to the chart displayed below.

Nevertheless, Kalshi traders suggest this recovery period could extend further, calculating a 65% probability that Bitcoin will surpass $100,000 before June 2026.

Market participants on Polymarket actually assess 65% odds of BTC declining to $80,000 initially, before eventually climbing back to $100,000 sometime in 2026.

Meanwhile, Kalshi bettors calculate 54% odds that Bitcoin will reach its floor at $70,000 during this year. Additionally, the probability of it declining to $65,000 stands at 50% while the chances of falling as low as $60,000 are estimated at 42%.

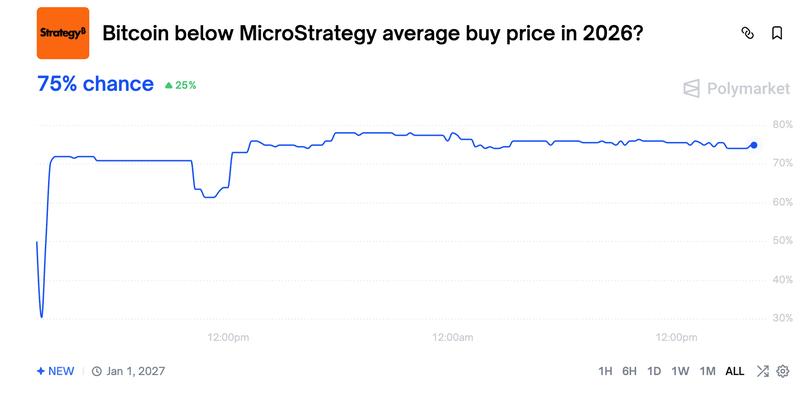

Could BTC price fall beneath Strategy's cost basis?

Multiple indicators suggest that Bitcoin has entered a bear market phase, with potential downside targets reaching as low as $58,000.

Polymarket traders calculate a 75% probability that Bitcoin will fall below Strategy's average BTC acquisition price during 2026, currently standing at $75,979 as of this writing.

Notwithstanding the anticipated price correction, Polymarket odds for Strategy divesting Bitcoin holdings in 2026 continue to sit below 26%, whereas expectations for consistent smaller acquisitions remain high.

Market participants on Polymarket continue to view regular Strategy purchases throughout the year as a highly probable outcome, placing an 84% chance of the company maintaining over $800,000 BTC by Dec. 31.

During the previous week, Strategy increased its Bitcoin holdings to 709,715 BTC following the acquisition of 22,305 coins for approximately $2.13 billion.