Matrixport: Extreme crypto fear levels point to potential market turning point

Bitcoin sentiment has reached its lowest point in four years, with market analysts identifying historically oversold conditions and signs of potential exhaustion among sellers.

The sentiment across cryptocurrency markets has plunged to exceptionally low levels, potentially setting the stage for a "durable bottom" that could exhaust the remaining selling pressure, analysts at Matrixport, a crypto financial services firm, have indicated.

"Sentiment has fallen to extremely depressed levels, reflecting broad pessimism across the market," Matrixport noted in a Tuesday report.

According to Matrixport's proprietary Bitcoin (BTC) "fear and greed index," "durable bottoms" typically emerge when the 21-day moving average falls beneath the zero threshold and subsequently reverses upward, a pattern that is presently unfolding.

"This transition signals that selling pressure is becoming exhausted and that market conditions are beginning to stabilize."

Despite this, Matrixport issued a warning that prices could experience additional declines in the immediate future. The firm emphasized that throughout history, such profoundly negative sentiment measurements have frequently provided favorable entry opportunities, according to their analysis.

"Given the cyclical relationship between sentiment and Bitcoin price action, the latest reading suggests the market may be approaching another inflection point," the report indicated.

Cryptocurrency market sentiment reaches four-year lows

Earlier instances when Matrixport's sentiment indicator registered similarly depressed levels occurred approximately in June 2024 and November 2025, both following significant market downturns and sharp price corrections.

The "Fear and Greed Index" compiled by Alternative.me has similarly descended to levels not witnessed since June 2022, currently showing a reading of 10 out of 100, which denotes "extreme fear" among market participants.

Should Bitcoin conclude February with negative performance, it would mark five consecutive monthly losses representing the longest losing streak observed since 2018, and potentially one of the most severe prolonged sell-offs in the cryptocurrency's history.

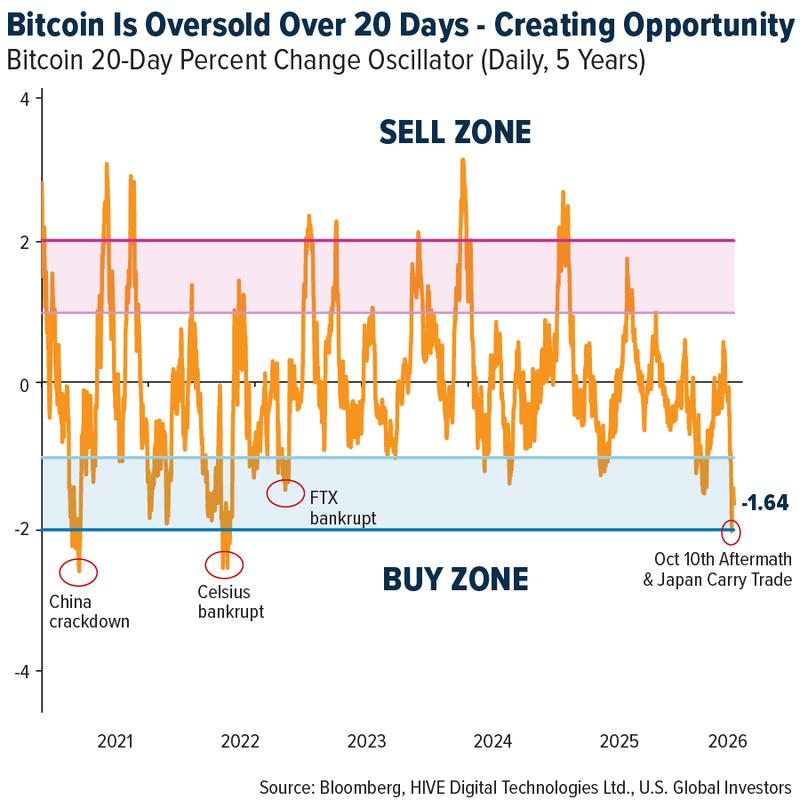

Bitcoin reaches historic oversold territory

Frank Holmes, who serves as chairman of Bitcoin mining company Hive, commented on Monday that Bitcoin has now dropped approximately two standard deviations beneath its 20-day trading average. "This is a level we've seen only three times in the past five years," Holmes observed.

"Historically, such extremes have favored short-term bounces over the subsequent 20 trading days," he elaborated on the historical pattern.

"Despite the ongoing market jitters, I remain bullish in the long term because the fundamentals still look strong."