Massive 17,000 BTC Exchange Deposits Spark Concerns: Is Further Bitcoin Decline Imminent?

Bitcoin's surge toward $90,000 lost momentum following the transfer of 17,000 BTC to trading platforms, though strengthening spot market indicators point to traders perceiving current BTC valuations as attractively priced.

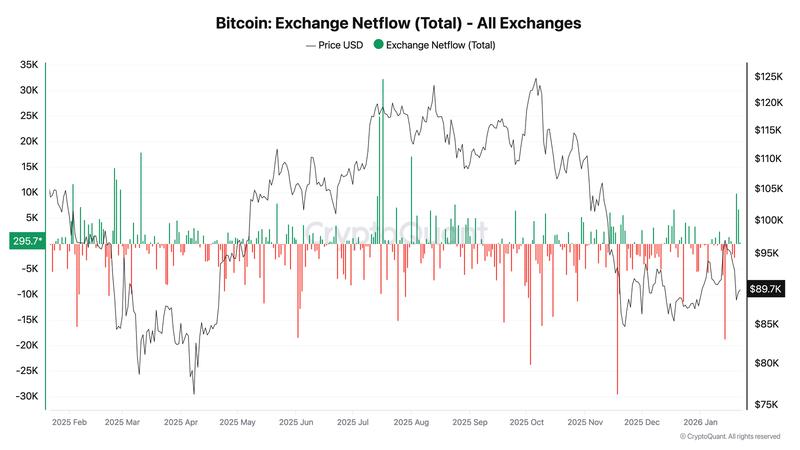

Trading platforms experienced a significant spike in Bitcoin (BTC) deposits during the last 48 hours, mirroring a behavioral pattern observed when prices peaked during July and August 2025. Over 17,000 BTC made its way to exchanges, raising concerns that the ongoing price correction may intensify further.

Axel Adler Jr., a Bitcoin researcher, noted that this unusual influx of 17,000 BTC to exchanges took place across Jan. 20 and 21, with 9,867 BTC arriving on Jan. 20 and an additional 6,786 BTC on Jan. 21. These figures stand in stark contrast to the typical daily netflow range observed throughout January, which has fluctuated between -2,000 and +2,000 BTC.

While netflow figures have returned to normal levels (+296 BTC), the buildup of these inflows has established a significant supply overhang at present price points. Consequently, the ongoing push toward the $89,000 to $90,000 range is being interpreted as a critical resistance challenge.

This observation correlates with Bitcoin's short-term holder SOPR metric, which monitors whether recent purchasers are liquidating their positions at gains or losses. The metric's seven-day SMA currently stands at 0.996, falling short of the crucial 1.0 break-even threshold. During the latest price trough near $87,500, the SOPR plummeted to 0.965, suggesting short-term holders faced an average loss of 3.5%.

Data points to an improving market

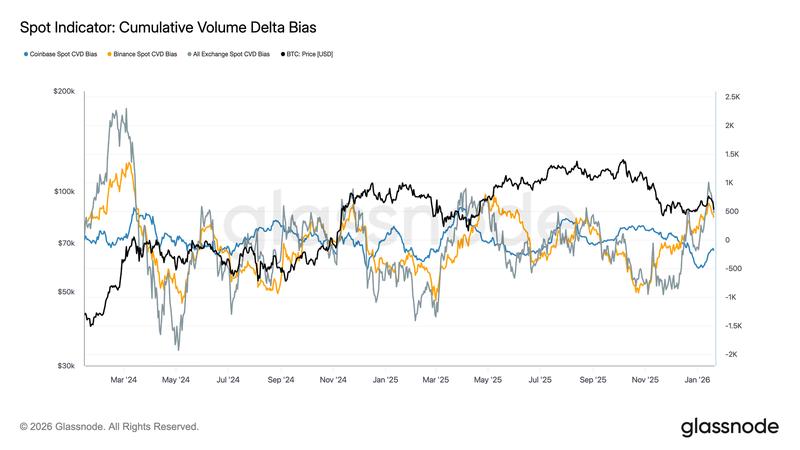

Analysis from Glassnode reveals positive developments within Bitcoin's spot trading environment. Both Binance and the aggregate exchange cumulative volume delta (CVD) have shifted back into buy-dominant territory, while selling momentum on Coinbase has reached equilibrium. This decrease in overhead supply should theoretically provide price stability, though current buying activity remains inadequate.

Significantly, the combined exchange spot CVD measurement has climbed to levels not witnessed since April 2025, a timeframe that historically led to range expansion in the market.

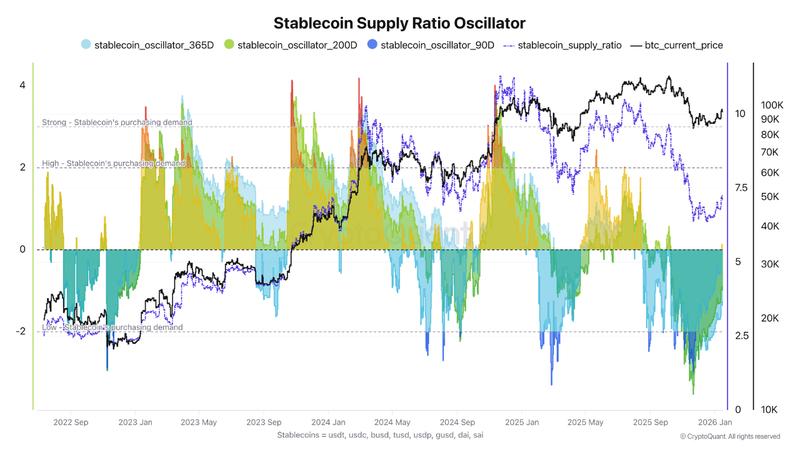

Cryptocurrency analyst Darkfost observed that stablecoin indicators lend credence to a possible bottoming formation. In the wake of Bitcoin's price pullback, the Stablecoin Supply Ratio (SSR) experienced its most dramatic decline of the current cycle, signaling that Bitcoin's market capitalization contracted more rapidly than available stablecoin liquidity.