Goldman Sachs, Barclays Reportedly Engaged in Discussions with Ledger for American Market Debut: FT

According to the Financial Times, Ledger is preparing for a United States stock market debut with a projected $4 billion valuation, driven by increased hardware wallet demand as cryptocurrency fraud and security breaches escalate.

The French-based cryptocurrency hardware wallet manufacturer Ledger is said to be pursuing an initial public offering (IPO) on United States exchanges, a move that could place the company's valuation above the $4 billion threshold.

According to a Friday report by the Financial Times, Ledger has entered into discussions with banking executives from Goldman Sachs, Jefferies and Barclays regarding a prospective listing in the United States, the publication stated, referencing sources with knowledge of the situation.

Back in November 2025, Pascal Gauthier, Ledger's CEO, revealed that the firm was considering either a capital raise or a public listing in New York, emphasizing that funding opportunities for cryptocurrency ventures are "certainly not in Europe."

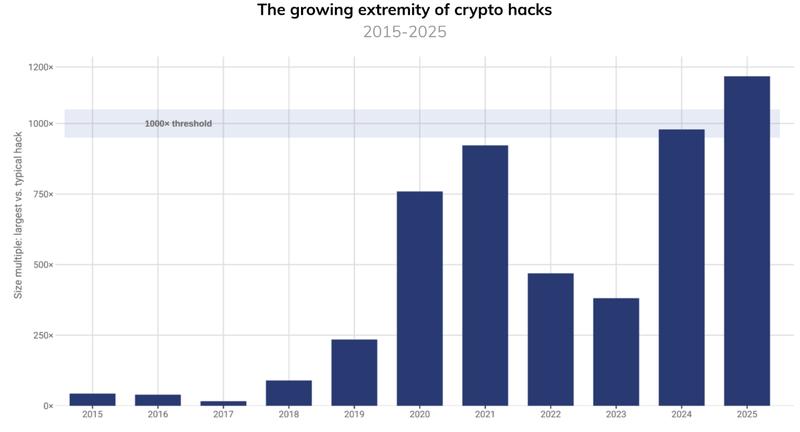

Should these IPO discussions be verified, they would highlight the growing appetite for cryptocurrency storage solutions during a period marked by an increase in digital asset security breaches, with Chainalysis data indicating that over $3.4 billion was stolen throughout 2025.

Ledger posts record year amid rising crypto hacks

Established in Paris during 2014, Ledger stands as one of the leading manufacturers of cryptocurrency hardware wallets — tangible, USB-style devices designed to store private keys in an offline environment, thereby safeguarding digital assets from internet-based hacks and malicious software.

With the rise in cryptocurrency theft as a backdrop, Ledger experienced an exceptional performance in 2025, with revenue figures reportedly reaching "triple-digit millions."

"We're being hacked more and more every day [...] hacking of your bank accounts, of your crypto, and it's not going to get better next year and the year after that," Ledger CEO Gauthier said in late 2025.

When contacted by Cointelegraph, Ledger chose not to provide confirmation regarding the reported potential for a US IPO.

The Financial Times' report emerged just one day following BitGo, recognized as one of the globe's leading cryptocurrency custody service providers, making its public market debut on the New York Stock Exchange on Thursday.

Based on data from the NYSE, BitGo's shares (BTGO) commenced trading at $22.4, representing a 24% increase from the initial IPO price of $18, climbing as high as $24.5 during the inaugural trading session.

Following this development, YZi Labs, a venture capital firm associated with former Binance CEO Changpeng Zhao, made public its strategic investment in BitGo's IPO.