Gold Surges Toward $23K Forecast for 2034 While Bitcoin Falters Below $90K

As Bitcoin continues to struggle beneath the $90,000 threshold, precious metals gold and silver surge to new all-time highs, prompting analysts to project a $23,000 price target.

As Wall Street's Friday session commenced, Bitcoin (BTC) remained confined under the $90,000 threshold while precious metals gold and silver pushed toward all-time high territory.

Key points:

- Bitcoin remains stuck in sideways movement as gold approaches within 2% of the $5,000 per ounce milestone.

- Optimistic BTC price predictions grow scarce while traditional safe haven assets demonstrate superior performance.

- Analysts issue extraordinary $23,000 price forecast for gold spanning the next eight-year period.

Bitcoin price action remains confined in narrow range

Information from TradingView revealed BTC price movements remaining largely static, creating an increasingly stark contrast with precious metals hitting fresh record peaks.

While market participants reached consensus that additional macro lows remained probable for BTC/USD, upward price objectives increasingly concentrated around the 2025 yearly open positioned at $93,500.

"So my bullish outlook still has our going down overall to $75,000 - $70,000 region, but we revisit $100,000 first," trader Crypto Tony told X followers in his latest analysis.

According to Crypto Tony, the 2025 opening price level aligned with a proximate "gap" in CME Group's Bitcoin futures market, potentially amplifying its attraction as a price magnet.

"We would only see this happen if we get that leg up to $93,000 to close the CME gap IMO," he continued.

"A tap of $85,000 would present the best long opportunity. IF WE HOLD."

Previously, BTC/USD successfully "filled" an outstanding gap positioned at $88,000 prior to recovering toward present levels, leaving only gaps situated above the current spot price remaining unfilled.

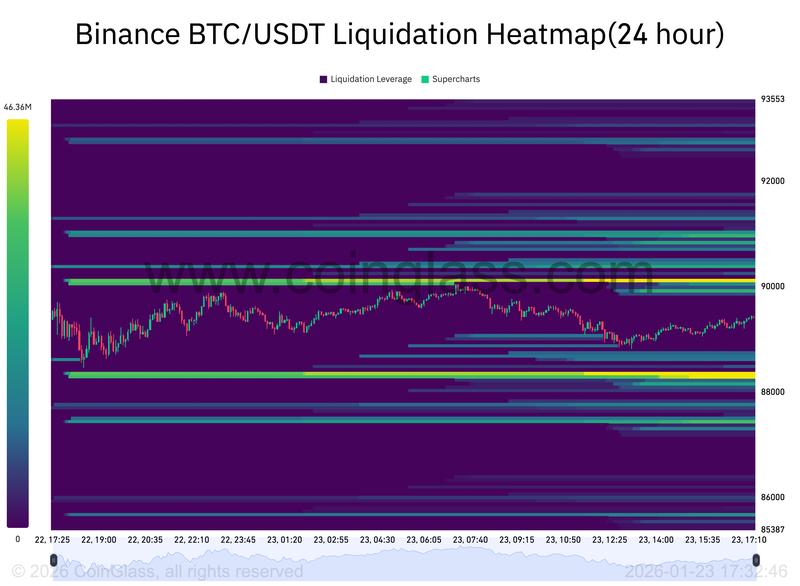

Information from the monitoring resource CoinGlass indicated intensifying liquidation concentrations at the $88,300 and $90,100 levels as the United States trading session drew near.

"If the $86.8K level is lost and doesn't get reclaimed quickly after that, I would assume we'll start to see a test of the lows," crypto trader, analyst and entrepreneur Michaël van de Poppe wrote in an X update on the day.

"On the other hand, a crucial level is found at $91K. Break that & we'll see a strong surge."

Analysts project gold reaching $23,000 per ounce

Media attention concentrated predominantly on precious metals performance as gold and silver approached the significant psychological thresholds of $5,000 and $100, respectively.

The XAU/USD pair achieved fresh all-time highs at $4,967 per ounce during overnight trading, while BTC/XAU maintained a precarious position just above the 18-ounce benchmark.

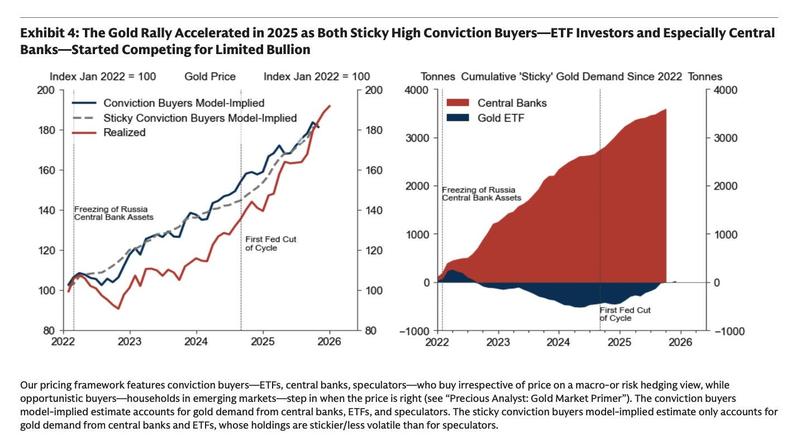

Despite gold's monthly relative strength index (RSI) readings reaching their most extreme "overbought" levels witnessed since the 1970s era, optimistic price projections persisted.

Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, came out with a giant $23,000 gold price tag.

"We have record high Central bank gold accumulation. China has 10Xed their gold stack in the last 2 years alone," he wrote in a blog post dedicated to analysis of gold within the current macro landscape.

"We have an incredible 10.5% fiat money supply inflation per year, ratcheting up asset prices."

According to Edwards' analysis, the ongoing asset bull market could potentially mirror the trajectory of the most significant expansion periods documented throughout the twentieth century.

"If is, we can expect the gold price to trend to between $12,000 to $23,000 over the coming 3-8 years," he concluded.