BTC Faces Extended Sideways Movement, Analysts Warn of Fragile Market Structure

Glassnode highlights Bitcoin's vulnerable onchain fundamentals, cautioning traders about an incoming extended period of sideways price movement for BTC.

A fresh analytical report suggests that Bitcoin (BTC) price may face an extended sideways trading phase should critical resistance thresholds fail to be recovered in the near term.

Key takeaways:

- Bitcoin remains trapped between critical cost-basis thresholds, suggesting a consolidation pattern similar to 2022 unless important support zones are successfully retaken.

- US spot Bitcoin ETFs saw net withdrawals of $708.7 million, representing their fifth-biggest outflow day since inception, indicating growing institutional hesitation.

Bitcoin's "supply overhang" persists

The BTC/USD trading pair continues to fluctuate within a broad corridor bounded by the True Market Mean positioned at $81,100 on the lower end and the short-term holder (STH) cost-basis sitting at $98,400 on the upper end.

Based on Glassnode's assessment, the latest price rejection occurring near the STH cost basis level of $98,400 "mirrors the market structure observed in Q1 2022, where repeated failures to reclaim recent buyers' cost basis prolonged consolidation."

"This similarity reinforces the fragility of the current recovery attempt."

The visualization above demonstrates that Bitcoin's price action during the timeframe spanning February 2022 through July 2022 remained confined between the STH cost basis threshold and the True Market mean before transitioning into a prolonged bear cycle, ultimately reaching a low near $15,000 during November 2022.

Additionally, Glassnode's Entity-Adjusted UTXO Realized Price Distribution (URPD), which illustrates the price levels at which existing Bitcoin UTXOs were originally generated, has identified a broad and concentrated supply cluster above the $100,000 mark that has been progressively transitioning into the long-term holder category.

"This unresolved supply overhang remains a persistent source of sell pressure, likely to cap attempts above the $98.4K STH cost basis and the $100K level," Glassnode wrote, adding

"A clean breakout would therefore require a meaningful and sustained acceleration in demand momentum."

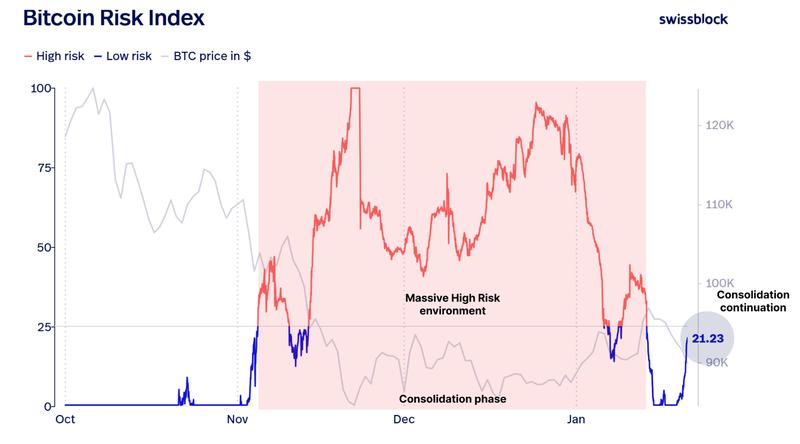

According to private wealth manager Swissblock in a recent X post, the Bitcoin "Risk Index has climbed to 21, hovering just below the High Risk zone (25)," adding:

"This uptick suggests a likely continuation of the consolidation phase triggered by the 'Massive High Risk' environment we faced over the past few months."

Cointelegraph previously reported that Bitcoin needs to overcome the resistance zone ranging from $98,000-$100,000 in order to reignite the bullish market cycle.

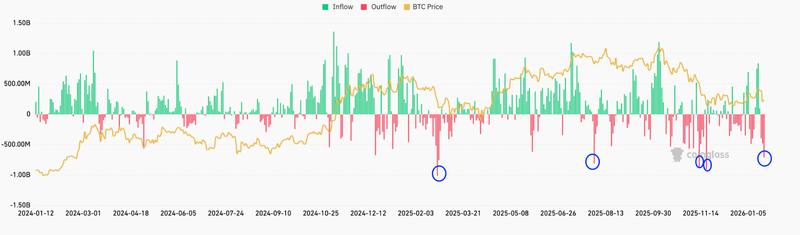

Bitcoin ETFs record their fifth-largest outflows

During Wednesday's trading session, spot Bitcoin ETFs based in the United States experienced net withdrawals for the third day running, amounting to $708.7 million, based on information from CoinGlass.

This represented their most substantial single-day exodus in a two-month period and the fifth-biggest withdrawal episode from these financial instruments since their introduction in January 2024, as illustrated in the chart below.

The largest outflows came from BlackRock's Bitcoin ETF, IBIT, which recorded withdrawals totaling $356.6 million. Fidelity's FBTC came in second with $287.7 million in exits, while four additional funds also experienced withdrawals.

At the same time, spot Ethereum ETFs registered a collective net outflow totaling $286.9 million during Wednesday's session across five different funds.

According to analyst NekoZ in a response to the withdrawal figures, the previous three days witnessed a "historic $1.58B exit from Bitcoin ETFs. BlackRock and Fidelity are leading the charge in heavy institutional de-risking."

The wave of selling from spot BTC ETFs occurred simultaneously with the price rejection at the $90,000 level on Wednesday amidst mounting macroeconomic uncertainty, which elevated the likelihood of sideways trading activity or additional downward movement should the support level at $84,000 fail to hold.