BTC Enters 'Nascent Bear Territory' With $84K Emerging as Critical Price Support

Key profitability indicators for Bitcoin mirror historical bear market patterns, suggesting potential for extended BTC price decline.

The decline of Bitcoin (BTC) beneath the $90,000 threshold has driven onchain profitability indicators into negative ranges, indicating the cryptocurrency's transition into bear market territory, according to recent analysis.

Information from TradingView indicated that the price movement of Bitcoin had formed a fresh trading range on shorter timeframes, with market analysts closely monitoring critical support thresholds underneath.

Key takeaways:

- The net realized profit/loss metric for Bitcoin suggests the market may be transitioning into a macro bearish trend.

- A significant buyer congestion area spanning $80,000 to $84,000 currently represents the primary support zone for BTC.

Profitability metrics for Bitcoin shift into negative range

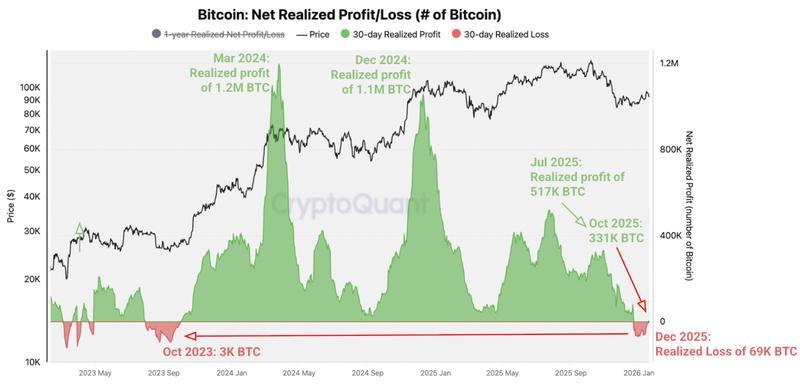

According to the analysis, the net realized profit/loss metric, which measures the cumulative gains or losses that investors secure when transferring coins onchain, has decreased to 69,000 BTC throughout the previous 30-day period, indicating a substantial weakening in market conditions.

CryptoQuant analysts noted that "Bitcoin holders began realizing net losses for the first time since October 2023," further stating:

"Realized profits peaks have been declining since March 2024, an indication that prices are losing momentum as the bull market ends."

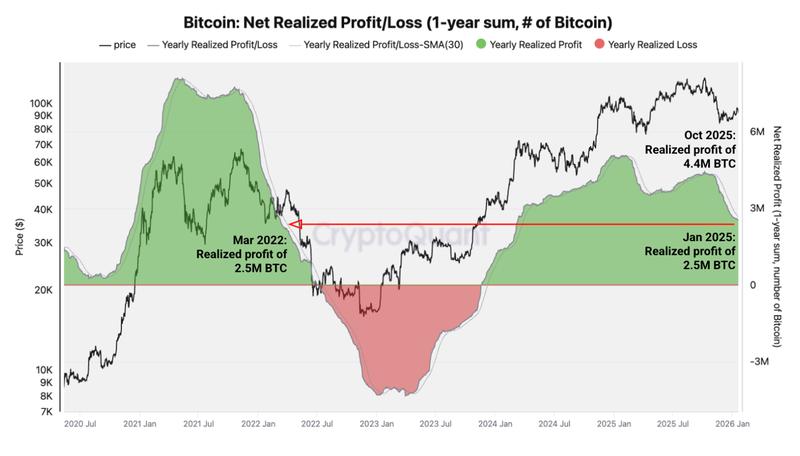

At the same time, yearly net realized profits have experienced a dramatic reduction, declining to 2.5 million BTC from the October figure of 4.4 million BTC, representing levels not witnessed since March 2022.

This development supports the hypothesis that "onchain profit dynamics are now consistent with early-stage bear market conditions," according to the analysts.

The current profitability trajectory bears striking resemblance to the 2021–2022 transition from bull to bear market, during which realized profits reached their zenith in January 2021 and subsequently created descending peaks throughout 2021. These metrics then reversed into net losses prior to the 2022 bear market, as illustrated in the chart above.

Numerous analysts anticipate that 2026 will manifest as a bear market year, with multiple projections forecasting BTC price could retreat to levels as low as $58,000.

Analyst Titan of Crypto stated in a recent X post that "Bitcoin just flashed a bear market signal," pointing to a bearish crossover from the MACD indicator on the two-month timeframe.

"Historically, similar set-ups were followed by 50% - 64% drawdowns."

Critical Bitcoin price thresholds to monitor ahead

The most recent wave of selling pressure has resulted in the BTC/USD trading pair experiencing a 9% decline from its 2026 peak of $97,930.

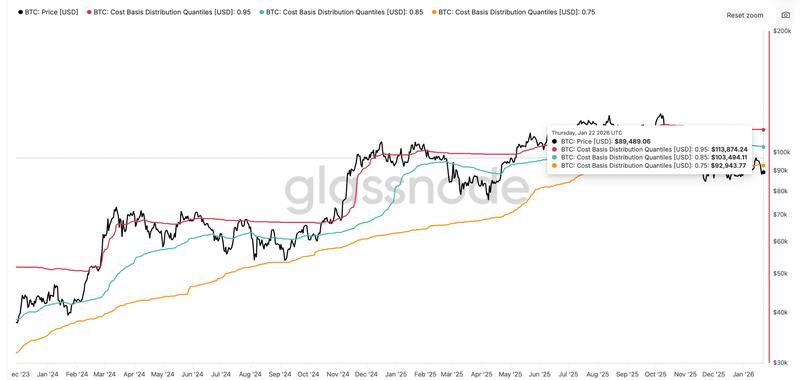

Consequently, Bitcoin has surrendered important support thresholds, including the 75th percentile cost basis presently positioned at $92,940.

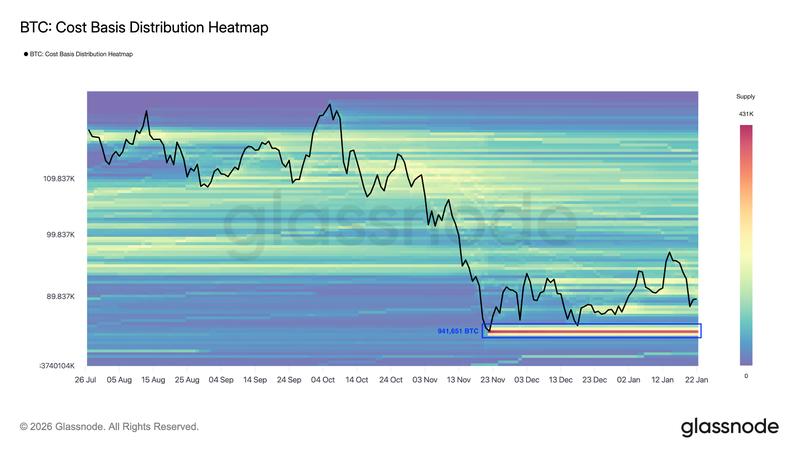

Glassnode stated in a Thursday X post that Bitcoin "now trades below the cost basis of 75% of supply, signalling rising distribution pressure," further noting:

"Risk has shifted higher, with the downside dominant unless this level is recovered."

Trader Merlijn The Trader noted in a Friday X analysis that Bitcoin price is "now back at the rising trendline support," making reference to the support zone spanning $89,000 to $90,000.

Should this threshold fail to hold, "we are likely to revisit the range lows" in the vicinity of $84,000, according to the trader.

The heatmap showing Bitcoin cost basis distribution indicates that approximately 941,651 BTC were accumulated by investors at this price point during the past six months, implying it represents a crucial support threshold.

The subsequent significant support threshold is located near the $80,000 mark, where more than 127,000 BTC were acquired in prior periods.

A consensus exists among many analysts that deteriorating derivatives market conditions, selling activity from long-term holders, and BTC transfers to exchanges may drive Bitcoin's price into a prolonged downtrend throughout this year.