Blockchain Firm Superstate Secures $82.5M Series B to Transform Public Equity Issuance

Superstate's latest funding round will fuel its mission to enable corporations to launch and exchange SEC-regulated equity shares on public blockchain networks.

Superstate, a company specializing in financial technology and asset tokenization, has successfully secured $82.5 million through a Series B funding round. The capital injection comes as the firm accelerates its expansion into onchain capital markets, with plans to revolutionize how corporations conduct fundraising and execute initial public offerings through blockchain technology.

Bain Capital Crypto and Distributed Global served as the lead investors for this funding round, joined by a robust consortium of participants including Haun Ventures, Brevan Howard Digital, Galaxy Digital, Bullish, ParaFi and numerous other investment firms focused on cryptocurrency, as stated in a press release provided to Cointelegraph.

This year, tokenization will catalyze the transformation of capital markets. We're grateful to our partners that allow us to grow our best-in-class team, products, and ambitions.

Robert Leshner, CEO of Superstate

Based on information available on its website, Superstate presently oversees assets exceeding $1.23 billion distributed across two tokenized investment funds. The majority of these assets are held within the US Government Securities Fund (USTB), which manages approximately $794.6 million in AUM and provides investors with a yield of 3.52%, whereas the Crypto Carry Fund (USCC) represents around $441.9 million and delivers a more attractive yield of 5.58%.

Superstate to scale onchain issuance layer

The newly acquired capital will be deployed by Superstate to advance beyond its current Treasury-backed product offerings and construct a comprehensive onchain issuance infrastructure for equities registered with the United States Securities and Exchange Commission (SEC) on both Ethereum (ETH) and Solana (SOL) blockchain networks.

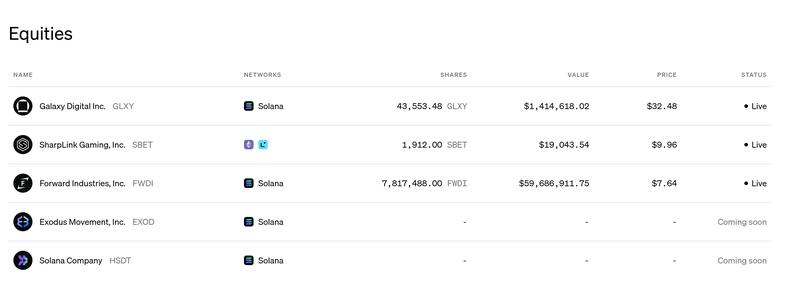

The firm, which maintains its headquarters in New York, has also disclosed intentions to enhance its transfer agent platform alongside Opening Bell, its platform dedicated to tokenized public equities, with the goal of accommodating additional issuers, operational workflows and distribution channels.

Toward the end of 2025, Superstate broadened the capabilities of its Opening Bell platform by introducing support for Direct Issuance Programs, which empower publicly traded companies to issue and distribute digital shares directly to investors via public blockchain networks.

Operating as an SEC-registered transfer agent, Superstate handles issuance processes, settlement operations and maintains ownership records onchain, facilitating real-time trade execution and ownership modifications. According to the company, this approach eliminates sluggish, manually-intensive procedures and enhances the efficiency of fundraising activities and IPOs while maintaining full regulatory compliance.

Tokenized US Treasurys surge 50x

According to reporting by Cointelegraph, tokenized US Treasury products have emerged as one of the most rapidly expanding segments within the real-world asset marketplace, experiencing growth of approximately 50-fold over a period of less than two years as institutional investors pursue onchain yield opportunities.

The market capitalization of this sector climbed from under $200 million in the early months of 2024 to approach $7 billion by the latter part of 2025. BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) emerged as the market leader, amassing nearly $2 billion in assets by providing tokenized access to short-term Treasury securities with daily yield distributions and onchain settlement capabilities.