Why Bitcoin's $75K Level Could Mark the 2026 Price Floor: 4 Key Indicators

Market analysis indicates that Bitcoin is expected to maintain support above its 2026 low of $74,680. Here's why this price level may hold.

Key takeaways:

Following a wave of futures market liquidations, Bitcoin dropped to $74,680, though derivatives market data reveals an absence of panic selling or extreme negative sentiment.

While spot Bitcoin ETF withdrawals hit $3.2 billion, this amount accounts for under 3% of total assets under management.

The price of Bitcoin (BTC) experienced a sharp decline to $74,680 on Monday following the liquidation of approximately $1.8 billion worth of bullish leveraged positions since Thursday's market correction. Market participants shifted toward cash holdings and short-duration government securities, particularly following a dramatic 41% three-day collapse in silver prices. Worries about inflated valuations across the technology sector prompted investors to adopt a more defensive positioning.

Market participants express concern that Bitcoin could experience additional downward pressure, given that gold has emerged as the preferred store of value, with its market capitalization climbing to $33 trillion—representing an 18% increase over the previous three months. Notwithstanding the recent price weakness, four distinct indicators point to Bitcoin maintaining support above $75,000 throughout 2026, as macroeconomic uncertainties have diminished and market participants appear to be overstating the magnitude of capital outflows and the influence of BTC derivatives.

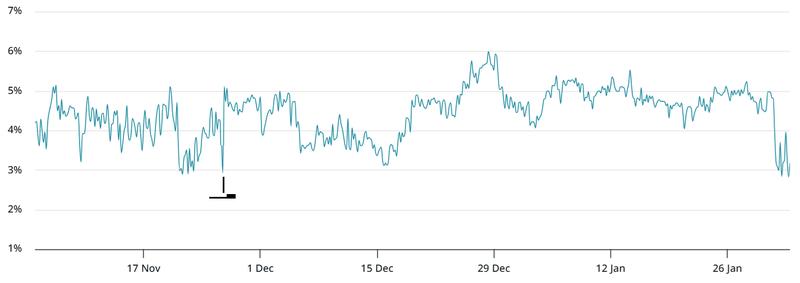

The yield on the US 2-year Treasury note registered 3.54% on Monday, remaining flat compared to levels observed three weeks prior. A significant increase in demand for US government-issued securities would have likely driven yields beneath the 3.45% threshold, comparable to October 2025, when the US experienced an extended government funding shutdown, and employment data reflected weakening conditions.

Similarly, the S&P 500 index closed on Monday trading merely 0.4% beneath its record high, indicating market confidence in a rapid resolution to the most recent US government partial shutdown, which commenced on Saturday. According to Fox News, US House Speaker Mike Johnson indicated that a resolution is anticipated by Tuesday, notwithstanding minimal backing from House Democrats.

Bitcoin derivatives demonstrate strength amid 40.8% price correction

Apprehensions surrounding the artificial intelligence industry progressively subsided following technology giant Oracle's (ORCL US) announcement of intentions to secure up to $50 billion through debt and equity issuances throughout 2026 to satisfy contracted obligations from its cloud computing clients. Market participants had previously been troubled by Oracle's ambitious artificial intelligence expansion strategy, which had resulted in a 50% decline in the corporation's stock price, as reported by CNBC.

The stability observed in Bitcoin derivatives markets indicates that institutional traders have declined to adopt bearish positions despite the 40.8% price retreat from the $126,220 all-time high established in October 2025. Episodes characterized by excessive demand for bearish positions generally result in an inversion within Bitcoin futures markets, whereby these contracts price below spot market levels.

The annualized premium for Bitcoin futures (basis rate) measured 3% on Monday, reflecting subdued appetite for leveraged long positions. During neutral market conditions, this metric typically fluctuates between 5% and 10% to account for the extended settlement timeframe. Nevertheless, there are no indications of distress within BTC derivatives markets, with aggregate futures open interest maintaining a robust $40 billion level, representing a 10% decrease over the preceding 30 days.

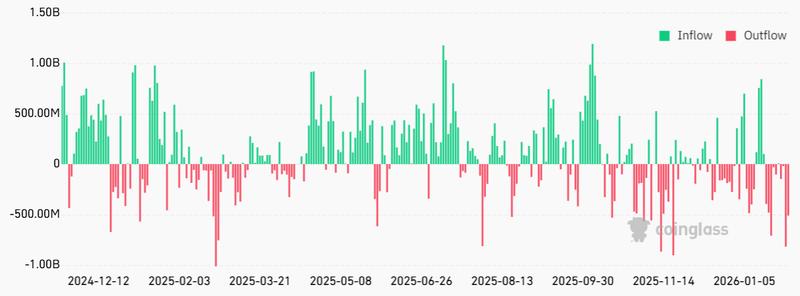

Market participants became progressively worried following the recording of $3.2 billion in net withdrawals from spot Bitcoin exchange-traded funds (ETFs) beginning Jan. 16. However, this amount constitutes less than 3% of the investment products' total assets under management. Strategy (MSTR US) additionally became subject to baseless conjecture after its stock traded beneath net asset value, generating concerns that the enterprise might liquidate portions of its Bitcoin holdings.

Apart from the lack of covenants that would mandate liquidation beneath a designated Bitcoin price threshold, Strategy disclosed $1.44 billion in cash reserves during December 2025 to satisfy dividend payments and interest commitments. Bitcoin's price could continue facing downward pressure as market participants attempt to identify the catalysts driving the recent sell-off, though there exist compelling indications that the $75,000 support threshold may remain intact.