Trading Volume Surges to Record $63B While Crypto ETP Withdrawals Slow

Digital asset ETPs experienced $187 million in withdrawals during their third week of consecutive outflows, even as trading activity reached an all-time high exceeding $63 billion.

Digital asset investment vehicles registered their third consecutive week of withdrawals, although the rate of redemptions slowed considerably as cryptocurrency valuations stabilized following a steep decline.

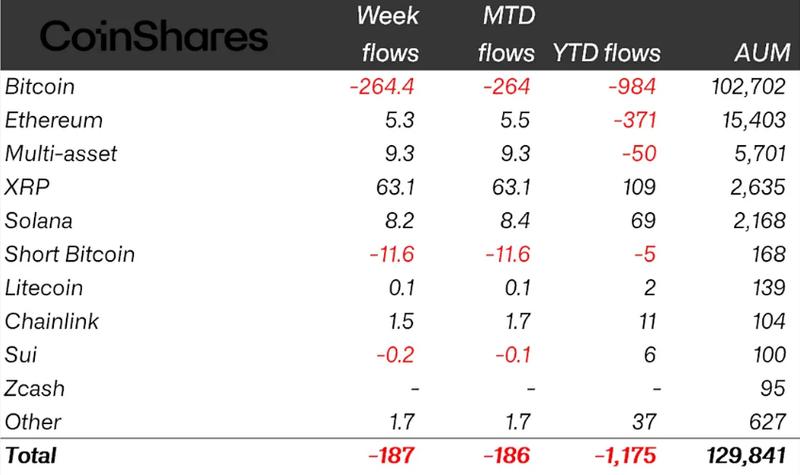

Digital currency exchange-traded products (ETPs) saw $187 million in net withdrawals throughout the week, representing a significant decline from the $3.43 billion in outflows recorded during the prior two-week period, according to a Monday report from CoinShares.

The deceleration in withdrawals occurred as Bitcoin (BTC) dropped to its weakest point since November 2024, with the cryptocurrency bottoming out at $60,000 on the Coinbase exchange last Thursday.

While flows typically move in line with crypto prices, changes in the pace of outflows have historically been more informative, often signaling inflection points in investor sentiment.

James Butterfill, CoinShares' head of research

Bitcoin ETPs only to post major losses, while XRP leads inflows

Investment products focused on Bitcoin represented the sole ETP category to experience substantial withdrawals during the previous week, recording net outflows of $264.4 million.

Investment vehicles tracking XRP (XRP) dominated incoming capital flows, capturing $63 million in new investments, while alternative cryptocurrency ETPs, including those following Ether (ETH) and Solana (SOL), registered moderate increases of $5.3 million and $8.2 million, respectively.

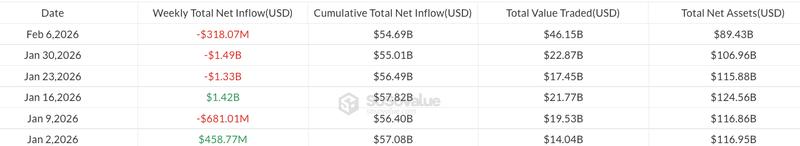

Bitcoin exchange-traded funds (ETFs) with spot exposure represented a substantial share of the total Bitcoin ETP withdrawals during the week, totaling $318 million, based on information from SoSoValue data.

ETP volumes hit record $63 billion in weekly trading

Commenting on the previous week's deceleration in redemptions, Butterfill indicated that a "potential market nadir may have been reached," suggesting that a possible floor might have established itself for ETPs.

Notwithstanding the reduction in outflows, the previous week represented a landmark achievement in trading activity. As reported by Butterfill, ETP trading volumes climbed to an unprecedented $63.1 billion, eclipsing the prior record of $56.4 billion established in October of last year.

Total assets under management (AUM) for Bitcoin ETPs registered $102.7 billion at the week's conclusion, whereas ETF AUM dropped beneath the $90 billion threshold.

At the same time, worldwide cryptocurrency ETP AUM decreased to $129 billion, representing the most modest level recorded since March 2025, according to Butterfill's observations.

After three successive weeks of net withdrawals, digital asset ETPs have shed a cumulative $1.2 billion on a year-to-date basis, in comparison with $1.9 billion in redemptions experienced by Bitcoin ETFs.

In additional sector developments, prominent cryptocurrency fund provider 21Shares submitted documentation last week to the US Securities and Exchange Commission requesting approval for an ETF designed to track Ondo (ONDO).