Traders Eye Critical $68K Support Level as Bitcoin's Long-Term Trendline Emerges

As Bitcoin's price movement nears crucial weekly trendlines, market participants anticipate these levels could establish a sustainable price floor.

Market participants trading Bitcoin (BTC) are observing what could be the cryptocurrency's most important support trendline emerging as a potential foundation for a new macro-level BTC price floor.

Key points:

- Bitcoin is approaching a significant long-term trendline retest not seen since the final months of 2023.

- Traders are monitoring weekly moving averages as potential support mechanisms if the market experiences additional declines.

- Analytical perspectives highlight the remarkable perseverance of market participants despite experiencing a 40% price correction.

200-week trend line for BTC "should be the bottom"

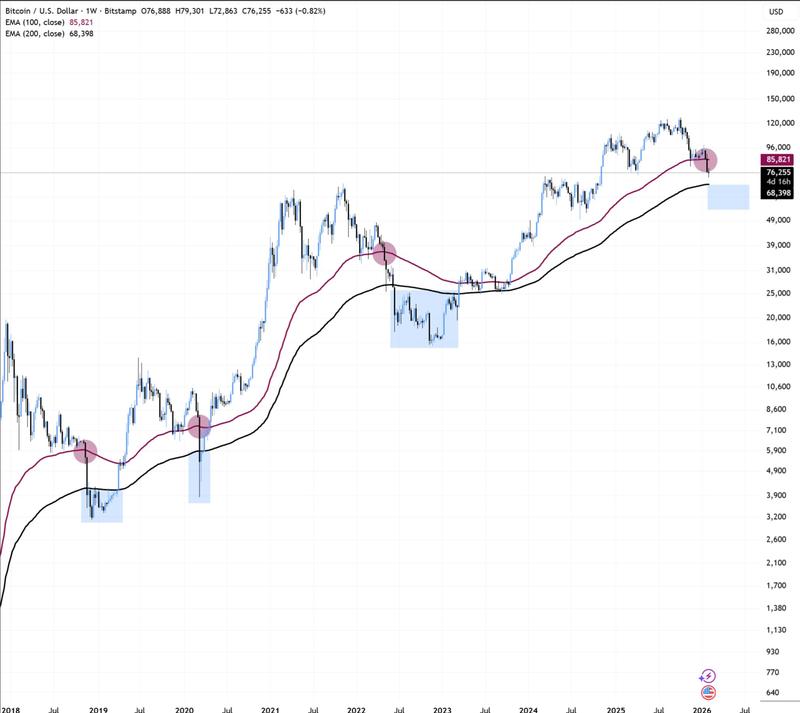

Recent market analysis demonstrates growing expectations that Bitcoin will reach its 200-week exponential moving average (EMA) positioned at $68,400.

Following a sequence of four consecutive negative monthly candles, the BTC price is facing new downward projections, with some targets indicating levels beneath the $50,000 mark.

Although BTC/USD has declined to price points not witnessed since the latter part of 2024 during the current week, traditional support trendlines could ultimately provide rescue.

"We're currently trading at Strategy's cost basis & are close [to] the April lows at $74.4k. If we break below, the next key level is $70k which is just above the previous ATH of $69k," Nic Puckrin, CEO of crypto education resource Coin Bureau, wrote in an X post Wednesday.

"Breaking below that means we head to a bear market low target. The area to watch here $55.7k - $58.2k. That's just between the average realised price of all coins & the 200w MA. That should be the bottom."

In his analysis, Puckrin highlighted the 200-week simple moving average (SMA), which creates a $10,000-wide support zone when combined with the EMA equivalent, according to data available from TradingView.

On the other hand, trader Altcoin Sherpa indicated that a price decline to at minimum the 200-week EMA would "make sense" given current market conditions.

"on 1 hand it makes sense for $BTC to tap the 200W EMA, an indicator that hasn't been touched since 2023. This would be around 68k. On the other, this is still an interesting level as the 2025 low. Either way, the bottom is closer than we think imo"

"Every time Bitcoin has lost 100W EMA, it has retested the 200W EMA," trader BitBull continued on the topic.

"Right now, 200W EMA is at $68,000 and this will most likely be retested. Once the retest happens, you could start accumulating for the long-term."

Bitcoin investors resist full capitulation

Additional market assessments are also providing optimism to BTC investors experiencing uncertainty.

New analysis published Tuesday by Matt Hougan, chief investment officer of crypto asset manager Bitwise, forecasted that the ongoing "crypto winter" would reach its conclusion in the near future.

"Retail crypto has been in a brutal winter since January 2025. Institutions just papered over that truth for certain assets for a while," he argued, noting that the average "winter" lasted around 14 months.

Cointelegraph further reported on strong conviction among Bitcoin derivatives traders after enduring a drawdown of more than 40%.

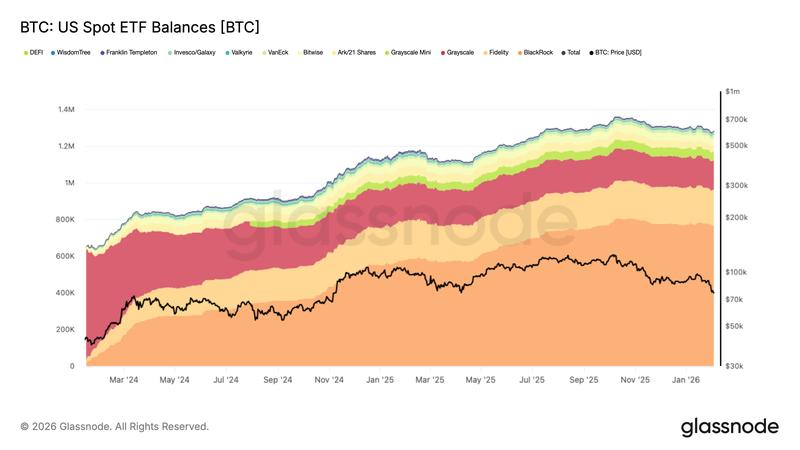

The US spot Bitcoin exchange-traded funds (ETFs) have seen net outflows of $3.2 billion since mid-January — just 3% of their total assets under management.