Manufacturing PMI Reaches 40-Month Peak: Experts Predict Potential Bitcoin Rally

Historical data reveals that movements in the manufacturing index between mid-2020 and 2023 closely tracked the price trajectory of Bitcoin and the wider cryptocurrency market during that period.

An indicator measuring the strength of the United States economy has just reached its highest monthly reading since August 2022, and cryptocurrency analysts believe this development could indicate an upcoming reversal for Bitcoin, currently trading around the $78,000 mark.

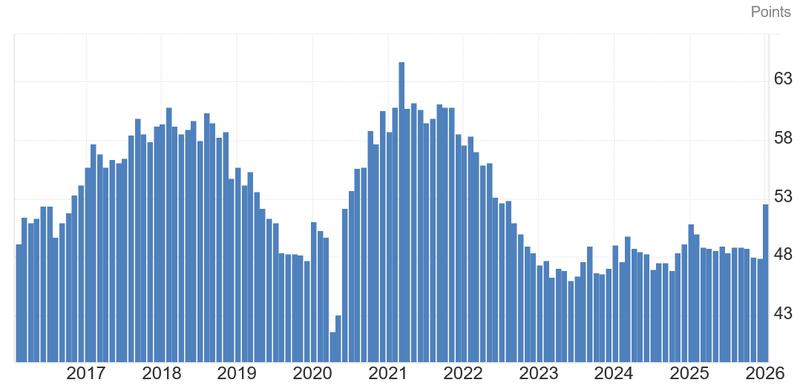

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers' Index (PMI), an indicator that measures manufacturing sector activity across the United States, achieved a reading of 52.6 in January, surpassing market expectations of approximately 48.5 and bringing to a close 26 straight months of economic decline, according to a report released by ISM on Monday.

This particular index reading serves as a key indicator monitored by investors and the Federal Reserve when evaluating economic robustness, potential inflation pressures, and decisions regarding monetary policy tightening or relaxation.

Any reading exceeding 50 signifies economic expansion, whereas a reading falling below 50 signals economic contraction. The previous occasion when the ISM measurement surpassed 52.6 occurred in August 2022.

Cryptocurrency analysts specializing in Bitcoin suggest that the robust ISM measurement could indicate an upcoming reversal for Bitcoin following its decline to a 10-month low of $75,442 on Monday.

Historical information demonstrates that the manufacturing index's upward and downward movements from mid-2020 through 2023 closely paralleled Bitcoin's (BTC) valuation fluctuations throughout the identical timeframe.

"Historically, these PMI reversals mark the shift to risk-on conditions," Strive's vice president of Bitcoin strategy, Joe Burnett, said, pointing out that Bitcoin has rallied after rises in the manufacturing output index score in 2013, 2016, and 2020.

Pseudonymous Bitcoin analyst, Plan C, added: "If you don't upgrade your understanding of the Bitcoin cycle from the 4-year halving mirage mindset to a business cycle / macro mindset fast... You will miss the boat completely on the second massive leg of this Bitcoin bull market!"

Conversely, Into The Cryptoverse founder and CEO Benjamin Cowen observed that Bitcoin doesn't necessarily move in tandem with the manufacturing index at all times, emphasizing that "Bitcoin is not the economy."

Throughout multiple months during the previous year, the ISM Manufacturing PMI either declined or stayed unchanged even as Bitcoin climbed toward its peak of $126,080.

BTC price predictions are far and wide

Bitcoin has experienced significant volatility over recent months following the Oct. 10 liquidation event, during which more than $19 billion in leveraged cryptocurrency positions were abruptly eliminated from the market.

Compared to its October peak, Bitcoin's current valuation represents a decline of almost 38%, even as precious metals and equity markets have generally maintained upward trends, resulting in diminished Bitcoin market confidence.

Professional institutional investors maintain divergent perspectives regarding Bitcoin's potential performance throughout 2026.

In a 2026 prediction report, crypto venture capital firm Dragonfly said Bitcoin would trade above $150,000 by the end of the year, while Fundstrat research head Tom Lee on Jan. 20 tipped Bitcoin would retrace further before making a late-stage comeback and set a new high.

Galaxy Digital took a pass on making a prediction and said 2026 would be "too chaotic" to even guess, saying Bitcoin could end up anywhere between $50,000 and $250,000.