Kansas lawmakers propose Bitcoin reserve funded by unclaimed digital assets

Instead of purchasing Bitcoin directly, the state reserve would be financed through abandoned cryptocurrency, staking yields, and airdrop distributions.

A legislative proposal in Kansas is being evaluated by state lawmakers that would establish a reserve fund for Bitcoin and digital assets managed by the state, with funding derived from unclaimed property instead of direct cryptocurrency acquisitions.

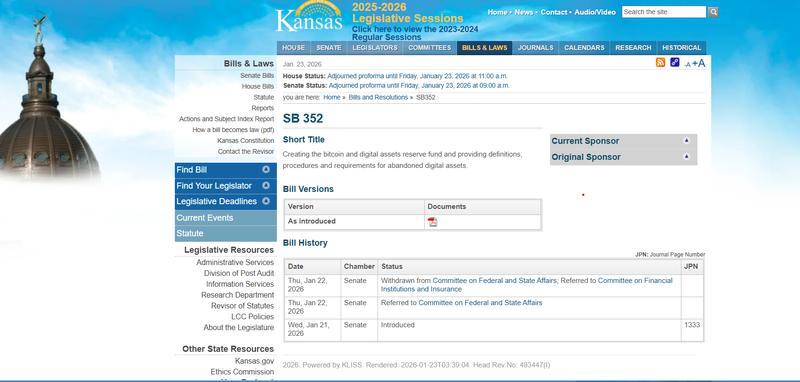

On Wednesday, Senator Craig Bowser introduced Kansas Senate Bill 352, legislation that would create a "Bitcoin and digital assets reserve fund" within the state treasury, with oversight responsibilities assigned to the state treasurer.

The reserve fund would be composed of interest payments, staking rewards, and airdrops generated from abandoned digital assets maintained under the state's unclaimed property legislation in Kansas.

The fund's scope would encompass cryptocurrencies along with "other digital-only assets," explicitly excluding any direct acquisitions of Bitcoin (BTC) by state authorities, a structure that closely resembles the White House's approach to establishing a US Strategic Bitcoin Reserve through forfeited BTC rather than purchasing coins through market transactions.

According to the legislation's provisions, each deposit of digital assets into the reserve fund requires that 10% be allocated to the state's general fund, though Bitcoin holdings themselves would remain separate from the general fund.

Additionally, SB 352 modifies the state of Kansas' unclaimed property laws to establish legal definitions for "digital assets" and "airdrops," while clarifying the procedures the state will follow when handling such assets that have been deemed abandoned.

Following its initial review by the Federal and State Affairs Committee, the bill was transferred to the Committee on Financial Institutions and Insurance on Thursday.

This latest legislative effort follows previous Kansas proposals, including Senate Bill 34, legislation that would permit the Kansas Public Employees Retirement System to invest up to 10% of its holdings in spot Bitcoin exchange-traded funds (ETFs).

SB 34 received its introduction in January 2025 and continues to be under consideration within the Senate Committee on Financial Institutions and Insurance.

Kansas and other states test Bitcoin legislation

Kansas represents one of several US states where legislative bodies have put forward Bitcoin or cryptocurrency-related bills, with proposals spanning from strategic reserve frameworks to task force formations and regulated allocations toward digital asset investment products.

On the federal stage, US President Donald Trump's administration has announced its intention to proceed with plans establishing a Strategic Bitcoin reserve and digital asset stockpile, with funding sources limited to forfeited Bitcoin instead of utilizing new taxpayer funds for purchases.

On Jan. 16, a senior White House official confirmed that the Bitcoin reserve continues to be a priority objective for the administration.

Beyond the borders of the US, nations including El Salvador and Bhutan have previously integrated Bitcoin into their governmental strategies through direct holdings, state-supported mining operations, and utilizing BTC to support long-term development initiatives and special economic zones.