Elliptic Reports: Russian A7A5 Stablecoin Handled $100B in Transactions Prior to Sanctions Implementation

According to Elliptic's analysis, the A7A5 token, backed by the Russian ruble, served as an access point to USDT trading before regulatory restrictions and sanctions limited its expansion.

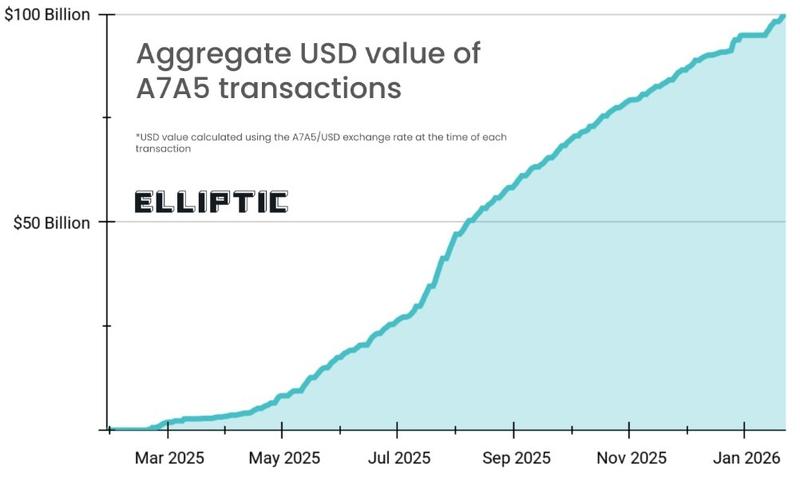

More than $100 billion in onchain transactions were handled by a stablecoin backed by the ruble and connected to sanctioned Russian financial systems over a period of less than twelve months, as revealed in a recent analysis from blockchain analytics company Elliptic.

According to Elliptic's Thursday report, the A7A5 stablecoin's architecture was built to function within a larger system aimed at minimizing vulnerability to sanctions imposed by Western nations. The framework enabled entities with Russian connections to transfer value throughout cryptocurrency markets while mitigating the threat of frozen assets.

The analytics firm discovered that transaction volumes for A7A5 experienced a significant increase after the token's introduction in early 2025, with activity subsequently declining during the latter half of the year when sanctions and enforcement measures implemented by both exchanges and token issuers began limiting the stablecoin's utility.

According to Elliptic's assessment, the magnitude and organization of these transaction flows demonstrate how stablecoins not denominated in US dollars can be engineered to facilitate trade involving sanctioned entities, and simultaneously show that enforcement mechanisms retain the capacity to disrupt these networks.

A7A5's $100 billion figure and its role as a USDT bridge

The $100 billion valuation represents the total accumulated value of every A7A5 transfer documented on publicly accessible blockchains, encompassing both Ethereum and Tron networks, Elliptic explained.

"This is the aggregate value of all A7A5 transfers," Tom Robinson, the founder and chief scientist at Elliptic, told Cointelegraph.

"We are not taking a subjective view on whether each transaction constitutes distinct economic activity, although the fact that transaction fees have been paid for all A7A5 transfers suggests they all confer a benefit to the transactor."

According to Elliptic's examination, A7A5 operated predominantly as an intermediary asset facilitating movement between the Russian ruble and Tether's USDt (USDT), which continues to hold the position as the world's most substantial dollar-denominated stablecoin.

According to the firm, this configuration enabled participants to transfer value into markets for USDT without sustaining extended exposure through wallets that could be susceptible to freezing actions by authorities in Western countries.

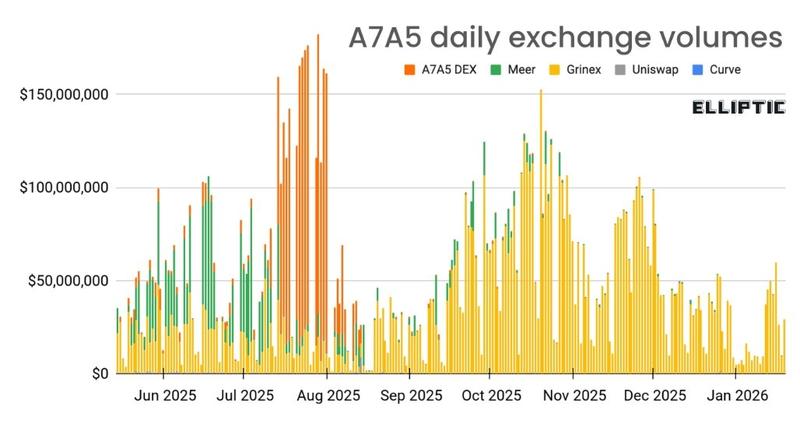

The analysis observed that trading volume for the stablecoin remained focused on a restricted set of platforms, which included exchanges operating from Kyrgyzstan and infrastructure connected to the project itself. This pattern strengthens the assessment that the token served as a specially designed settlement instrument rather than functioning as a widely embraced consumer-facing stablecoin.

Sanctions pressure and exchange controls curb growth

The stablecoin's growth trajectory experienced a deceleration around the middle of 2025, with issuance activity ceasing after July and no significant new minting occurring, while transaction volumes decreased from highs of $1.5 billion down to approximately $500 million, according to Elliptic's findings.

In statements to Cointelegraph, Robinson indicated that sanctions implemented by the United States in August 2025 delivered the most direct and significant effect on the operational capabilities of the stablecoin.

"The US sanctions in August 2025 appear to have had the largest impact," Robinson said. "Immediately after the US designations, USDT liquidity provision to A7A5's DEX dropped substantially, removing one of the stablecoin's key benefits — easy on-chain access to USDT."

Further limitations emerged when exchanges began implementing countermeasures. During November 2025, the decentralized exchange (DEX) platform Uniswap incorporated A7A5 into its blocklist of prohibited tokens, which prevented transactions through its web-based interface.

Elliptic additionally referenced accounts from platform users who experienced USDT deposit freezes by exchanges following trace analysis that connected their funds to wallets associated with A7A5.

On Oct. 23, the European Union officially imposed sanctions on A7A5, characterizing the stablecoin as an instrument utilized to circumvent financial measures connected to Russia's military economy.

According to Robinson's analysis, the development path of A7A5 demonstrates both the opportunities and the constraints inherent to non-dollar stablecoins constructed for operating within a sanctions-dominated financial environment.

"While the US dollar dominates the global economy, there are structural limits to how far a stablecoin such as this can grow," he told Cointelegraph. "However, if that changes, all bets are off."