Capital One Seals $5.15B Acquisition of Stablecoin-Enabled Fintech Brex

In a major acquisition, Capital One has purchased Brex, securing access to stablecoin payment technology mere months after the fintech company introduced support for digital tokens.

Leading American financial institution Capital One has finalized a $5.15 billion acquisition agreement for fintech company Brex, positioning itself to take control of the startup's stablecoin payment technology.

The banking giant announced on Thursday that the transaction will involve a mix of cash and stock compensation, with an anticipated completion date in mid-2026.

Since our founding, we set out to build a payments company at the frontier of the technology revolution. Acquiring Brex accelerates this journey, especially in the business payments marketplace.

Richard Fairbank, Capital One's founder and CEO

This transaction represents one of the most significant fintech acquisitions seen in recent years and will integrate the stablecoin-embracing startup into the operations of one of America's premier financial institutions, as legacy financial services firms explore pathways into the cryptocurrency sector.

A potential move into stablecoins

Last October, Brex made headlines when it announced its plans to become the inaugural global corporate card provider offering native stablecoin payment capabilities, beginning with USDC.

Pedro Franceschi, Brex's founder and CEO, shared on X that he plans to remain at the helm of the company, emphasizing that the combined entities would "be able to move faster, invest more deeply, and bring more powerful capabilities to businesses than either of us could alone."

This story is about growth acceleration, and two founder-led companies coming together to bring a better way to manage money to millions of businesses in the mainstream US economy, who are dramatically underserved by traditional banks.

Pedro Franceschi, Brex founder and CEO

The stablecoin sector has emerged as a highly discussed subject within traditional finance communities following Congressional approval of crucial regulatory frameworks for these digital assets last year.

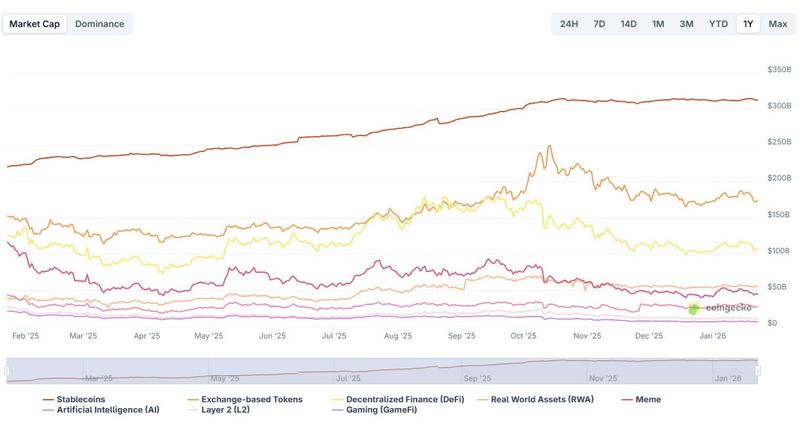

According to data from CoinGecko, the total market capitalization of stablecoins has grown by 18.6% to reach an unprecedented $314 billion following the enactment of the GENIUS Act in July 2025.