BTC ETFs Face $545M Exodus While Bitcoin Hovers Around $70K Mark

Daily withdrawals from Bitcoin ETFs reached $545 million as Bitcoin approached the $70,000 threshold, yet market experts note that the majority of investors continue maintaining their holdings amid ongoing market turbulence.

Exchange-traded funds focused on Bitcoin continued their losing streak on Wednesday as the cryptocurrency's value moved closer to the $70,000 threshold, contributing to increased strain throughout cryptocurrency investment vehicles.

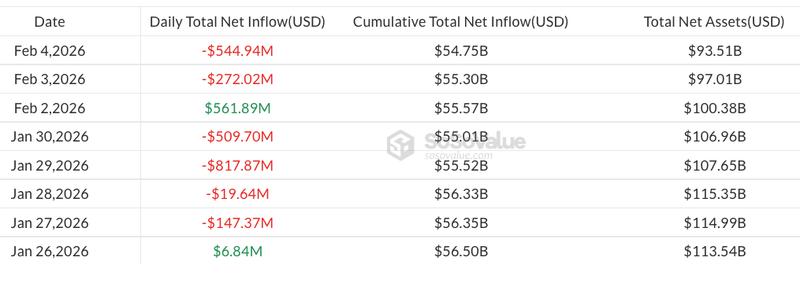

Information sourced from SoSoValue reveals that exchange-traded funds holding spot Bitcoin (BTC) experienced withdrawals totaling $545 million during the trading session, resulting in negative weekly movement with net redemptions reaching $255 million.

Since the beginning of the year, these investment vehicles have seen $3.5 billion in capital flowing in while experiencing $5.4 billion in withdrawals, creating a net deficit of $1.8 billion. The combined assets under management currently total $93.5 billion.

This negative ETF trend reflects wider market challenges, as the overall cryptocurrency market valuation has declined approximately 20% year-to-date, dropping from roughly $3 trillion to $2.5 trillion as of this writing, based on data from CoinGecko.

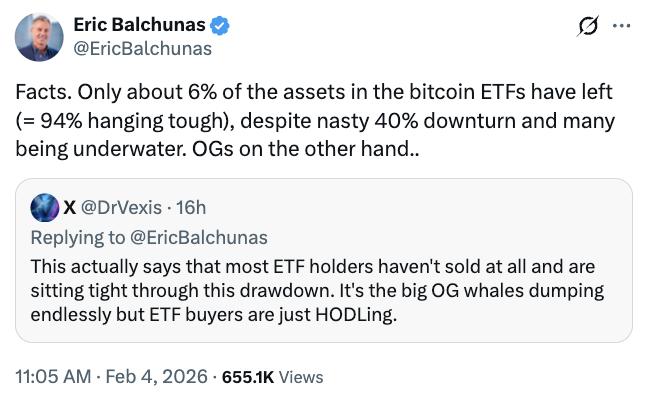

Bitcoin ETF investors HODL, with only 6% of assets exiting the market

Even while experiencing their most significant drawdowns since their debut two years ago, certain market observers suggest Bitcoin ETFs demonstrate strength throughout the current market fluctuations.

Considering that cumulative net capital inflows for spot Bitcoin ETFs stand at $54.8 billion, the marketplace has declined merely 13% from its highest point of $62.9 billion achieved in October last year.

That's not too shabby considering these funds took in around $63 billion at their peak.

James Seyffart, Bloomberg ETF analyst

Eric Balchunas, who serves as senior ETF analyst at Bloomberg, indicated that the vast majority of those invested in Bitcoin ETFs have maintained their holdings throughout the current market decline.

According to Balchunas' calculations, merely 6% of the total assets have been withdrawn from these funds, despite Bitcoin's significant price decline and numerous investors currently holding positions at a loss.

He further noted that BlackRock's iShares Bitcoin ETF (IBIT) experienced an asset decline to $60 billion following a brief peak at $100 billion "for a hot second."

It could stay stuck at this level for the next three years and it would still be the all time fastest ETF to hit $60 billion.

Eric Balchunas, Bloomberg ETF analyst

In the context of substantial withdrawals from Bitcoin ETFs, alternative cryptocurrency funds also experienced varied capital movements. Ether (ETH) ETFs registered $79.5 million in redemptions on Wednesday, whereas XRP funds showed moderate inflows totaling $4.8 million. Solana (SOL) ETFs, on the other hand, experienced withdrawals amounting to $6.7 million.