BlackRock's IBIT investors face losses as Bitcoin downturn erases gains — fund manager

Investors in BlackRock's iShares Bitcoin Trust are now seeing negative aggregate returns on a dollar-weighted basis after Bitcoin's latest price collapse.

The weekend's precipitous drop in Bitcoin prices has likely driven the collective investor holdings in the world's largest spot Bitcoin exchange-traded fund (ETF) below breakeven, highlighting just how severe the latest market correction has been.

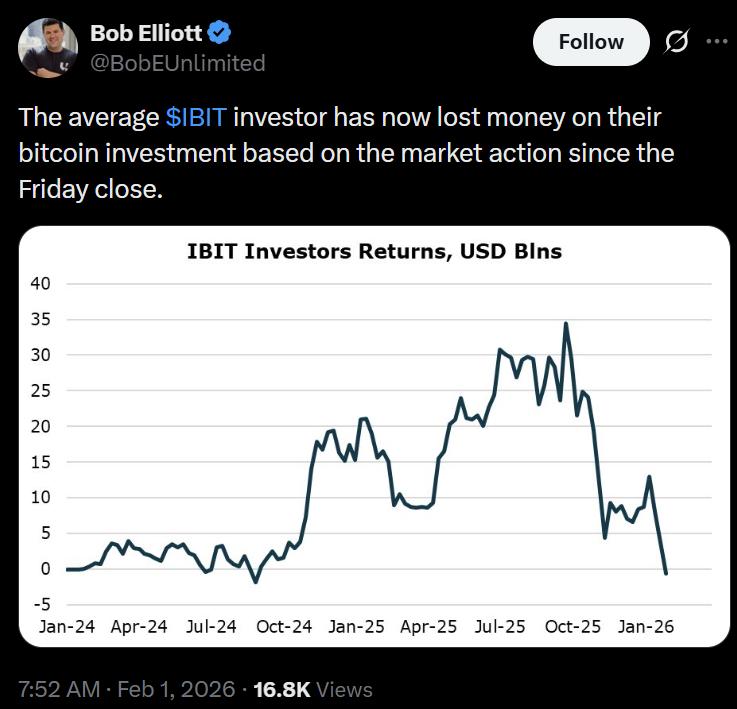

Data from Bob Elliott, who serves as chief investment officer at Unlimited Funds, an asset management firm, indicates that the typical dollar placed into BlackRock's iShares Bitcoin Trust (IBIT) has now fallen below its entry point as of Friday's market close. This development came as Bitcoin's (BTC) value tumbled sharply into the mid-$70,000 price range.

Elliott published a chart monitoring the aggregate investor returns weighted by dollar amounts, which revealed that cumulative profits had dipped marginally below zero by the end of January.

The figures indicate that although investors who entered IBIT positions early may continue to hold profitable stakes, substantial capital inflows during periods of elevated prices have dragged the overall dollar-weighted performance into the red. Essentially, the total accumulated profits measured on a dollar-weighted framework since the fund's inception have now been completely wiped out.

For context, IBIT's dollar-weighted performance had reached approximately $35 billion in positive returns during October, a period when Bitcoin was hitting all-time price peaks.

IBIT stands as one of BlackRock's most triumphant ETF introductions, achieving the milestone of becoming the quickest fund ever to amass $70 billion in assets under management. Reports from October indicated that IBIT was collecting approximately $25 million more in management fees compared to the asset manager's next most lucrative ETF offering.

Third-party information available on Yahoo Finance demonstrates that IBIT's net asset value has experienced a downturn in recent weeks, consistent with the wider Bitcoin market correction. This value erosion provides clarity as to why the aggregate dollar-weighted returns for investors have crossed into negative territory.

Bitcoin ETF outflows accelerate

The erosion in dollar-weighted performance across Bitcoin ETFs is occurring in tandem with a wider retreat from cryptocurrency investment vehicles, as market participants scale back their positions in response to falling asset prices.

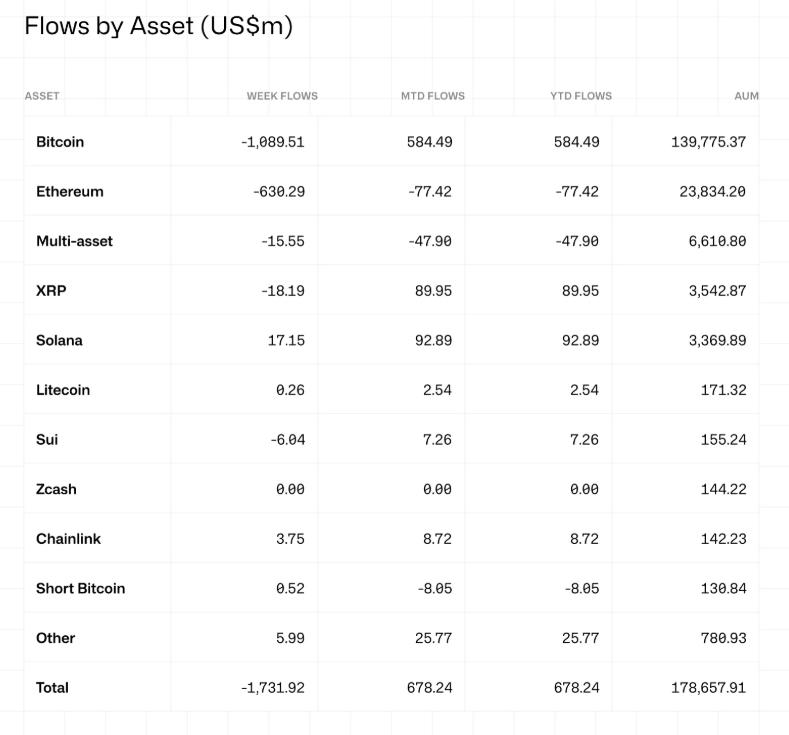

During the week ending Jan. 25, digital asset investment vehicles experienced approximately $1.1 billion in redemptions from Bitcoin-focused funds exclusively, while aggregate withdrawals from all crypto funds totaled $1.73 billion — marking the most substantial weekly exodus since the middle of November, per data from CoinShares. The United States accounted for the overwhelming majority of these outflows.

Dwindling expectations for interest rate cuts, negative price momentum and disappointment that digital assets have not participated in the debasement trade yet have likely fuelled these outflows

CoinShares

The term "debasement trade" describes investment positioning in assets anticipated to maintain purchasing power during periods of inflation and monetary devaluation. Bitcoin has been broadly viewed as a suitable candidate for this investment thesis due to its capped supply and underlying monetary architecture.

Nevertheless, Bitcoin has not yet captured such investment flows to the degree that gold has achieved. Even accounting for a minor recent correction, gold has maintained a persistent upward trajectory spanning more than twelve months and has recently climbed to unprecedented peaks exceeding $5,400 per troy ounce.