Bitwise reports Bitcoin reaches 'bargain basement' pricing amid capital exodus

BTC appears significantly undervalued based on current metrics, and with diminishing sell pressure, market experts view Bitcoin as an exceptional entry point for investors.

The Bitcoin (BTC) market witnessed prices plunge to a year-to-date bottom of $74,555 during Monday's trading session, representing a substantial 40% decline from the cryptocurrency's record peak. This downward movement occurred in tandem with global Bitcoin exchange-traded products (ETPs) experiencing $1.3 billion in net capital withdrawals throughout the previous week.

The significant price correction aligned with intensely pessimistic market sentiment and depressed valuation indicators, yet the positive aspect may be found in market analysts' perspective that a prospective asymmetric trading opportunity could be developing.

Key takeaways:

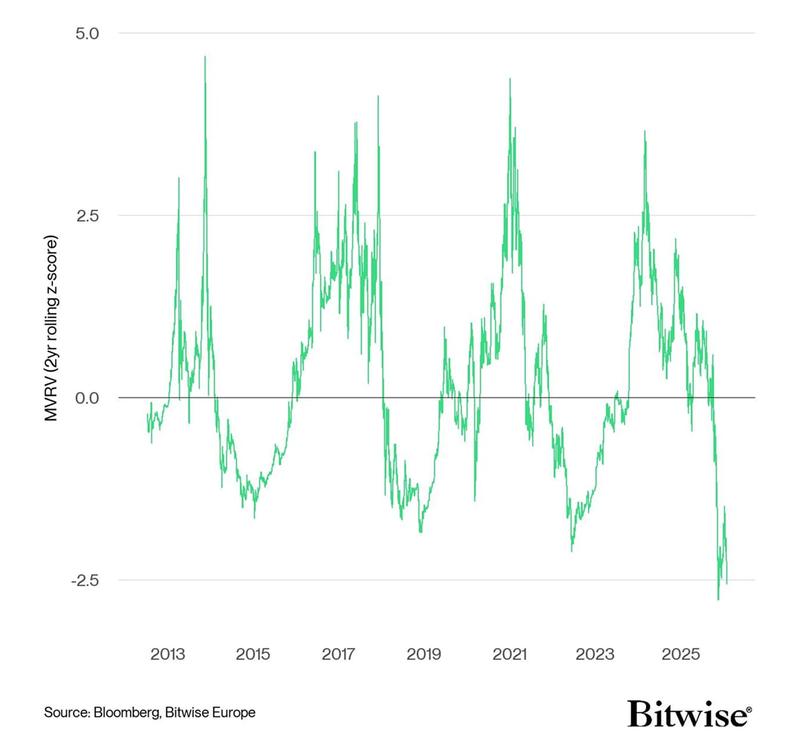

- The 2-year rolling MVRV z-score for Bitcoin has declined to a record-low reading, indicating severe undervaluation conditions.

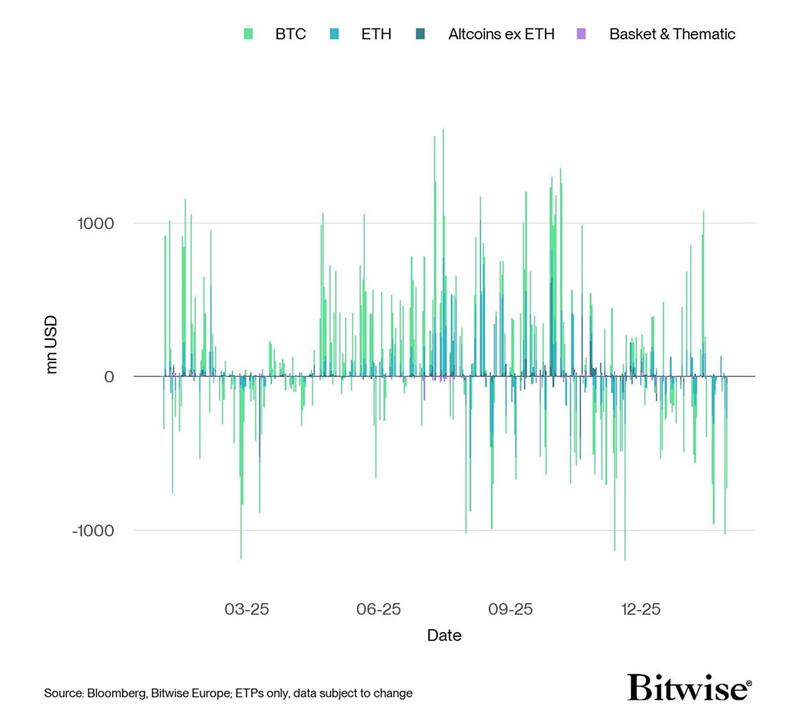

- Bitcoin ETPs worldwide experienced $1.35 billion in net weekly capital outflows, with US spot exchange-traded funds (ETFs) accounting for $1.49 billion of the total.

- The daily RSI for Bitcoin descended into the 20 to 25 territory, a level that has historically been followed by 10% price recoveries in each occurrence since August 2023.

Bitcoin reaches "fire-sale" pricing levels as market sentiment deteriorates: Bitwise analysis

Based on findings from Bitwise's Weekly Crypto Market Compass report, the recent BTC price decline has pushed its two-year rolling Market-Value-to-Realized-Value (MVRV) z-score down to an unprecedented low in the metric's history, an indicator associated with undervalued conditions, "signalling fire-sale valuations for Bitcoin".

The metric known as MVRV z-score calculates the extent to which Bitcoin's current market value diverges from the collective cost basis held by all investors, while accounting for historical price volatility patterns.

The Cryptoasset Sentiment Index from Bitwise similarly fell to readings comparable to those observed during the liquidation event of October 2023, showing just 2 out of 15 monitored indicators maintaining positions above their short-term trend lines.

Investment capital movement patterns further validated the pessimistic market atmosphere. Worldwide crypto ETPs witnessed $1.73 billion in net capital exits during the past week, coming on the heels of $1.81 billion in outflows the preceding week. Bitcoin-focused products by themselves represented $1.35 billion, with the majority stemming from US spot BTC ETFs.

The Grayscale Bitcoin Trust along with the iShares Bitcoin Trust experienced $119 million and $947 million in weekly capital withdrawals, respectively.

Bitcoin could discover price support around Monday's low points

Bitcoin appears well-positioned for a near-term relief rally following the establishment of a local bottom in the vicinity of $74,500 during Monday's session. The daily relative strength index (RSI) descended into the 20 to 25 band, a region that has historically preceded approximately 10% in price recoveries during every occurrence since August 2023, with June 2024 representing the sole delayed outlier.

Analysis of lower time frame data lends credence to the potential for an upward reversal, with the spot cumulative volume delta (CVD) across Binance and Coinbase shifting to positive territory as BTC recovered toward the $79,300 level.

The upward trajectory in spot CVD demonstrates net aggressive buying activity, whereas the stable open interest and negative aggregated funding rates indicate the upward movement originates from spot market demand instead of leveraged long positions, thereby minimizing immediate liquidation threats.

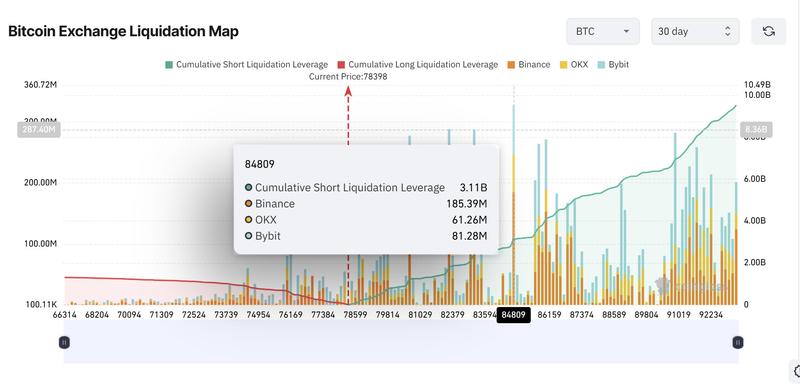

BTC long position liquidations exceeding $1.8 billion throughout last week reinforce this outlook, and the present liquidity concentration exists on the upper side, with more than $3 billion in aggregate short positions facing liquidation risk in the proximity of $85,000.

Cryptocurrency trader 'exitpump' corroborated this configuration, highlighting a bullish spot CVD divergence pattern visible across leading exchanges.