Bitcoin ETFs Experience $1.72B Exodus Over Five Consecutive Trading Days

American spot Bitcoin exchange-traded funds have experienced net outflows exceeding $1.72 billion over the last five trading sessions, with cryptocurrency market sentiment remaining firmly entrenched in "Extreme Fear" levels.

American-based spot Bitcoin exchange-traded funds (ETFs) have now extended their ongoing outflow pattern to a fifth consecutive day while cryptocurrency market sentiment continues its downward trajectory.

Exchange-traded funds tracking spot Bitcoin (BTC) recorded net outflows totaling $103.5 million on Friday, marking a continuation of the withdrawal pattern that initially commenced on the preceding Friday.

Across the full five-day period, which encompasses the abbreviated four-day US trading week due to the Martin Luther King Jr. Day holiday observed on Monday, aggregate outflows climbed to roughly $1.72 billion, based on data compiled by Farside.

At the time of this writing, the spot price for Bitcoin stands at $89,160, having failed to breach the significant psychological threshold of $100,000 since Nov. 13, based on CoinMarketCap data.

Investors and market analysts frequently monitor the flow patterns of spot Bitcoin ETFs as a barometer for retail investor sentiment and to identify potential indicators regarding Bitcoin's trajectory in the upcoming weeks.

The crypto market is in a "phase of uncertainty," says Santiment

This development arrives as the broader cryptocurrency market sentiment has experienced deterioration in recent periods.

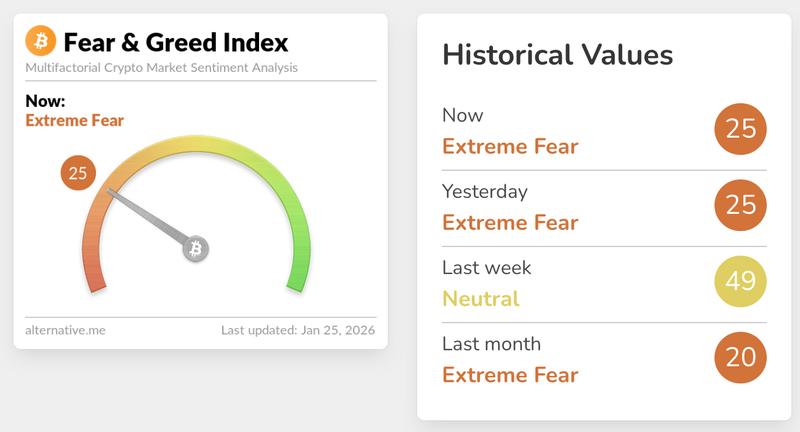

The Crypto Fear & Greed Index, a gauge that tracks overall cryptocurrency market sentiment, registered an "Extreme Fear" reading of 25 in its most recent Sunday update.

Cryptocurrency sentiment analysis platform Santiment stated in a Saturday report that the digital asset market is currently experiencing "a phase of uncertainty."

"Retail traders are heading for the exits, while money and attention are flowing to more traditional assets," Santiment said, suggesting that a reversal from the present downward trend could be on the near-term horizon.

"At the same time, quieter signals like supply distribution and the lack of social chatter hint that a bottom may be taking shape," Santiment said.

"The best move is probably patience."

In the meantime, Nik Bhatia, founder of global macro research firm The Bitcoin Layer, commented in a Saturday post on X that the declining sentiment might be partially attributed to recent increases in precious metal valuations.

"With gold practically $5,000 and silver at $100, the sentiment in Bitcoin is so poor due to being left out of the metals rally that it almost feels like post-FTX $17,000 bear vibes," Bhatia said.

"I am bullish but the painful type where fear dominates and you have to push through it," Bhatia added.

Crypto analyst Bob Loukas said that "sentiment is in the gutter and we could argue overdue some type of strong countertrend rally."