Bitcoin ETF holders face losses as $2.8B exodus unfolds over two-week period

The cryptocurrency plunged to $74,600 during Monday's trading session after a turbulent weekend, marking its lowest point in nine months.

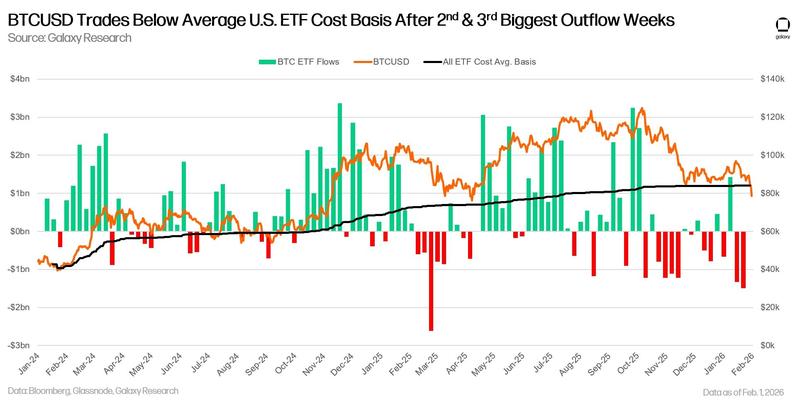

The current Bitcoin price has dipped beneath the mean acquisition price of United States spot Bitcoin exchange-traded funds, a development occurring after these investment vehicles experienced their second-largest and third-largest withdrawal periods in recent weeks, as noted by Alex Thorn, who serves as Galaxy's research division head.

According to data from Coinglass, the aggregate assets under management across US Bitcoin ETF offerings stand at roughly $113 billion, while BiTBO reports these funds maintain collective holdings of approximately 1.28 million BTC, suggesting a mean cost basis hovering around $87,830 for each Bitcoin unit.

Concurrently, Bitcoin (BTC) valuations experienced a dramatic downturn of roughly 11% during a precipitous decline from $84,000 recorded on Saturday down to approximately $74,600 during the early hours of Monday trading—a price level not witnessed in nine months.

"This means the average Bitcoin ETF purchase is underwater," said Thorn.

The collection of eleven spot BTC ETF products witnessed withdrawals totaling $2.8 billion throughout the preceding two-week timeframe, encompassing $1.49 billion during the most recent week and an additional $1.32 billion in the week prior, based on data compiled by CoinGlass.

Institutional investors have tougher hands

The total assets under management for United States-based spot Bitcoin ETF products have experienced a 31.5% reduction from their October zenith of $165 billion, whereas spot BTC has declined by 40%.

"They've [institutional investors] been hodling," said Thorn, who added that ETF cumulative inflow is only down 12% from its peak while Bitcoin is down 38%.

Dwindling demand sparks bear market fears

LVRG Research director Nick Ruck has issued a cautionary statement suggesting Bitcoin could potentially descend into a comprehensive bear market scenario should a price recovery fail to materialize in the near term.

"The crypto market continues its sell-off as Bitcoin falls to around $76,000 amid heightened macro uncertainty, while the proposed US CLARITY Act stalls," he told Cointelegraph.

"Despite Trump's crypto-friendly pick for the next Fed chair, investors are de-risking due to continuous geopolitical conflicts and dollar instability as the US economy struggles between rising unemployment and inflation," he continued.

"BTC may enter into a bear market if it continues to drop further, as technical indicators showcase long-term sell pressure patterns forming if demand doesn't recover soon."