UK's Cryptocurrency Hub Dreams Take Hit as Gemini Withdraws from Market

Cryptocurrency platforms and industry organizations point to the United Kingdom's sluggish regulatory development, overlapping compliance requirements, and operational challenges as barriers to achieving its ambition of becoming a leading digital asset center.

The choice by Gemini to withdraw from operations in the United Kingdom, the European Union, and Australia in order to concentrate resources on the United States and Singapore has intensified debate about whether Britain's incomplete regulatory framework is driving away precisely the kind of well-regulated operators that government officials had hoped to welcome.

Back in April 2022, Rishi Sunak, who was serving as Chancellor at the time, publicly declared his "ambition to make the UK a global hub for cryptoasset technology," announcing Treasury initiatives including stablecoin regulation and initiating a Financial Conduct Authority (FCA) "CryptoSprint" designed to facilitate corporate investment in the nation.

Yet when Gemini released its most recent strategy update on Feb. 5, the exchange characterized numerous international markets as "hard to win," explaining that geographic expansion had left the organization "stretched thin" and encumbered by organizational complexity, which drove operational costs higher.

Why Gemini's exit stings for UK policymakers

According to Susie Violet Ward, CEO of Bitcoin Policy UK, the situation underscores how protracted regulatory development, overlapping regulatory frameworks, and elevated compliance expenses relative to market opportunity are discouraging companies from establishing operations locally, despite the FCA's movement toward implementing a Markets in Crypto Assets Regulation (MiCA) style prudential framework for crypto asset companies.

In her conversation with Cointelegraph, she explained that when regulatory frameworks remain in flux and compliance costs are disproportionate to market potential, it becomes increasingly difficult for organizations to allocate capital, expand headcount and achieve growth. "Capital goes where it can operate with clarity and confidence," she stated, noting that Gemini's strategic withdrawal exemplifies this dynamic.

Ward further noted that crypto businesses in the UK presently navigate a "patchwork" of Anti-Money Laundering (AML) registration requirements, financial promotions limitations and provisional guidance while comprehensive regulations remain "years away."

In her view, this amalgamation renders the country a more challenging environment for capital deployment compared to jurisdictions that provide more transparent regulatory frameworks.

Friction in the UK framework

Laura Navaratnam, head of UK policy at the Crypto Council for Innovation, shared with Cointelegraph that given Gemini's status as one of the earliest companies to obtain FCA registration in 2020, the firm's departure will undoubtedly represent "a blow for policymakers" working to complete the new regulatory structure before license applications commence in September.

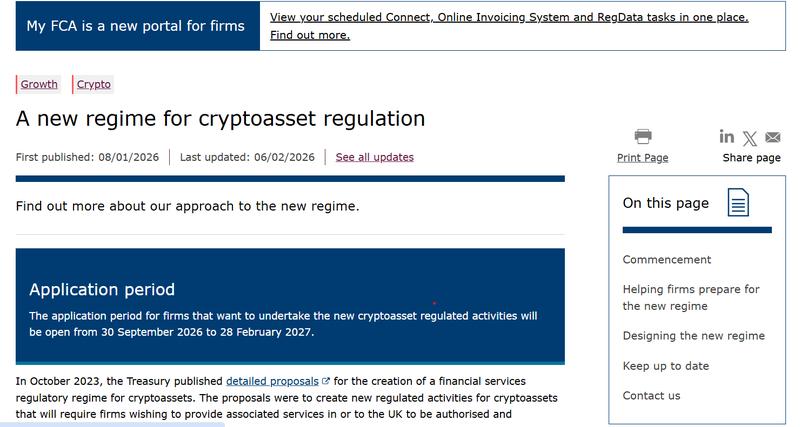

According to proposed regulations, crypto companies targeting UK customers will be required to submit applications for complete FCA authorization during a five-month 'gateway' period running from Sept. 30, 2026, to Feb. 28, 2027, preceding the implementation of the new prudential framework in October 2027.

Navaratnam emphasized that critical elements of the regulatory structure remained unsettled, particularly the relationship between the FCA's stablecoin regulations and the Bank of England's systemic framework, cautioning that these divergent methodologies created the risk of a "cliff edge" for companies transitioning between regimes and might trigger additional withdrawals if left unaddressed.

Asher Tan, CEO of CoinJar crypto exchange, informed Cointelegraph that the UK's transition from a limited AML‑registration framework to comprehensive Financial Services and Markets Act (FSMA) authorization is "materially raising the operational lift" for platforms attempting to service domestic clientele.

Ward from Bitcoin Policy UK maintains that the UK is miscalibrating the balance by not establishing clear distinctions between Bitcoin (BTC) and alternative crypto assets and by not providing timely, practical guidance. She also pointed out that research among UK crypto companies revealed that account terminations and banking service refusals were widespread occurrences, significantly increasing the probability of business relocations.

FCA's next steps and signs of resilience

Strategic withdrawal by industry participants is not a phenomenon exclusive to the UK. International operators such as Coinbase have withdrawn from markets, including Argentina, when domestic circumstances and strategic priorities no longer warranted the operational burden.

The FCA is currently conducting consultations on CP25/42, a proposed prudential framework that would expand its regulatory authority to crypto trading platforms, staking and dealing activities, incorporating capital and liquidity mandates throughout the sector as one component of a wider suite of consultations that concludes on Thursday.

The new regulatory framework is anticipated to take effect on Oct. 25, 2027, subsequent to the authorization gateway.

According to Tan, the "direction of travel is clear." Companies intending to maintain their UK presence will need to dedicate substantial resources to satisfy the new requirements, and "many are weighing that cost against the opportunity."