TRM Labs: Xinbi crypto escrow platform handled $17.9B in transactions following Telegram shutdown

According to TRM Labs, the $17.9 billion total represents overall blockchain transaction activity, which encompasses internal fund movements rather than verified criminal earnings.

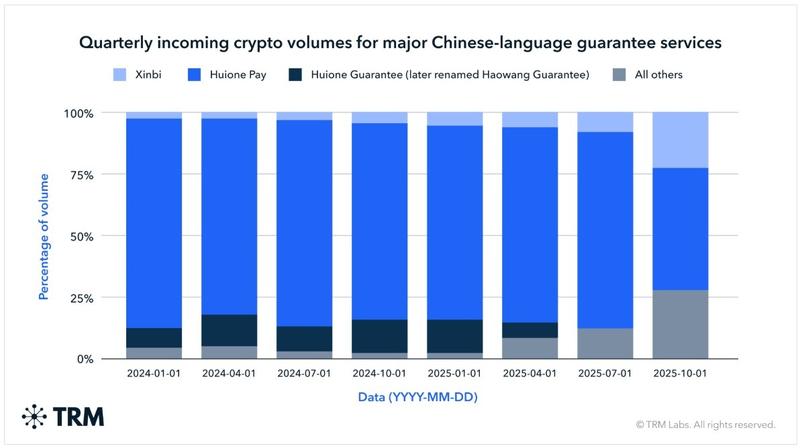

Xinbi, a guarantee marketplace operating in Chinese that facilitates cryptocurrency transactions, handled approximately $18 billion worth of blockchain-based transaction activity notwithstanding platform prohibitions and law enforcement initiatives by United States authorities targeting comparable operations, a recently published TRM Labs investigation reveals.

According to the investigation, recent enforcement measures have transformed rather than eliminated a critical component of the infrastructure enabling cryptocurrency-based money laundering activities. TRM's research demonstrated that Xinbi maintained its blockchain presence following Telegram's 2025 prohibition of numerous Chinese-language guarantee service groups.

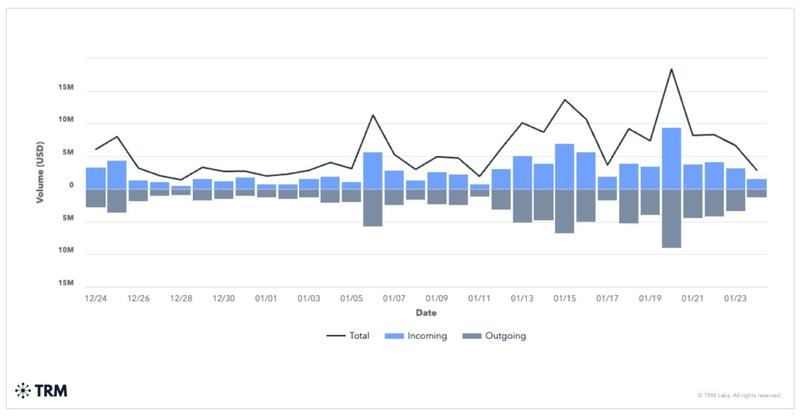

The investigation credits Xinbi's continued operation to swift relocation to different messaging platforms and the introduction of XinbiPay, an associated digital wallet service. Blockchain-based information revealed wallet transaction activity recovered in January 2026 as participants adapted to the newly established infrastructure.

According to the analytics company, Xinbi has functioned as a pivotal intermediary for laundering revenues generated by fraudulent operations and cybercriminal organizations, particularly pig-butchering scam enterprises.

The $17.9 billion amount represents total blockchain transaction activity handled by digital wallets that TRM has identified as belonging to Xinbi. This encompasses incoming funds, outgoing funds and transfers occurring internally within the platform's custody and wallet infrastructure.

According to TRM, this amount does not signify the actual criminal profits or validated illegal earnings, and could incorporate circular movement of capital within the platform, a typical characteristic of guarantee operations.

Criminal guarantee platform Xinbi adjusts to law enforcement pressure

Through a communication provided to Cointelegraph, Ari Redbord, global head of policy at TRM Labs, indicated that platforms such as Xinbi are evolving their strategies.

Guarantee services like Xinbi are learning to survive enforcement by fragmenting across platforms and building their own infrastructure.

"These services sit at the center of the scam economy," he said, adding that taking them out of the laundering chain exposes entire networks that depend on them.

According to TRM, Xinbi began advertising backup communication channels starting in mid-2025, establishing the foundation for platform migration in anticipation of increasing enforcement activity.

The blockchain analytics company indicated the platform shift gained momentum during January, aligning with supplementary measures targeting competing operations and detentions connected to laundering organizations.

Previous investigations identified over $8 billion in Xinbi stablecoin transactions

Xinbi has faced regulatory examination since 2025. During May, Elliptic, a blockchain analytics company, disclosed that digital wallets associated with Xinbi Guarantee had processed no less than $8.4 billion worth of stablecoins, connected to money laundering operations and fraudulent activity throughout Southeast Asia.

The previous investigation connected Xinbi to a Chinese-language, Telegram-hosted platform offering money laundering capabilities, compromised information, fraud facilitation resources and additional illegal services.