Restaking's High Yield Claims Mask Multiplied Dangers and Absence of Genuine Utility

The yields generated through restaking originate from token distributions and venture capital subsidies rather than genuine productive operations. Intricate frameworks consolidate influence with major operators as risk compounds through cascading effects.

Opinion by: Laura Wallendal, co-founder and CEO of Acre

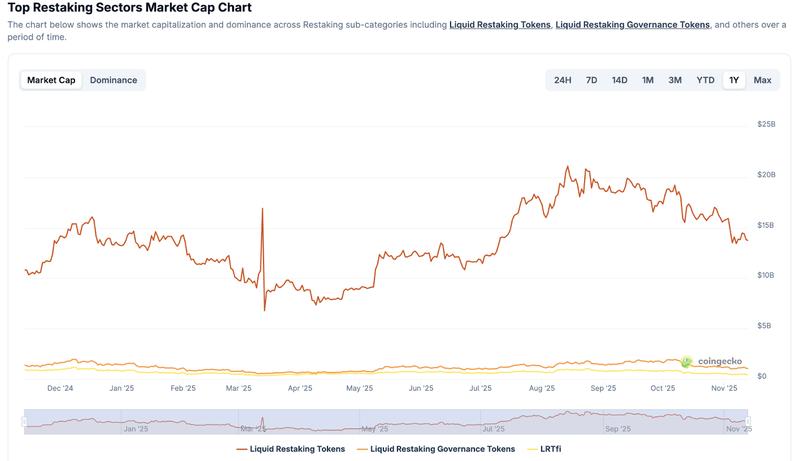

The restaking phenomenon frequently receives promotion as decentralized finance's (DeFi) next major yield innovation, yet underneath this enthusiasm exists a dangerous juggling routine. Validators accumulate obligations and exposure to slashing penalties, reward structures contain fundamental misalignments, and the $21 billion in total value locked (TVL) concentrates primarily among limited whales and venture capital firms instead of widespread market participants.

We'll examine the reasons restaking demonstrates inadequate genuine product-market fit and amplifies risk beyond its yield generation capacity. More critically, we must address challenging realities: Which parties benefit from system collapses, and who ultimately bears the consequences?

Restaking's fundamental flaws

Fundamentally, restaking permits previously-staked assets, predominantly Ether (ETH), to receive secondary pledging for deployment in protecting additional networks or services. Within this framework, validators leverage identical collateral for validating across multiple protocols, theoretically generating additional rewards from one deposit.

Conceptually, this appears productive. Realistically, it represents leverage masquerading as productivity: a financial illusion where identical ETH receives multiple tallies as collateral, with each protocol adding dependencies and prospective breakdown scenarios.

This creates substantial problems. Each restaking layer amplifies exposure instead of returns.

Imagine a validator restaking across three protocols. Does this generate triple returns? Or does it introduce triple the vulnerability? Although positive scenarios typically dominate discussions, any governance breakdown or slashing incident within those downstream frameworks can trigger upward cascades and completely eliminate collateral.

Furthermore, restaking architecture cultivates subtle centralization. Operating sophisticated validator arrangements spanning numerous networks demands substantial resources, restricting realistic participation to limited major operators. Authority consolidates, creating small validator clusters securing multiple dozens of protocols and establishing precarious trust concentration within an industry supposedly founded on decentralization principles.

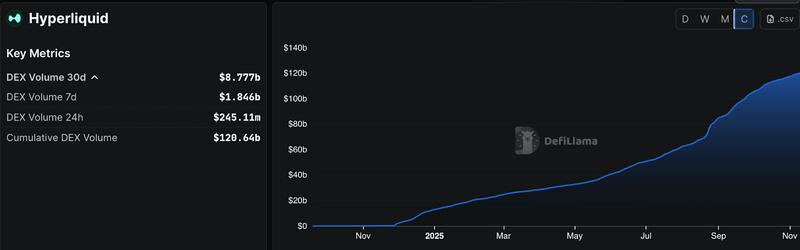

Valid justification exists explaining why prominent DeFi platforms and decentralized exchanges like Hyperliquid or established lending markets aren't incorporating restaking to drive their infrastructure. Restaking continues lacking demonstrated real-world product-market fit beyond speculative operations.

Examining yield sources

Beyond immediate vulnerabilities, restaking presents fundamental questions: Does this framework possess economic viability? Within finance, whether traditional or decentralized, yields must originate from productive operations. Focusing on DeFi specifically, this includes lending activities, liquidity contributions or staking compensation linked to genuine network utilization.

Conversely, restaking yields are artificial. They repackage identical collateral creating appearances of enhanced productivity. This mirrors traditional finance's rehypothecation practices. Actual value creation doesn't occur; existing value simply undergoes recycling.

Additional "yield" within this structure typically derives from three recognizable origins. Either token emissions inflating supply for capital attraction, borrowed liquidity rewards financed through venture treasuries or speculative charges paid using volatile native tokens.

Naturally, this doesn't render restaking fundamentally malicious. However, it establishes fragility. Without clearer connections between validator-assumed risks and concrete economic value their security delivers, returns will maintain speculative characteristics at most.

Transitioning from artificial yields toward sustainable alternatives

Restaking will probably maintain capital attraction, yet within its present configuration, achieving genuine, enduring product-market fit remains challenging. This persists while incentives stay short-term focused, risks maintain asymmetric distribution, and yield narratives feel progressively disconnected from authentic economic activity.

As DeFi progresses toward maturity, sustainability will outweigh velocity in importance because protocols require transparent incentive structures and genuine users comprehending their assumed risks rather than inflated TVL figures. This necessitates transitioning away from complicated, multi-tiered frameworks toward yield mechanisms anchored in verifiable onchain operations where compensation reflects quantifiable network utility instead of recycled incentive programs.

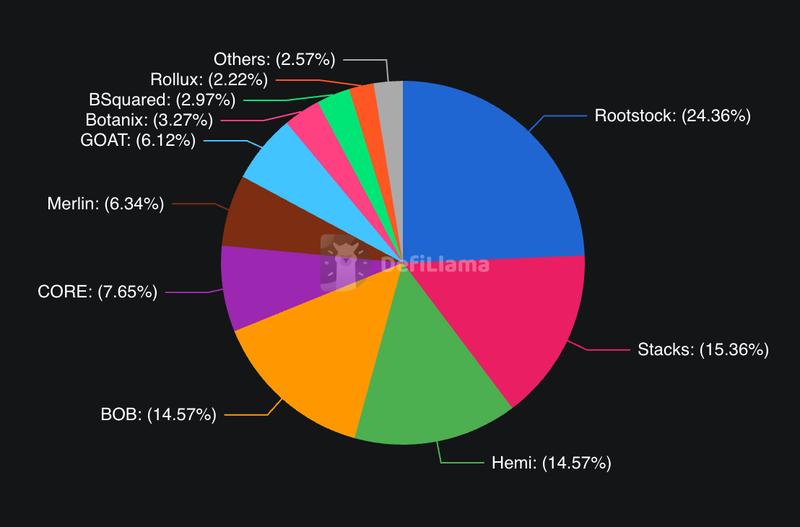

The most encouraging innovations are surfacing within domains like Bitcoin (BTC) native finance, layer-2 staking mechanisms and cross-chain liquidity networks, where yields stem from network utility and ecosystems emphasize harmonizing user trust with capital efficiency.

DeFi requires fewer risk abstractions. It demands systems prioritizing transparency over intricacy.

Opinion by: Laura Wallendal, co-founder and CEO of Acre.