Released DOJ Emails Indicate Epstein's $3.2M Coinbase Stake From 2014

According to emails made public by the DOJ, Epstein potentially acquired as much as $3.2 million worth of shares in cryptocurrency exchange Coinbase during 2014, subsequently divesting approximately half of his holdings for $15 million.

Recent email disclosures from the United States Department of Justice indicate that Jeffrey Epstein, the deceased financier who was convicted of sex-related crimes, obtained access to early-stage cryptocurrency venture capital opportunities through various intermediaries, including what appears to be an ownership position in Coinbase.

Documents released by the US Department of Justice (DOJ) indicate that Epstein potentially placed $3.25 million into the cryptocurrency exchange Coinbase during 2014.

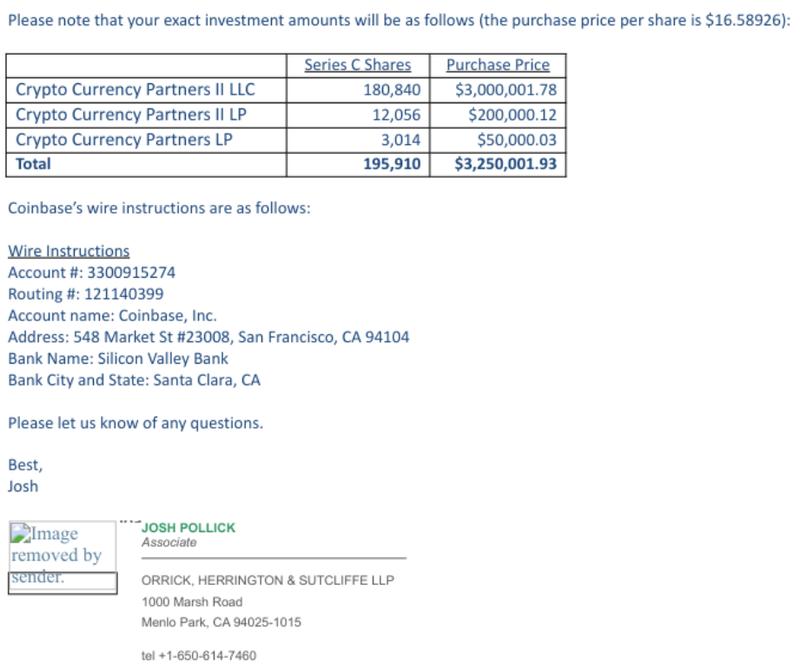

According to the email correspondence, an entity associated with Epstein purchased 195,910 Series C shares totaling $3.25 million at a time when Coinbase carried a valuation of $400 million.

The released documentation provides no evidence that executives at Coinbase engaged in any direct communication with Epstein or possessed knowledge regarding the actual beneficial owner behind the investment when it occurred.

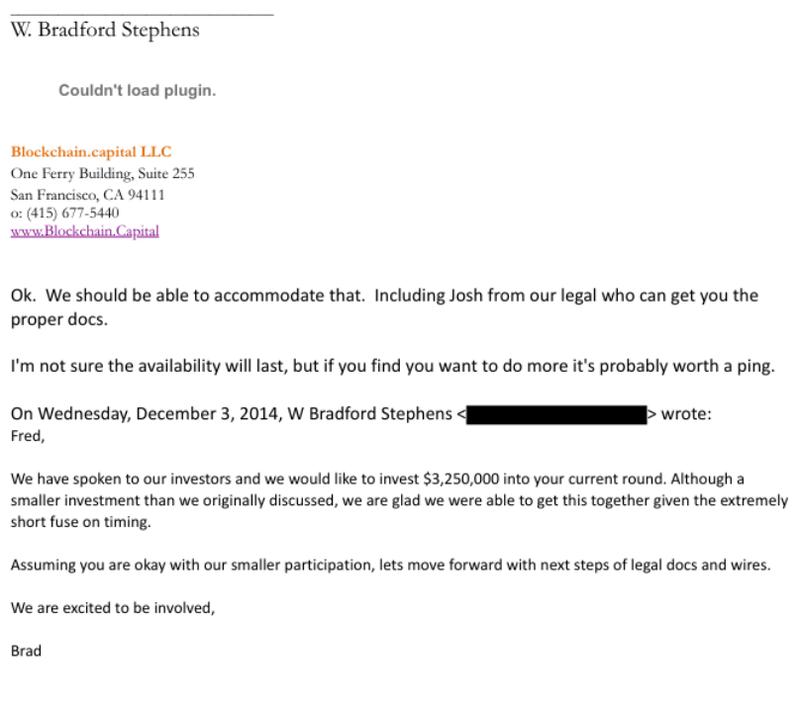

"When we figure out which LLC will be making the $3m investment, we will have them change the name of the investing entity. Wire instructions are also included," wrote Bradford Stephens, the founder and managing partner of Blockchain Capital, in an email on Dec. 4, 2014, to Darren Indyke, one of Epstein's known associates.

The most recent tranche of documents connected to Epstein demonstrates that the late convicted sex trafficker maintained expanding connections to the cryptocurrency industry during its formative years and that his investment portfolio included stakes in several prominent cryptocurrency-focused companies.

The capital was deployed through three distinct limited liability company structures, which included Crypto Currency Partners II LLC, Crypto Currency Partners II LLP, and Crypto Currency Partners LP.

Emails reveal Epstein liquidated half of Coinbase holdings for $15 million in 2018

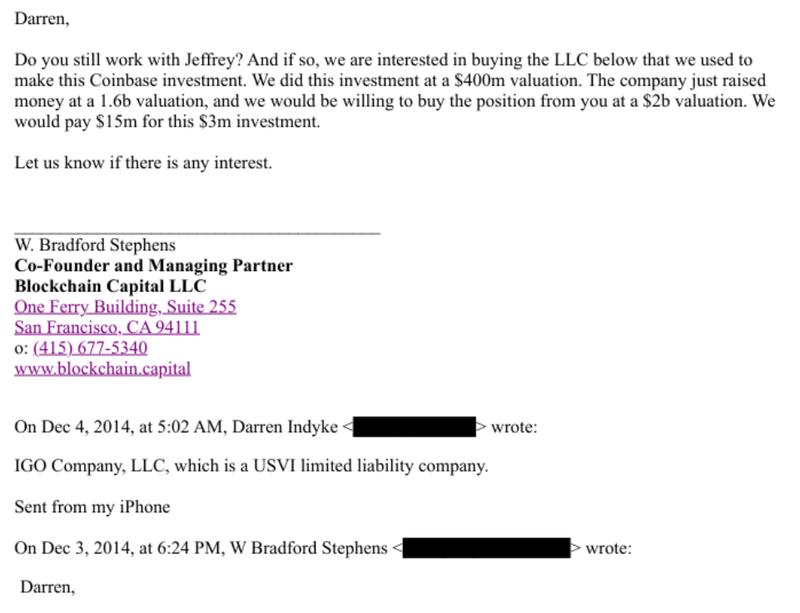

Four years following the initial investment transaction, Stephens contacted Epstein in 2018 with an offer to purchase his Coinbase stake.

The documentation shows that Stephens proposed purchasing 50% of Epstein's holdings calculated on a $2 billion company valuation, offering to pay $15 million for approximately half of the shares that were initially purchased for roughly $3 million.

"We are interested in buying the LLC below that we used to make this Coinbase investment," wrote Stephens in an email on Jan. 20, 2018, adding:

"We did this investment at a $400m valuation. The company just raised money at a 1.6b valuation, and we would be willing to buy the position from you at a $2b valuation. We would pay $15m for this $3m investment."

One month afterward, in an email dated Feb. 22, Brock Pierce, who co-founded Blockchain Capital, stated that Stephens had "wired $15m for half of your Coinbase position yesterday. So you still have $15m of equity and now $=5m of cash back if so."

Pierce served as another key individual who played a role in enabling Epstein's investment in the cryptocurrency exchange. The materials made public by the DOJ contain multiple mentions of Pierce in relation to cryptocurrency investment conversations connected to entities linked to Epstein.

Cointelegraph has approached Coinbase for comment on Epstein's potential investment in the exchange.