BTC Plummets Below $70K, Wiping Out 15 Months of Bullish Momentum

Intense selling pressure pushed Bitcoin beneath the 2021 cycle peak, with analysts anticipating further downside targets for BTC prices.

On Thursday, Bitcoin (BTC) dropped beneath the $70,000 level amid growing speculation of deliberate, coordinated selling activity.

Key points:

- Bitcoin tumbles below 2021 highs for the first time since November 2024.

- Gold and silver volatility spark copycat BTC price maneuvers as lower targets stay in play.

- Market participants believe that large entities are selling BTC on a schedule.

BTC crashes to $69,000 level in latest downturn

According to TradingView data, BTC prices touched fresh 15-month lows at $69,100 on the Bitstamp exchange during Asian market hours.

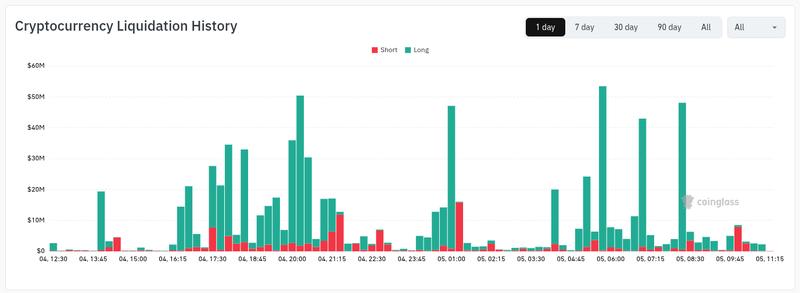

This most recent decline represented Bitcoin's initial descent into the $60,000 territory since the beginning of November 2024. The move triggered approximately $130 million in liquidations of long positions across the cryptocurrency market within a four-hour window, according to figures from CoinGlass, a market monitoring platform.

The cryptocurrency's movement mirrored a sudden reversal occurring in precious metals markets.

Gold prices, which had experienced a relief rally to $5,100 per ounce the previous day, tumbled to lows of $4,789 on Thursday before attempting to reclaim the $5,000 level.

Silver experienced wild swings between $90 and $73 per ounce as turbulent market conditions persisted.

In an X platform post, trader CW issued a warning that "$BTC has entered a key support zone."

"If it fails to support the 69k level, another significant decline could occur."

Previously, market traders identified several potential BTC price bottom targets worth watching, including the region surrounding $50,000. Just beneath the $69,000 threshold sits the critical 200-week exponential moving average (EMA) support trend line.

In response to the developments, cryptocurrency entrepreneur Alistair Milne expressed alignment with observations shared by veteran trader Peter Brandt. According to Brandt's analysis, Bitcoin was experiencing "campaign selling."

"Agree with this take. Someone enormous is unloading to a deadline," Milne stated on X.

His commentary drew parallels between the present selling pressure and the period when Germany's government liquidated its BTC holdings into the market, proposing that coins were being "handed over to OTC desks who simply execute."

"For me it started 14th Jan," he added.

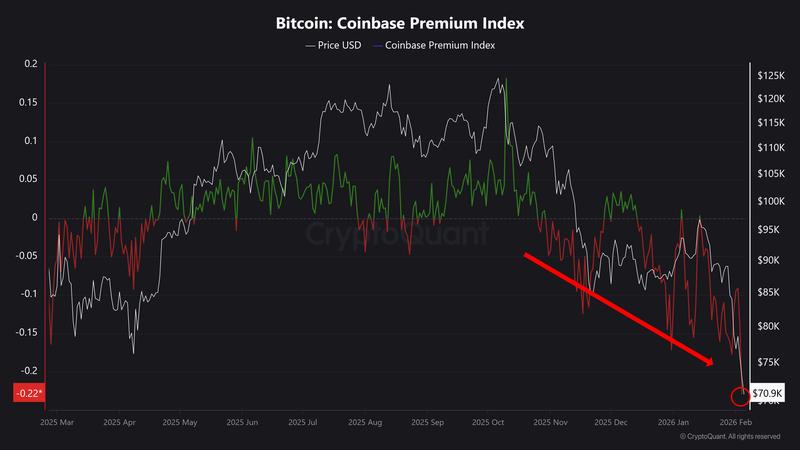

Coinbase Premium sinks below Liberation Day low

Nic Puckrin, who serves as CEO of Coin Bureau, a cryptocurrency education platform, similarly identified "large selling" activity by major holders during United States trading hours.

As previously covered by Cointelegraph, the negative Coinbase Premium, an indicator measuring the price differential between Coinbase's BTC/USD pair and Binance's BTC/USDT pair, underscored the absence of robust US Bitcoin demand.

"The Coinbase Premium is the lowest it has been in over a year. It's even lower than post liberation day tariffs," Puckrin noted.

He further stated that downward pressure would persist until the Premium metric reversed direction.

Charles Edwards, founder of Capriole Investments, a quantitative Bitcoin and digital asset fund, observed that "OG" whales were conducting themselves as though BTC/USD remained at record highs.

"Bitcoin's at $72K and the OG whales continue to dump like we're still at $125K"

Charles Edwards (@caprioleio)