BTC Faces Critical $68.3K Weekly Close to Prevent 'Bearish Acceleration,' Says Analyst

Analysis suggests Bitcoin could mirror its 2022 downtrend unless buyers successfully recapture the 200-week exponential moving average before week's end.

Bitcoin (BTC) struggled to maintain position above a crucial 200-week trend line on Thursday as Wall Street's opening bell rang, with concerns about "bearish acceleration" continuing to mount.

Key points:

- The 200-week exponential moving average could potentially become another resistance level for Bitcoin.

- Historical patterns reveal important insights regarding price behavior when rejection occurs from this critical 200-week trend line.

- Current Mayer Multiple readings indicate BTC remains deep in "oversold" conditions.

Critical $68,300 level holds Bitcoin's destiny

Information from TradingView revealed BTC price movement concentrating around the $67,000 zone for the second consecutive day.

Buyers were already contending with insufficient momentum — an issue that has prevented them from recapturing the former 2021 all-time high positioned at $69,000.

At this juncture, the 200-week exponential moving average (EMA) for Bitcoin emerged as a focus point, potentially representing a second fresh resistance barrier.

Addressing this development, trader and analyst Rekt Capital drew parallels to earlier Bitcoin bear markets to caution that an inability to defend the 200-week EMA would lead to more severe downward pressure on price.

"What would confirm additional downside for Bitcoin? Historically, a Weekly Close below the 200-week EMA (black) followed by a post-breakdown retest of the EMA into new resistance (red circles) has triggered additional Bearish Acceleration," he stated in a post accompanying a chart on X.

"The 200-week EMA (black) represents the price point of ~$68300. Therefore a Weekly Close below ~$68300 followed by a bearish retest of it would likely position Bitcoin for a repeat of history with additional downside over time."

Analysts had previously expressed hope that the EMA would serve as a long-term support floor for BTC price before the previous week's drop beneath $60,000. In combination with the 200-week simple moving average (SMA), it currently creates a "cloud" of support that price action has thus far managed to avoid breaching.

Taking a more optimistic stance, William Clemente, head of strategy at crypto over-the-counter settlement platform Styx, identified a potential buying opportunity in the current conditions.

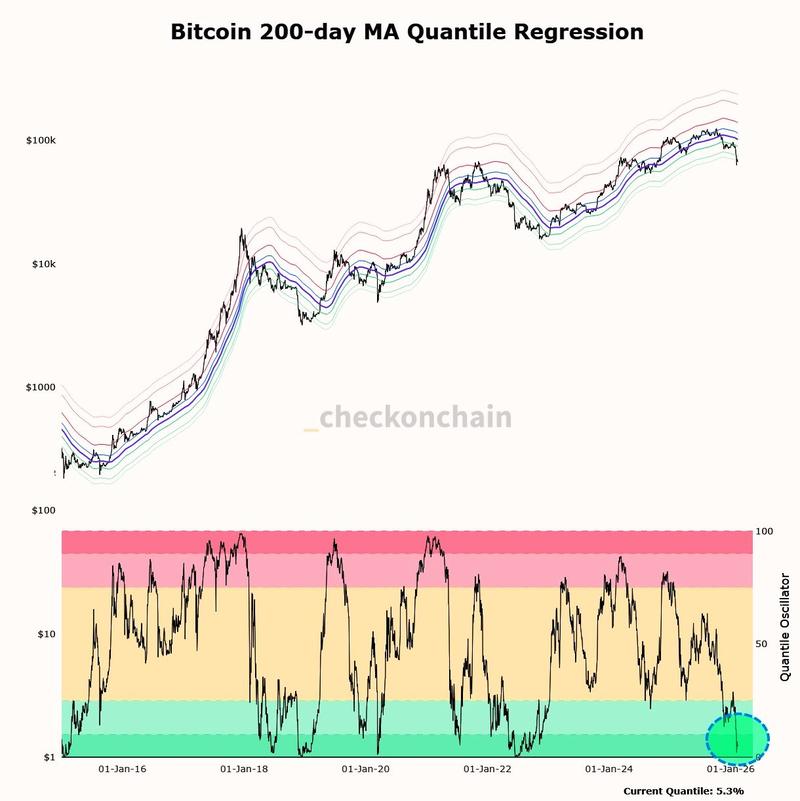

"Throughout Bitcoin's life span we have seen two indicators continue to be the best global market bottom signals: The Mayer multiple (distance from 200 day moving average) and the 200 week moving average," he stated on the day.

"Both of these are clearly in long term accumulation territory."

Traditional BTC price indicator signals "cheap" levels

Expanding on this subject, the X analytics account bearing the name of renowned economist Frank Fetter highlighted the exceptional rarity of present Mayer Multiple measurements.

This Multiple stands among the most recognized Bitcoin price measurement tools, with values falling below 0.8 historically indicating favorable long-term return prospects. Conversely, on the opposite end of the spectrum, readings exceeding 2.4 suggest that prudence should be exercised.

"Only 5.3% of days have seen the Bitcoin Mayer Multiple at a lower level. Yeah it can go lower but I'm running out of ways to say BTC is cheap here," the account communicated to followers.

As previously documented by Cointelegraph, Bitcoin most recently experienced such depressed Mayer Multiple levels throughout the 2022 bear market period.

During the previous week, Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, expressed similar views.

"It rarely hits 0.6x. Can price go lower?" he questioned.

"Yes, but this is historically one of the best buy signals in Bitcoin history."