Bhutan transfers $22M worth of Bitcoin amid declining crypto markets and challenging mining environment

The Himalayan kingdom has dropped to seventh place among nation-state Bitcoin holders, seeing its reserves decline from 13,295 BTC in October 2024 down to 5,700 BTC.

The Himalayan nation of Bhutan has sold more than $22 million worth of Bitcoin obtained through its government-controlled mining operation as cryptocurrency valuations continue their downward trajectory and mining profitability deteriorates.

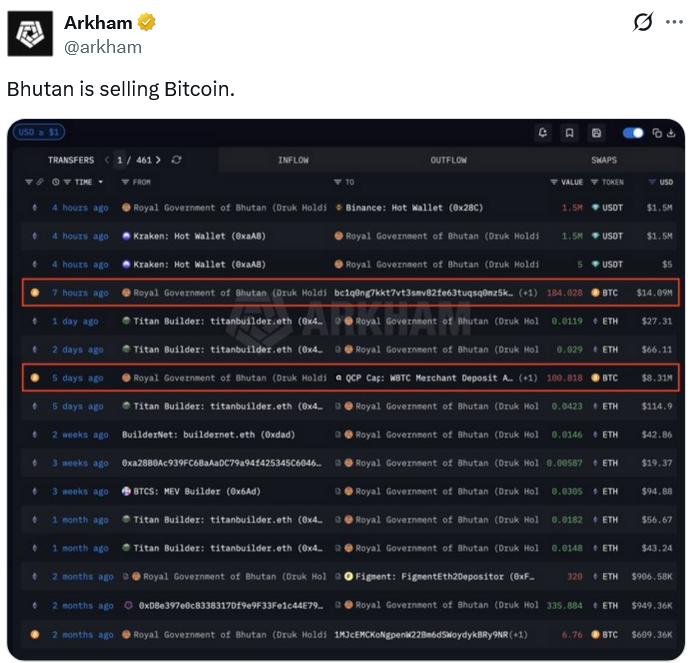

According to information from Arkham, a blockchain analytics platform, Bhutan transferred 184 Bitcoin (BTC) valued at $14 million from its sovereign reserve on Wednesday, following a previous transaction of 100.8 Bitcoin worth $8.3 million that occurred last Friday.

These transfers totaling $22.3 million in value were directed to QCP Capital, a cryptocurrency market maker, according to Arkham's analysis. When assets are transferred to market makers, it typically signals an intention to sell, as these entities facilitate the conversion of such assets into liquid market positions.

The South Asian nation has amassed approximately $765 million in Bitcoin value since initiating its Bitcoin mining activities in 2019, operations that rely predominantly on hydroelectric power generation, as Arkham highlighted.

Nevertheless, the analytics firm observed that the expense associated with mining 1 Bitcoin has approximately doubled following the 2024 Bitcoin halving event, and that Bhutan's current Bitcoin production has fallen significantly short of the 8,200 BTC it successfully mined during 2023.

The Bitcoin reserves held by Bhutan have decreased from their highest point of 13,295 BTC in October 2024 to their current level of 5,700 BTC.

According to Bitcoin Treasuries data, Bhutan has fallen to the seventh position in Bitcoin ownership among sovereign nations, now ranking behind US, China, UK, Ukraine, El Salvador and the United Arab Emirates.

Although the precise motivations driving the sell-off remain unclear, Arkham observed that Bhutan routinely liquidates Bitcoin in increments of approximately $50 million, with the country's latest phase of significant selling activity occurring during mid-to-late September 2025.

Cointelegraph contacted Druk Holding and Investments, the government-owned company responsible for managing Bhutan's Bitcoin strategy, but did not receive an immediate response.

Bitcoin is now over 42% off its ATH

The decline in Bhutan's Bitcoin reserves coincides with Bitcoin's 42.8% plunge from its all-time high of $126,080 reached last October to levels below $72,000, with market sentiment throughout the previous three months dropping to levels last observed in mid-2022.

Bitcoin's value has declined amid US government shutdowns, President Donald Trump's ongoing war and tariff threats, and the stagnation of crypto market structure legislation in Washington.

Despite global liquidity approaching all-time high levels, investors are increasingly shifting away from risk-on assets toward safe haven investments such as gold and silver in response to wider macroeconomic uncertainty.

Concerns regarding quantum computing threats to Bitcoin's security framework and Bitcoin's network hashrate dropping beneath 1 zetahash per second as more miners disconnect unprofitable equipment have also played a role in shaping some of the current narratives circulating around Bitcoin.