XRP Faces Potential 2022-Style Collapse as Recent Investors Experience Losses

Recent XRP purchasers face unrealized losses as the token trades beneath the 12-month average acquisition price, signaling heightened vulnerability to further declines.

The cryptocurrency XRP (XRP) displayed patterns reminiscent of a 50% decline witnessed in 2022 as the digital asset experienced its most severe weekly price drop since October 2025.

Key takeaways:

- A breach below $1.48 could trigger prolonged downward pressure for XRP amid ongoing whale distribution.

- Bulls maintain hope if the asset can defend the $1.43–$1.48 range.

Recent XRP Purchasers Face Unrealized Losses

By Monday's trading session, XRP was changing hands near $1.60, representing a decline exceeding 20% throughout the previous week and positioned significantly beneath the average entry point for investors who acquired the token during the past 12 months.

The digital asset currently hovers marginally above its consolidated realized price in the vicinity of $1.48, a metric representing the average acquisition cost for all XRP tokens currently in circulation. This positioning indicates that a substantial portion of investors who recently purchased XRP are experiencing negative returns.

Should XRP conclusively fall beneath the $1.48 threshold, it would signify that the typical holder faces unrealized losses, a configuration that bears striking resemblance to the 2022 bearish cycle that eventually culminated in a 50% price reduction to approximately $0.30.

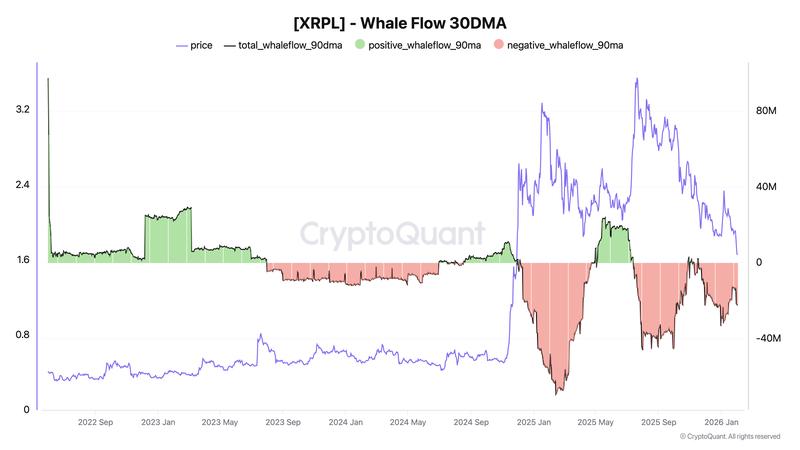

Furthermore, XRP's 90-day whale flow indicator continues to show net negative values, with major holders engaging in distribution activities rather than accumulation, according to information provided by CryptoQuant.

In circumstances where recent purchasers are already experiencing losses, persistent selling activity from whales has the potential to amplify overhead resistance and undermine any attempts at price recovery.

Declining Stablecoin Deposits Compound XRP's Bearish Outlook

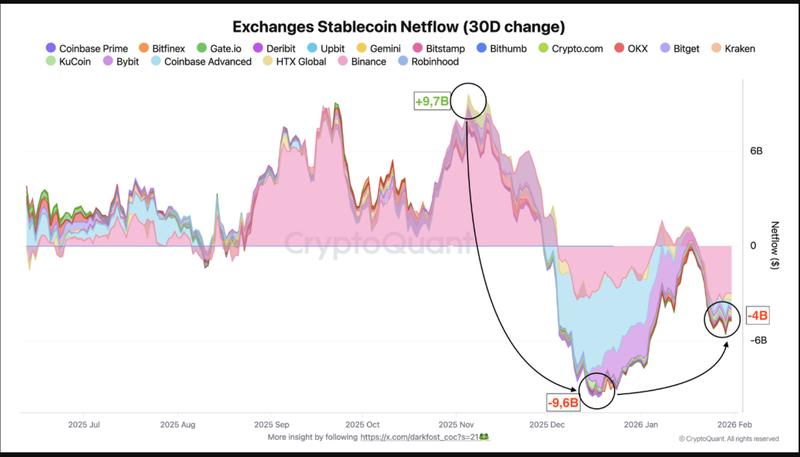

Moreover, stablecoin movement patterns into cryptocurrency exchanges experienced a dramatic reversal to negative territory during late 2025, with 30-day net withdrawals approaching approximately $9.6 billion.

While outflow rates moderated during January, net movement patterns remained in negative territory at approximately $4 billion, based on data compiled by Darkfost, a research analyst at CryptoQuant.

Diminished stablecoin balances on trading platforms translates to reduced purchasing power, creating additional obstacles for XRP to climb above the realized price level.

XRP Confronts Risk of Additional 50% Price Decline

Technical analysis reveals that XRP has maintained support above its 100-period biweekly exponential moving average (100-2W EMA; the purple line) positioned around $1.43, in close proximity to the consolidated realized price of $1.48.

However, although XRP retains the possibility of descending into the $1.43–$1.48 support zone during February, its biweekly relative strength index (RSI) hovering near 38 has historically served as a precursor to trend reversals.

Regardless of near-term fluctuations, XRP may require several weeks to establish stable price support before initiating a more robust recovery effort during the latter portion of Q1 or throughout Q2 2026, provided the RSI maintains its position around 38 consistent with historical patterns.

On the other hand, a conclusive breakdown beneath XRP's 100-2W EMA would most likely negate the prospective recovery thesis.

Under such circumstances, XRP faces the prospect of declining toward its 200-period biweekly EMA (the blue line) situated near $1 as soon as March, mirroring the type of structural breakdown that materialized following comparable support failures during 2022.

A descent to the $1 level would represent XRP trading approximately 36% beneath its current valuation.