Trump crypto venture sells 49% stake to UAE company for $500M, report says

An investment entity from Abu Dhabi with backing from Sheikh Tahnoon reportedly purchased nearly half of World Liberty Financial for half a billion dollars shortly before Trump's White House return.

An investment entity backed by the United Arab Emirates discreetly secured an agreement to acquire nearly half the ownership of World Liberty Financial, a digital currency venture connected to President Donald Trump, mere days prior to his return to presidential office, The Wall Street Journal reported.

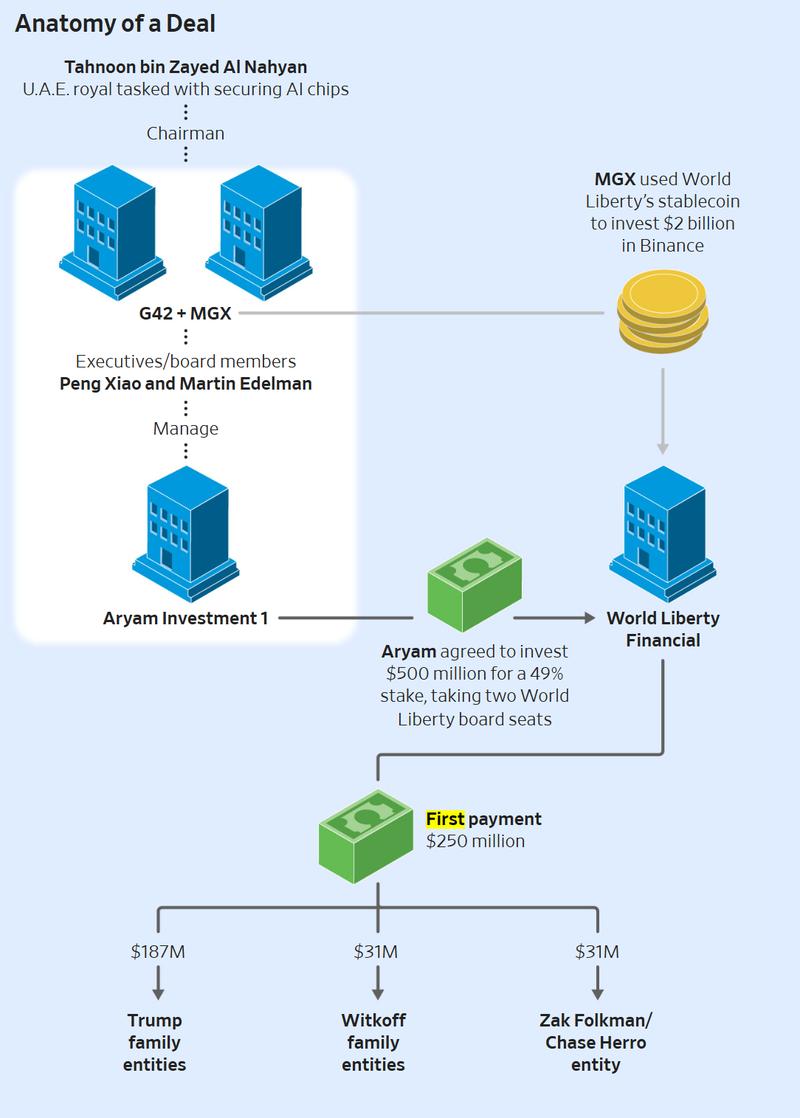

According to the Journal's reporting, which drew from internal documents and sources with knowledge of the transaction, Aryam Investment 1, an entity based in Abu Dhabi with financial backing from Sheikh Tahnoon bin Zayed Al Nahyan, inked an agreement in January 2025 to acquire a 49% ownership position in World Liberty Financial for a total of $500 million.

According to the report, the deal included an initial payment representing half the total purchase price, which resulted in $187 million being transferred to entities under Trump family control, while several tens of millions in additional funds were directed to entities connected to the venture's co-founders, including family members of Steve Witkoff, who serves as US Middle East envoy.

Eric Trump reportedly executed the agreement as a signatory. Despite World Liberty subsequently disclosing that the Trump family's ownership percentage had experienced a significant decline, the Journal noted that the transaction had not been made public.

Tahnoon's ambitions grow after Trump election

Sheikh Tahnoon, who serves as both the sibling of the UAE's president and the nation's national security adviser, has played a pivotal role in Abu Dhabi's strategic initiative to establish itself as a worldwide hub for artificial intelligence development. During the Biden administration period, his attempts to obtain cutting-edge AI chips manufactured in the United States faced restrictions due to apprehensions that advanced technology might be transferred to China, especially through corporate entities like G42.

After Trump secured electoral victory, these initiatives experienced acceleration. Sheikh Tahnoon engaged in several meetings with Trump and high-ranking US government officials, and in a matter of months the administration made commitments to provide the UAE with authorization to access hundreds of thousands of sophisticated AI chips on an annual basis.

According to the Journal's reporting, senior leadership from G42 participated in managing Aryam Investment 1 and obtained positions on World Liberty's board of directors as components of the agreement, which positioned Aryam as the startup's predominant external shareholder. In the weeks preceding the public announcement of the US-UAE chip access framework, MGX, another investment firm under Tahnoon's leadership, utilized World Liberty's stablecoin infrastructure to execute a $2 billion investment transaction in Binance.

According to reports, both World Liberty and the White House have issued denials of any improper conduct. Representatives informed the Journal that President Trump had no involvement in the transaction and that the deal provided no leverage or influence regarding US policy decisions.

World Liberty faces US probe calls

Democratic senators made demands last year for US regulatory authorities to launch investigations into purported connections between World Liberty Financial's token distribution activities and foreign entities subject to sanctions. Through a November letter addressed to both the Justice Department and Treasury Department, Senators Elizabeth Warren and Jack Reed referenced allegations that WLFI governance tokens were purchased by blockchain wallet addresses with ties to the Lazarus Group from North Korea, in addition to entities linked to Russia and Iran.

The situation becomes more contentious due to WLFI's ownership arrangement, which allocates control over the vast majority of token-generated revenue to entities associated with the Trump family. According to lawmakers' arguments, this arrangement establishes a clear conflict of interest, given that the bulk of funds generated from token distribution activities are directed to entities controlled by the president's family members.