Tom Lee Predicts V-Shaped Recovery Pattern for Ethereum Once Again

Tom Lee of Fundstrat believes Ether has reached near-bottom levels and encourages investors to focus on buying opportunities rather than exiting positions.

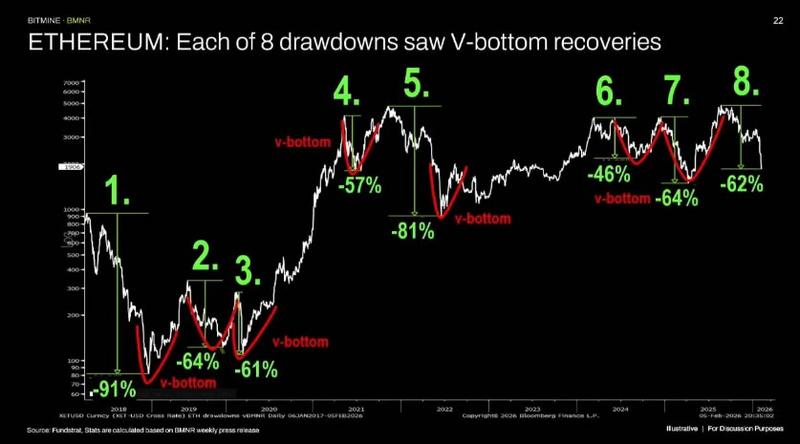

Tom Lee, who serves as head of research at Fundstrat, has expressed his expectation for Ether to stage a rapid rebound in the wake of its recent price declines, pointing to the fact that the cryptocurrency has undergone eight similar recovery patterns dating back to 2018.

During a conference presentation in Hong Kong on Wednesday, Lee noted that "A lot of people are frustrated, but keep in mind that Ethereum, since 2018, has fallen more than 50% eight times."

He went on to mention that during the previous year, Ethereum experienced a substantial 64% decline spanning from January through March.

"But eight out of eight times, Ethereum has had a V-shaped bottom. So it has recovered 100% of the time within almost the same speed that it fell."

According to Lee's analysis, the fundamental dynamics remain unchanged, and he anticipates that Ether (ETH) will undergo yet another V-shaped bottom formation.

Lee believes ETH has nearly reached bottom territory

Tom DeMark, a market analyst at BitMine, identified the $1,890 price point as a likely bottom level, though he indicated it would test this threshold twice through an "undercut" pattern. In response, Lee characterized this scenario as a "perfected bottom," further stating:

"We think Ethereum is really close to the bottom, and I think it's just like the fall of 2018, fall of 2022, and April 2025. You don't really have to worry about the bottom. If you've already seen a decline, you should be thinking about opportunities here instead of selling."

The price of Ether plummeted to $1,760 on the Coinbase exchange on Feb. 6, though this remained above the 2025 low point of slightly more than $1,400, based on data from TradingView.

The cryptocurrency has struggled to maintain levels above $2,000, trading at $1,970 at the time of publication after experiencing a steep 37% decline throughout the preceding 30-day period.

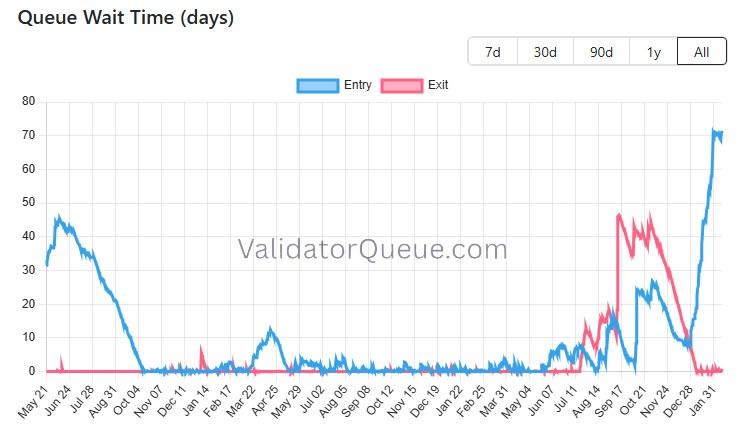

Ethereum staking queue reaches unprecedented levels

In spite of the cryptocurrency's underwhelming price action throughout this year, available data indicates that demand for Ether staking continues to demonstrate remarkable strength.

The waiting period for new Ether staking participants has reached an unprecedented peak of 71 days, accompanied by a record-breaking 4 million ETH sitting in the validator entry queue, as reported by ValidatorQueue. Additionally, the proportion of total supply currently staked has climbed to a historic high of 30.3%, representing 36.7 million ETH.

The clear consequence of this development is a "massive supply restriction," according to remarks made by analyst "Milk Road" on Wednesday.

The analyst noted that "One-third of all ETH is now illiquid, earning a modest 2.83% APR," before adding: "That's not sexy yield by crypto standards. Yet people are lining up anyway."

"When people lock up $74 billion during a price dip, they're not speculating. They're settling in."