Survey reveals crypto investors now favor infrastructure investments over DeFi

Top-tier decision-makers identified liquidity limitations and market depth deficiencies as primary obstacles to widespread institutional cryptocurrency adoption in 2026.

Recent research involving top cryptocurrency investors and industry executives indicates that capital allocation preferences are moving away from decentralized finance (DeFi) platforms and gravitating toward fundamental infrastructure, with decision-makers concentrating their attention on liquidity limitations and foundational market systems.

These insights originate from a recently released report by CfC St. Moritz, a digital asset conference, drawing from survey responses collected from 242 participants at its exclusive, invitation-only gathering held in January. Survey participants encompassed institutional investors, company founders, executive leadership teams, regulatory officials and family office delegates.

The survey data reveals that 85% of participants identified infrastructure as their primary funding focus, surpassing DeFi, compliance initiatives, cybersecurity measures and user experience improvements.

Despite maintaining generally optimistic outlooks regarding revenue expansion and innovation advancement, participants highlighted liquidity deficiencies as the sector's most critical vulnerability. The findings indicate that while investor appetite persists, capital allocation strategies are becoming increasingly discerning.

Infrastructure takes priority as liquidity concerns persist

Survey participants identified market depth inadequacies and settlement infrastructure capabilities as critical constraints limiting the entry of substantial institutional capital pools into cryptocurrency markets.

Approximately 84% of participants characterized the macroeconomic environment as favorable or better than neutral for cryptocurrency sector expansion, although numerous respondents indicated that current market infrastructure capabilities remain inadequate to support large-scale capital deployment.

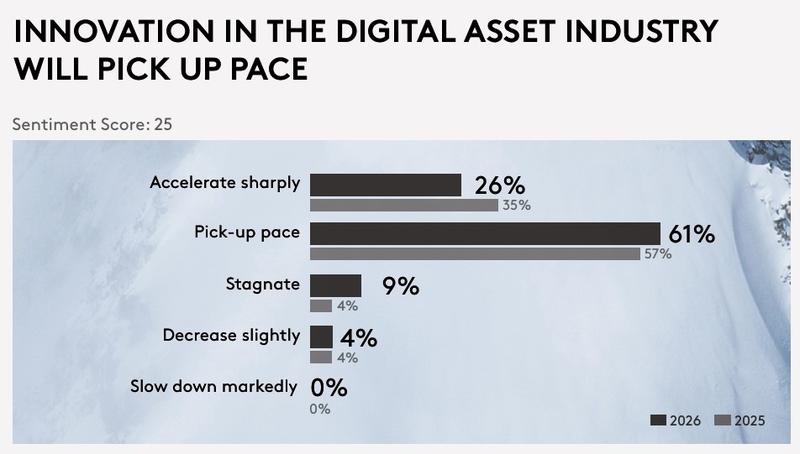

The research also revealed an evolution in innovation outlook. While the majority of respondents continues to anticipate accelerated innovation throughout 2026, a smaller proportion expects dramatic increases when compared to previous year projections, indicating a transition from speculative optimism toward implementation-oriented development strategies.

This transition corresponds with wider industry movements, including heightened emphasis on custody solutions, clearing mechanisms, stablecoin infrastructure development and tokenization frameworks instead of consumer-oriented applications.

US sentiment improves as IPO expectations cool

The research identified a notable enhancement in how respondents perceive the United States regulatory landscape, with participants placing the nation as the second-most accommodating jurisdiction for digital asset operations, trailing only the United Arab Emirates.

CfC St. Moritz credited this perception change to advancing stablecoin legislative efforts and increased regulatory clarity for banking institutions and regulated market participants.

Simultaneously, optimism surrounding cryptocurrency initial public offerings declined following what participants characterized as an exceptional year in 2025. Although the majority still anticipates continued listing activity, fewer participants conveyed strong confidence levels, referencing valuation adjustments and ongoing liquidity challenges.