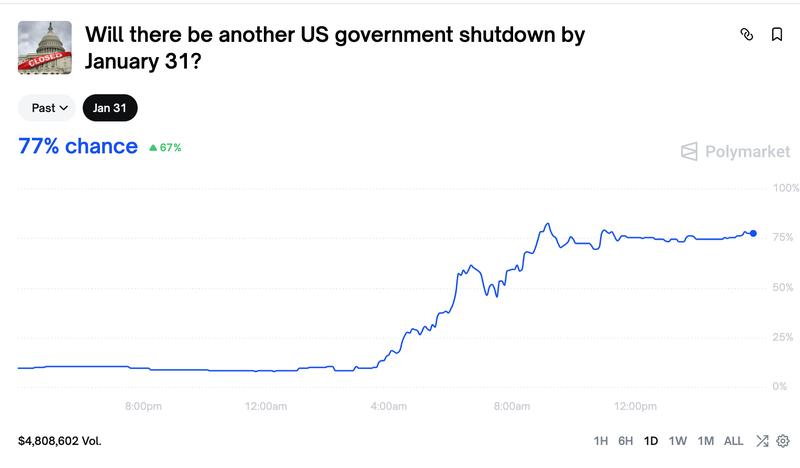

Prediction market Polymarket shows 77% probability for US government shutdown in January

Polymarket's dramatic probability increase follows closely on the heels of President Donald Trump's recent warning that the country is 'probably going to end up in another Democrat shutdown.'

Those placing bets on Polymarket are now assigning a 77% probability to another US government shutdown occurring before January concludes, representing a significant 67% jump within the last 24 hours alone.

This development arrives as the CLARITY Act, an important piece of cryptocurrency legislation designed to deliver greater regulatory clarity, continues to navigate its way through the congressional process, with prior setbacks attributed primarily to the unprecedented 43-day US government shutdown that occurred during October and November.

Political analyst Collin Rugg drew attention to the rising Polymarket probabilities through a Saturday post on X, pointing out that the increase came on the heels of US Senator Chuck Schumer's declaration that Senate Democrats would refuse to "provide the votes to proceed" on the appropriations bill should it contain funding designated for the Department of Homeland Security (DHS).

"What's happening in Minnesota is appalling —and unacceptable in any American city," Schumer said in a statement.

Saturday morning brought reports that US federal agents had fatally shot a 37-year-old individual in Minneapolis.

Trump didn't rule out shutdown in the future

According to Schumer, the DHS bill falls far short, being "woefully inadequate to rein in the abuses of ICE. I will vote no."

United States President Donald Trump refused to dismiss the possibility of another government shutdown at some future point, stating to Fox Business on Thursday: "I think we have a problem, because I think we're probably going to end up in another Democrat shutdown."

This introduces additional uncertainty surrounding the CLARITY Act's schedule, which has lately garnered a divided reaction from those within the cryptocurrency sector following the withdrawal of support by Coinbase CEO Brian Armstrong along with other industry executives.

"This version would be materially worse than the current status quo. We'd rather have no bill than a bad bill. Hopefully we can all get to a better draft," Armstrong said on Jan. 15.

CLARITY Act timeline remains unclear

Alex Thorn, Galaxy Digital's head of research, reinforced industry apprehensions in a Thursday report, noting that ambiguity persists regarding stablecoin yields, a matter the US banking lobby contends would damage the banking sector's competitive position.

"There aren't yet any significant indications that the two sides have identified a compromise that can rejuvenate the bill's prospects," he said, adding that "the additional 4-6 weeks until a second attempt at markup should give the parties more time to work on that."

According to Thorn, among the "big questions" is whether "the gridlocked negotiations over stablecoin rewards can advance in the interim to raise the odds that such a markup is a bipartisan success."