Maple expands syrupUSDC to Base network, eyes integration with Aave V3

Digital asset manager Maple launches syrupUSDC on Base, Coinbase's layer-2 network, bringing institutional-grade credit infrastructure while aiming for Aave integration.

Digital asset management platform Maple is bringing its yield-generating US dollar-denominated token, syrupUSDC, to Base, the layer-2 network built by Coinbase, thereby integrating institutional credit infrastructure directly into one of the fastest-expanding ecosystems within the Ethereum layer-2 landscape.

Based on a Thursday announcement provided to Cointelegraph, the deployment will offer the firm a "direct path" into Coinbase's extensive network of users and associated products, simultaneously delivering institutional-quality yields to a broader spectrum of onchain participants, instead of confining it exclusively to the Ethereum mainnet environment.

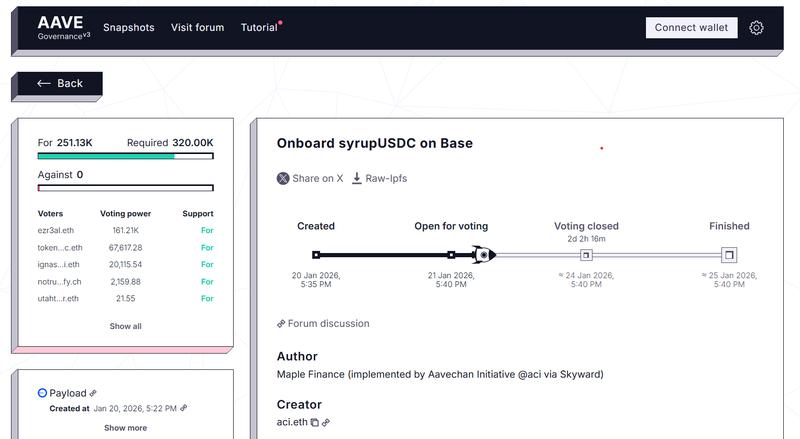

A governance proposal on Aave is presently active to integrate syrupUSDC as accepted collateral on the Aave V3 Base Instance, contingent upon the outcome of the voting process.

According to Maple, Chainlink's infrastructure will be utilized to facilitate interoperability between the Ethereum mainnet and Base, enabling syrupUSDC to operate as composable collateral throughout various lending, leverage, and additional decentralized finance (DeFi) applications and strategies.

Sid Powell, co‑founder and CEO of Maple, explained to Cointelegraph that the products were constructed around "overcollateralized loans" featuring collateral values that are "trackable in real time," which provides robust downside protection alongside sustainable yield generation as syrupUSDC expands its presence into emerging ecosystems such as Base.

Maple's Base strategy

Powell described Base as representing a "key next step" in Maple's roadmap due to its significant distribution capabilities and accelerating DeFi ecosystem expansion. He further noted that syrupUSDC, functioning as a composable yield-generating asset, "thrives in these conditions," and stated that its expansion would receive an additional "boosted further by the Aave listing."

From his perspective, the upcoming evolution of DeFi will be propelled by scalable, stable yield-generating products that both institutional participants and retail users can depend on, and his ambition is for syrupUSDC to serve as one of the fundamental building blocks within Base, mentioning that "further integrations" across the Base ecosystem are currently "in the works."

Guardrails and "institutional‑grade" yield

At the technical level, Maple highlights multiple protective guardrails surrounding "looping" — a mechanism whereby users take loans against their syrupUSDC holdings and subsequently redeposit those funds to amplify leverage — as well as leverage strategies in general.

The loan portfolios that underpin syrupUSDC maintain overcollateralization, with collateral valuations tracked continuously in real time, while borrowers are subject to clearly defined margin call and liquidation thresholds, according to Maple. Additionally, Aave's loan‑to‑value parameters place restrictions on how aggressively users are permitted to borrow against the token.

Powell additionally emphasized the "institutional‑grade" designation, characterizing Maple's technology stack as encompassing technical, operational, and legal infrastructure specifically designed to meet the requirements of institutional lending participants.

Base's DeFi stack and SocialFi tilt

From the perspective of Coinbase and Base, this integration contributes an additional component of credit infrastructure to a DeFi ecosystem that continues to expand beyond simple trading and speculative operations.

For development teams building applications on Base, syrupUSDC introduces another composable yield component at a moment when the blockchain network is attempting to balance its explosive growth in consumer-focused and Social‑Fi experiments alongside the development of a more sustainable and durable DeFi infrastructure stack.

Jesse Pollak, creator of Base, stated that constructing an open, global onchain economy necessitated the "best possible collateral and financial primitives," and that Maple delivers "institutional-grade infrastructure" that substantially strengthens Base's DeFi ecosystem and foundational stack.