Grayscale files for BNB spot ETF with SEC, pushing crypto portfolio beyond Bitcoin and Ethereum

Should the SEC grant approval, the investment vehicle would provide American investors with regulated access to BNB without requiring direct token ownership.

The digital asset management firm Grayscale has submitted an application to the US Securities and Exchange Commission requesting authorization to introduce a spot exchange-traded fund that would track BNB, representing one of the company's boldest strategic initiatives to diversify its offerings beyond Bitcoin and Ether.

A registration statement submitted on Friday reveals that the planned Grayscale BNB ETF would maintain direct holdings of BNB and distribute shares engineered to mirror the cryptocurrency's market price, after accounting for associated fees and operational expenses. Documentation shows the fund aims to secure listing on Nasdaq using the trading symbol GBNB, pending receipt of regulatory clearance.

Should regulators greenlight the proposal, the investment product would provide US-based investors with regulated access to BNB exposure while eliminating the need to personally manage custody of the digital asset or maintain holdings on cryptocurrency trading platforms.

The decision to pursue a filing centered on BNB carries particular significance, given that the digital asset ranks as the fourth-largest cryptocurrency measured by market capitalization, commanding a total market value of $120.5 billion as of the filing date.

As the native digital asset of the Binance ecosystem, BNB serves a fundamental function throughout the platform's various products and services. The cryptocurrency enables users to cover transaction costs on the BNB Smart Chain, take part in decentralized governance mechanisms, and obtain reduced trading fees on the Binance exchange platform, in addition to numerous other applications.

Expansion beyond Bitcoin and Ether

The application from Grayscale does not mark the initial effort to introduce a BNB-focused ETF to American financial markets.

Asset management firm VanEck has already filed a registration statement for its own planned BNB ETF, which includes an updated Form S-1 requesting a Nasdaq listing using the trading symbol VBNB, positioning it at a more advanced stage in the regulatory examination process compared to Grayscale's submission.

Nevertheless, the application underscores Grayscale's comprehensive approach to diversifying its portfolio of cryptocurrency investment offerings in the wake of regulatory approval and the prosperous rollouts of spot Bitcoin and Ether ETFs across the United States.

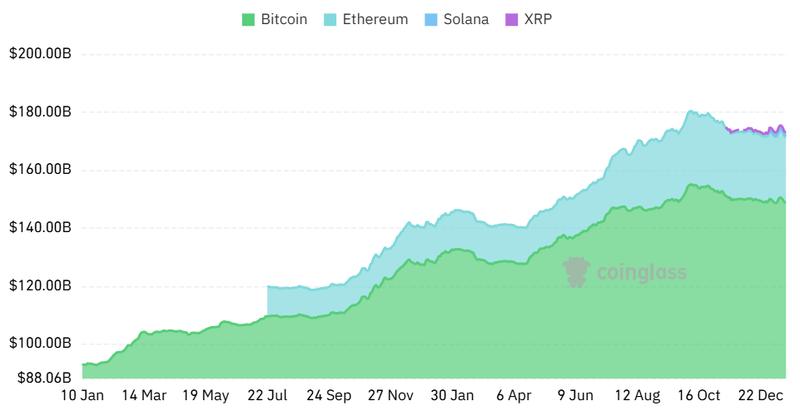

Combined, spot Bitcoin and Ether ETFs currently manage more than $100 billion in total assets under management, demonstrating substantial investor appetite for regulated cryptocurrency investment vehicles. An investment product linked to BNB would broaden that accessibility beyond fundamental blockchain networks, delivering exposure to a digital asset intimately connected to a leading cryptocurrency exchange infrastructure.